Don’t stress out about every headline, stress test your retirement plan instead. Markets move every day and the news cycle is 24-7. Unfortunately, headlines often leave investors wondering what the news means for their portfolio and financial outlook. We can’t predict the future, but we can control how we prepare a range of possible outcomes. Stress testing a financial plan or retirement income goals is crucial to help ensure retirees won’t run out of money under different conditions in the financial markets.

Most retirement calculators only use a few simplistic assumptions like expected rate of return, inflation rate, starting portfolio, and annual contribution rate. The result is usually a straight line projection assuming the portfolio never deviates from the average return. Notably, this ignores the reality that returns will fluctuate each year — sometimes significantly. Even if actual average returns meet targets over time, market volatility can still derail your portfolio and retirement plans.

Stress test a retirement plan with a Monte Carlo analysis

The situation above isn’t inherently flawed—these quick calculators can be helpful to get a sense of where you may stand under ideal conditions. However, if you never engage a financial planner how will you know if your retirement portfolio can survive different market cycles?

Stress testing a financial plan using simulations can find the probability of outcomes over a long-term plan. But even holistic modeling won’t guarantee that the timing and severity of short-term disruptions won’t derail some financial goals.

For example, if you suffer a job loss or a sharp decline in the stock market right before you plan to retire, you might need to hold off for a time. We can test the sequence risk on a portfolio—how timing impacts the outcome—but major financial decisions require a data check and a gut check. That’s where a Monte Carlo analysis comes in.

Average versus annual stock returns

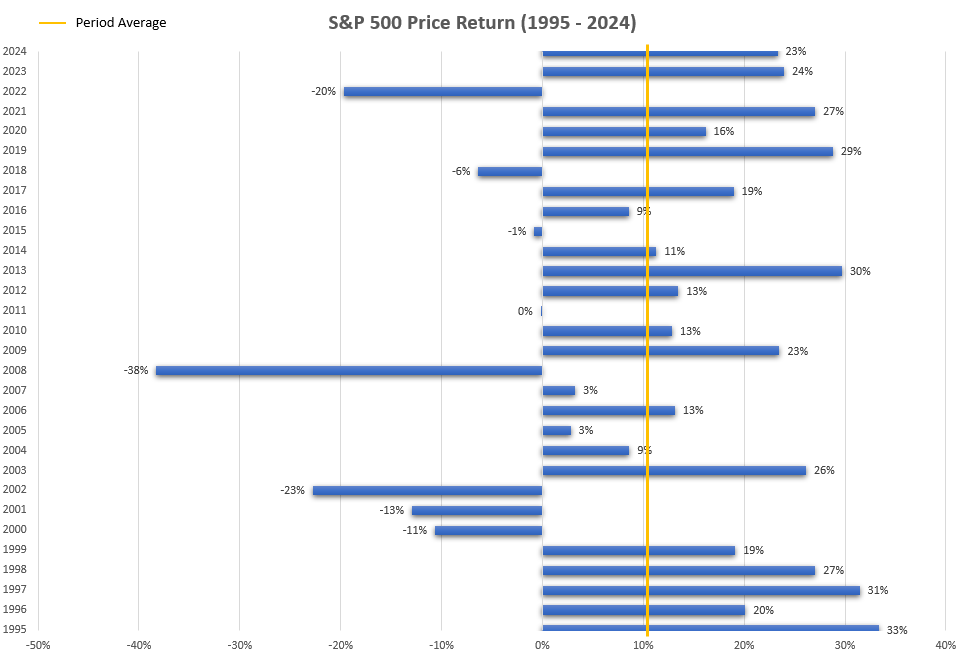

The average annual price return for the S&P 500 is about 10.5% between 1995 – 2024. Yet, over 30 years, the index never returned 10%. The actual return is typically much higher or considerably lower.

With a traditional investment return calculator, if you enter a 10% return, you’ll likely get an artificially optimistic outcome. Why? The variability of returns and cash flows, among other factors, matters a lot.

Straight line calculators don’t account for the variability in investment returns or the timing of down years. The only factor is a static average annual return. Significantly, these basic compounded return calculators only assume your investment account will grow. They ignore the other half of the equation that produced the average.

How much do I need to retire? Depends what type of retirement calculator you use

As I explain in this article for Forbes, the gap between a stress tested retirement income plan and projections using a regular retirement calculator are significant. In the analysis I compared two retirement simulations: one with an assumption for volatility and one without. See the full article for a complete discussion of assumptions.

