If you’re inheriting a trust fund, you likely have questions about how the distribution payouts to beneficiaries work and the tax implications. While general information about how trust funds work is useful, there are limitations. Trusts can be complex, highly customizable tools, so what applies to one situation may not in another. The ultimate guidance to understand how trust fund distributions to beneficiaries will occur will need to come from the trustee and your estate planning attorney.

Important disclosure: The material in this article is for generalized information only as to some of the financial planning considerations regarding trusts and should not be misconstrued as the rendering of personal legal, accounting, tax, or investment advice. We strongly recommend you consult an attorney in your state to discuss your personal situation and estate planning needs.

What beneficiaries need to know about distributions from a trust fund

After inheriting a trust fund, you (a beneficiary) may have questions about distributions. Trust fund distributions can happen in several different ways. So it’s critical to first review key trust terminology before digging into how trust funds work.

Key Terminology:

- Grantor: donor or person who set up and funded the trust

- Beneficiary: individual(s) who the grantor selected to receive money/property/assets from the trust (at some point)

- Trustee/successor trustee: individual or entity the grantor assigned to oversee the trust and abide by its terms

How do trust funds work? What is a trust fund?

A trust is a type of legal entity that you transfer assets to, either during your lifetime or upon death, to accomplish various financial goals. When someone sets up a trust fund, they’re able to maintain maximum control over the distribution of their assets to beneficiaries. Trusts come in many forms. The most common is a revocable living trust but the grantor can also create an irrevocable trust during their lifetime.

When setting up a trust, the grantor must make several decisions (here are a few):

- Choosing what type of trust to set up

- Selecting successor trustee(s) and beneficiaries

- Defining payouts and the terms of the trust

- Deciding what assets to put in the trust (e.g. financial accounts, real estate, life insurance, etc.)

At a high level, here’s how trust funds work. After establishing a trust, the trust is funded by retitling assets or accounts in the name of the trust. The terms of the trust dictate what happens next. The trust document will indicate when the trustee may (or must) distribute assets to beneficiaries and the amount.

A word of caution: it is common for individuals to go through the work of establishing a trust but never following through with the funding of the trust. This step is critical. Without it, when the grantor dies, the trust is irrelevant (because nothing is in it).

Here’s a simplistic example of how a trust fund could work:

Finn establishes a revocable living trust with his attorney. He puts his brokerage account in the trust by retitling it with the help of his financial advisor. Finn is free to take money from the account whenever he needs it or invest more, just as he did previously. His daughter, Olivia, age 15, is the sole beneficiary of the trust. Finn’s sister is his successor trustee.

To avoid probate and mismanagement of the money after he dies, Finn includes terms in his trust which dictate when Olivia can access money in her inherited trust fund.

Finn dies and the trust becomes irrevocable. The trust specifies that Olivia will receive 25% of the trust value at age 25, 25% at age 30, and the remainder at age 35. Prior to age 35, the trustee must also provide Olivia reasonable support for living expenses, medical expenses, and education and up to $50,000 for a wedding.

Inheriting a trust fund: distributions to beneficiaries

As you can see, trusts are highly customizable tools for leaving an inheritance to beneficiaries. Because of this complexity, it can take time for beneficiaries to receive distributions, assuming the terms of the trust call for payouts right away.

Trust administration is the process that begins when the grantor dies and the trustee must manage/distribute trust property accordingly. The trustee needs to collect trust assets, beneficiary information, pay debts, pay individual and/or estate taxes, and possibly ready assets such as a home for sale.

If there are disagreements between beneficiaries about what to do after inheriting a home, as is common, that will delay the process. This process can take months or years depending on the complexity of the estate and if disputes arise.

The ultimate guidance to understand how trust fund distributions to beneficiaries will occur will need to come from the trustee or the trust and estate attorney working on the administration and settlement of the estate. It can be frustrating for beneficiaries to learn that they might not have any visibility about how much they stand to inherit until the payouts are made. Every situation is different.

If you have concerns about the process, you may want to consider engaging your own attorney who focuses on trust administration and estate settlement (versus drafting wills and trusts).

Here are some examples of how trust distributions to beneficiaries could be structured:

- In a lump sum after the grantor passes away

- All, or a percentage of, trust income and/or principal

- Distributions at age milestones (e.g. age 25 or 35)

- Trust fund distributions for specific reasons, such as to pay for higher education, medical expenses, or a wedding

- At the discretion of the trustee

It’s not uncommon for a trust fund to use a blend of distribution methods.

Will a trust fund distribute cash, stock, or other property?

Unsurprisingly, the answer is it depends. The trust document may specify how distributions should be pay out or it may give discretion to the trustee. Or it may make no mention at all. Generally, though, the trustee will get to decide what’s in the best interest of the beneficiary.

For example, if a beneficiary is receiving a lump sum from a trust fund and plans to keep their inheritance invested in the market, the trustee could transfer the ETFs, mutual funds, stocks, and bonds ‘in kind’ into the beneficiary’s account. This would avoid incurring unnecessary capital gains taxes.

Alternatively, consider a beneficiary is getting a distribution to pay for college or a down payment on a home. It would be easier for the trustee to sell assets and send cash.

Trusts can own shares of privately held businesses, assets such as art, or real estate, such as a home or rental property. This can get very tricky, particularly when there are disagreements among beneficiaries or the trust doesn’t align with their wishes.