Average returns only. In brief, assuming a 7% average annual return, 2.5% inflation, and a probability of success of 80% or greater, the retirement projection (excluding market moves) for a $10 million retirement portfolio would appear to support annual income of $490,000 for 45 years.

Average returns and annual volatility. Using that income, but adding 11.5% volatility to the assumptions, the probability of success falls to 36%. In another words, there’s a 64% chance the retiree runs out of money during their lifetime.

Market volatility is inevitable. Understand how the timing of returns and cash flows impacts your portfolio

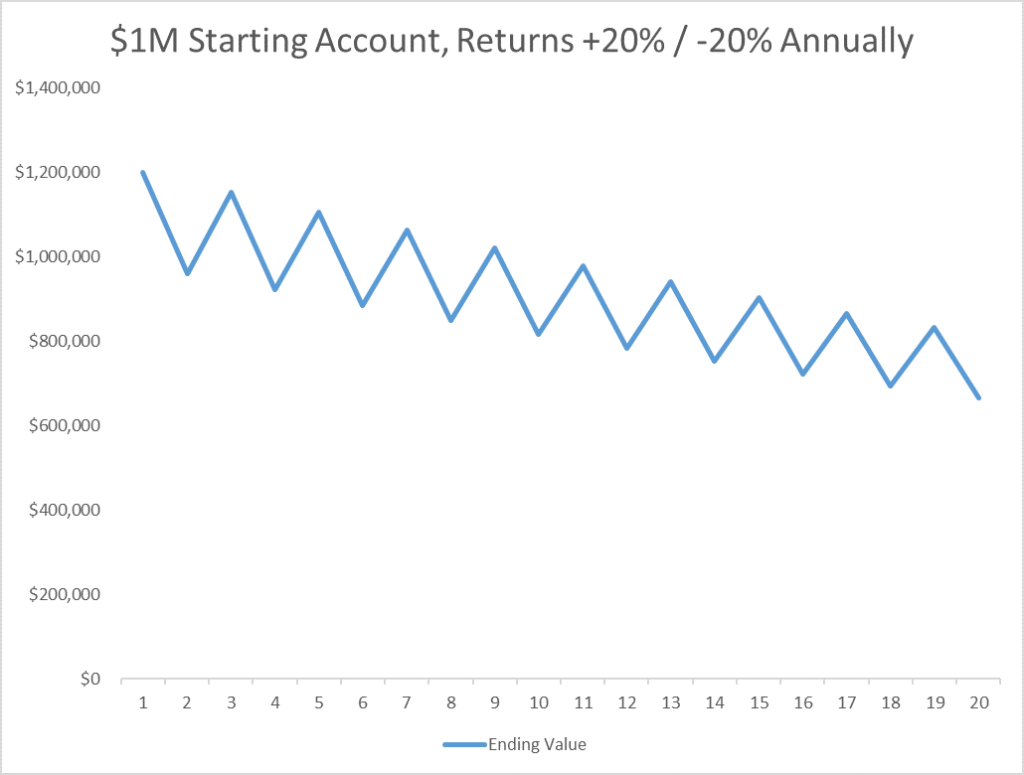

To show how volatility can impact your investments, consider the following three simplified examples. All examples assume a $1M starting portfolio and alternating returns of +20% or -20% every year for 20 years.

Example #1: market moves only (no cash flows in or out)

Result: The average return is 0% but the compound average growth rate is -2%. Accordingly, the account isn’t worth $0 at the end of 20 years, it’s actually worth $665,000. This is called volatility drag, and it explains how wild swings in the stock market can drag your investments down. Simply, if you lost -20% one day, you’d need a +25% gain the next day to break even. This is why it typically takes three years for the market to recover after a bear market.

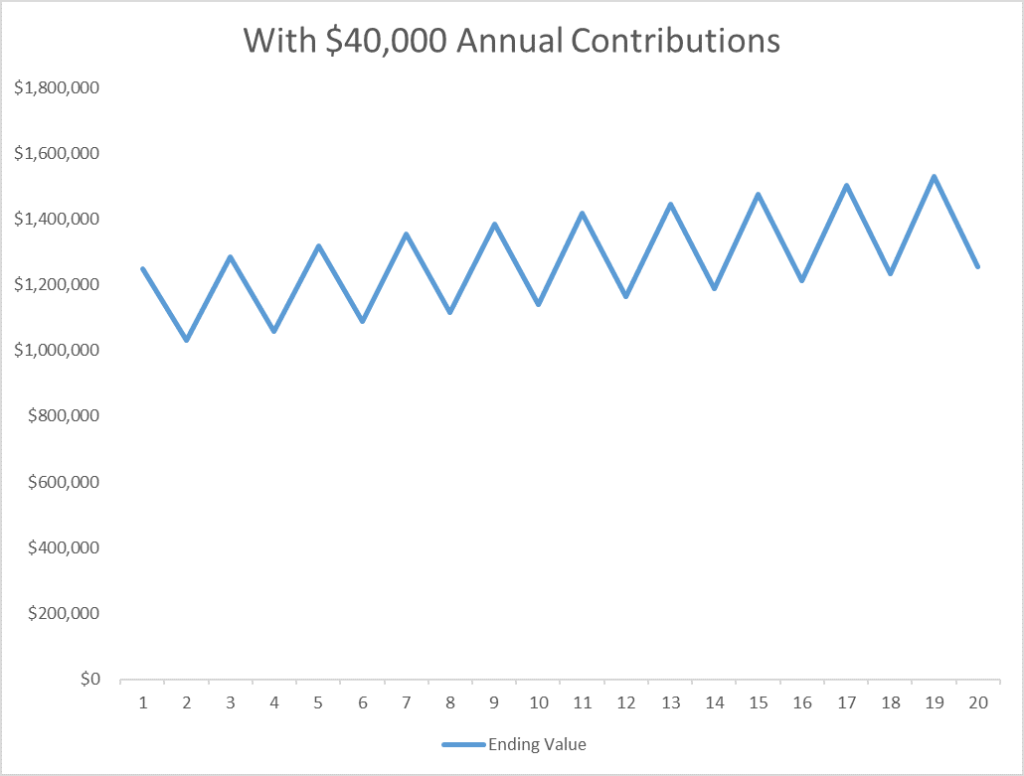

Example #2: contributions of $40,000 per year

Result: The $1M portfolio has grown to $1.25M by the end of year 20, equaling a compound average growth rate (CAGR) of 1.14%. Average return is still zero.

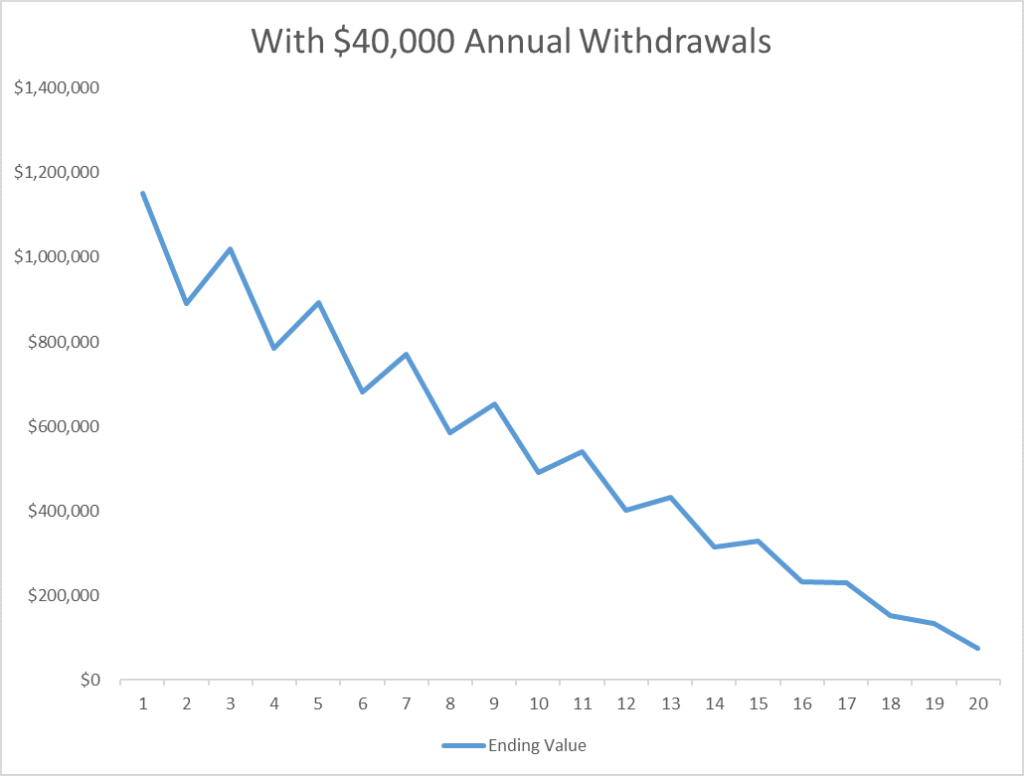

Example #3: retirement income of $40,000 per year

Result: By the end of year 20, the account would only be worth $75,000.