A straightforward and common example of this is when a parent leaves a home or vacation house to adult children. Real estate is a highly emotional asset. When parents don’t specify their wishes for the property, it can make beneficiaries feel guilty about selling a family home. Co-owning a home with family is difficult and buying out the other beneficiaries can put the purchaser in a poor financial condition.

Who pays taxes on an inherited trust fund?

You guessed it: it depends. You’ll need to work with your CPA and the trustee to discuss the tax treatment of the inheritance and what options you may have.

At a very high level, generally, if the trust fund distributes assets/income to the beneficiary, the individual will typically pay the tax at their own tax rates. If the trust retains income at the end of the year or if the inheritance was part of the decedent’s estate, then the trust or estate would pay the tax (respectively). The trustee will send K-1s to beneficiaries annually. This is how beneficiaries report income and payouts from the trust on their tax return.

Trust Taxes

The tax rates for trusts are extremely compressed. In 2023, a trust will enter the highest marginal tax bracket (37%) with taxable income above $14,450. For comparison, single filers don’t reach the 37% tax bracket until taxable income reaches $578,125. It may sound better to have the trust pay the tax instead of you, but taxes are paid with money from the trust fund. This reduces the amount left for beneficiaries, like you.

Federal Estate Tax

Large estates may be subject to federal estate tax to the extent they exceed the exemption. The estate and gift tax exemption is $12,920,000 per person in 2023. The current federal estate tax is 40%. Funds from the estate go towards paying the tax which can reduce what’s left for beneficiaries.

State Level Estate Tax

A handful of states (including Massachusetts) impose their own estate tax and exemption amounts. The tax rate is much lower than the federal estate tax, but the exemption amounts are much lower. State estate tax may apply to residents or nonresidents; in the latter case it’s usually because the decedent held real estate out of state. Funds from the estate go towards paying the tax which can reduce what’s left for beneficiaries.

Other tax questions about an inheritance in a trust fund

The type of asset inherited in a trust will also factor into whether you’ll pay tax on an inheritance and how much. This is another reason to discuss the inheritance with your CPA or accountant. If you inherit a retirement account, it will be taxable as ordinary income, often to the beneficiary directly due to the trust tax rates.

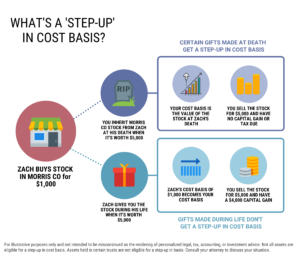

When stocks or bonds are held in a taxable account and inherited through a trust fund, the beneficiary might be eligible for a step up in cost basis to the market value of the security at the time of death. Eligibility often hinges on whether the decedent owned the asset when they died (e.g. in a revocable trust which became irrevocable when they passed).

Why would someone set up a trust fund?

Wondering why your inheritance was left in a trust instead of given to you outright? There are several reasons the grantor might have set up a trust. Trusts have several benefits:

- Avoid probate. Probate is a legal process where certain assets in the decedent’s estate that were owned as an individual are distributed by the court. Assets that pass via beneficiary designation, like a retirement account, or assets in trust, are not subject to probate. Probate is a lengthy, costly, and public process and should be avoided when possible. If there was a will, then assets are typically distributed accordingly. If the decedent did not have a will, then the court decides.

- Retain control over your assets, even after death. A trust and a will serve different purposes. In many situations, a will does not provide enough control for the grantor by itself. Here are some examples: if you have young children, you may want to ensure a teen doesn’t squander a large inheritance or funds aren’t misused by caretakers. Or if your family includes children from previous marriages or other types of family dynamics/disputes, a trust can help ensure your loved ones aren’t cut out of their inheritance, unless you want them to be…in which case a trust is a good vehicle for that, too.

- Privacy and peacekeeping. The probate process is public, which isn’t ideal for most families. Trust funds maintain financial privacy and can also limit the visibility between beneficiaries. Imagine the arguments if one child learns his/her sibling inherited twice as much…

- The trustee has a legal obligation. Appointing someone as a trustee on a trust is a big decision. It is a lot of work and can carry significant legal complications if done improperly. Trustees have a fiduciary duty to abide by the terms of the trust and act in beneficiaries best interests. People often name relatives as successor trustees, but this can strain family dynamics and is not typically advisable if a corporate trustee is an option.

Sudden wealth from inheriting a trust fund

If you have sudden wealth from inherited money in a trust and aren’t sure what to do next, we may be able to help. As an independent wealth management firm and second-generation family business, we pride ourselves on developing long-term relationships with our clients. Unfortunately, advisors at the big firms don’t always give adequate attention to new wealth inheritors.

But here’s the good news: as the beneficiary, once you receive a distribution from the trust, you’ll likely be free to start a relationship with a fiduciary financial advisor of your choosing. Through ongoing investment management and financial planning, we’ll work to help you develop a roadmap to meet your financial goals. To learn more, schedule a call with an advisor.

Important disclosure: The material in this article is for generalized information only as to some of the financial planning considerations regarding trusts and should not be misconstrued as the rendering of personal legal, accounting, tax, or investment advice. We strongly recommend you consult an attorney in your state to discuss your personal situation and estate planning needs.