Of course, these are dramatic examples. But it’s helpful to illustrate the impact timing, cash flows, and extreme market swings can have on your ability to reach your financial goals. A downturn before or just after retirement is especially damaging.

Retirement planning with a Monte Carlo risk simulation

A Monte Carlo analysis is a stress test for a financial plan. It can help investors reduce the risk that their retirement plan will fail by incorporating more realistic (and conservative) planning assumptions. In financial planning, one of the uses of a simulation is to test the viability of a projected income stream in retirement under various market conditions.

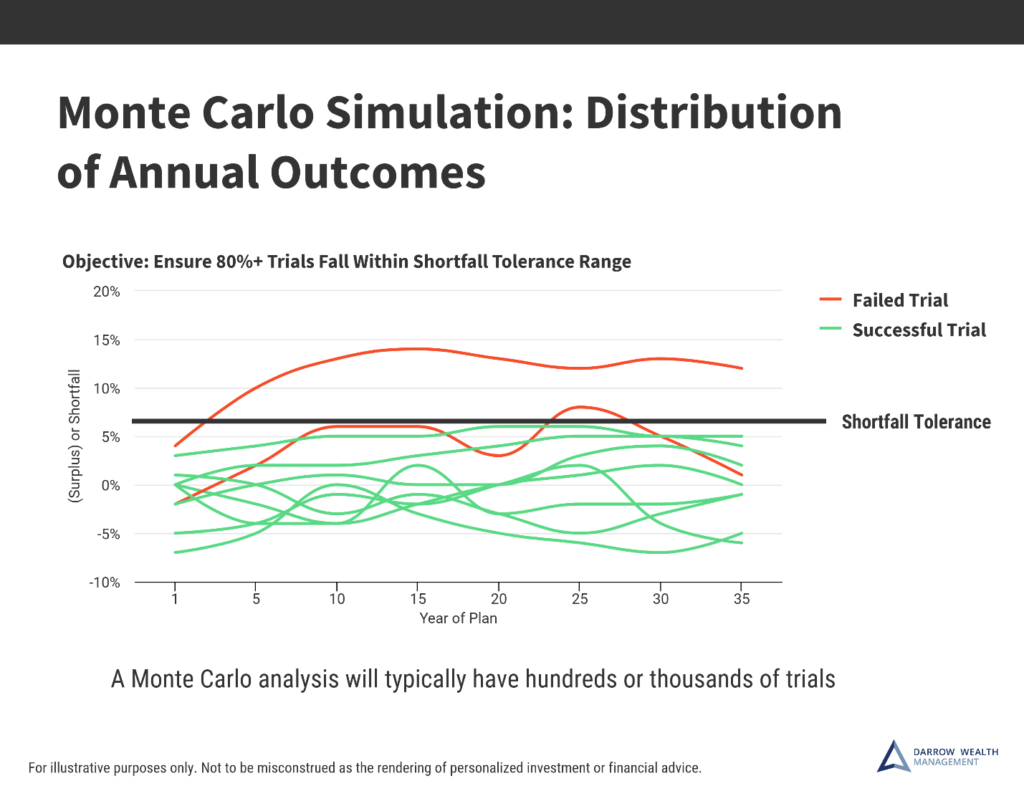

Specific parameters are set for the analysis, like how many hundreds of trials to run or specific deficit tolerances for each goal. A deficit tolerance limits the shortfall for each trial before the scenario is considered a failure.

Simplified illustration of a portfolio stress test:

Using the return and standard deviation assumptions for the asset allocation, the analysis accounts for market volatility and the impact on cash flows. This produces a probability of success across all trials.

When there’s an annual surplus or a deficit smaller than the parameters, the trial is a success. Generally, we strive to reach an 80% probability of success or better. This provides a confidence level that a client can achieve their lifestyle goals without running out of money in retirement. The analysis also accounts for the impact of taxes, inflation, and ‘lumpy’ cash flows as income and expenses change.

This is why a more robust approach to retirement planning is so critical. Comprehensive financial planning with a cash flow analysis and volatility simulation can be a great tool to help give investors piece of mind that their retirement strategy has been tested under a variety of outcomes.

[Last reviewed February 2025]