A restricted stock award (RSA) is a form of equity compensation. RSA grants are commonly issued by private companies, particularly early-stage startups, and may be referred to as founder’s stock or simply restricted stock grants awarded to employees. When restricted stock is granted, shares of company stock are held in escrow until vesting requirements have been met. When the stock vests, the employee receives the shares.

Restricted stock awards are different than restricted stock units (RSUs), stock options, and other forms of stock compensation. The restricted stock tax treatment, especially the ability to make an 83(b) election, is particularly important if you have RSAs.

Understanding these differences and the tax implications, particularly the 83(b) election, is crucial. This guide will walk you through the key aspects of your RSA grant.

Guide to Restricted Stock Awards (RSAs):

- What are restricted stock awards?

- How restricted stock awards are taxed

- 83(b) elections

- RSU vs RSA: differences between restricted stock awards and restricted stock units (RSUs)

- Performance stock grants vs restricted stock

- Restricted stock vs stock options

- Help managing equity compensation

What is a restricted stock award (RSA)?

A restricted stock award is a grant of employer stock that the employee will receive once vesting conditions have been met (which can be time or milestone-based). Unlike stock options or employee stock purchase plans (ESPPs), with restricted stock awards, the employee usually doesn’t have to buy the shares as they’re often granted at no cost.

Key features of a restricted stock grant

Review your grant agreement and the stock plan documents and look for the key terms below.

Grant agreement and plan documents

The grant agreement includes important provisions relating to your specific RSA grant, such as the number of company shares granted, purchase cost, vesting schedule and start date, and vesting conditions (time, event, or both).

If the grant includes an event such as a milestone, it will also have an expiration date. If the event doesn’t happen before the grant expires, you lose the restricted shares.

The company’s equity compensation plan document will contain other important rules which often apply to all employees. The plan document will also detail clawback or repurchase rights for unvested shares, accelerated vesting if the company is acquired, and whether there are any special vesting considerations for retirement, death, or disability.

These documents usually contain information about options for meeting the employer’s tax withholding obligations and if vested shares are settled in cash or company stock.

Purchase price

RSAs are usually given to employees at no cost (hence the award) or offered at a nominal cost per share (a matter of cents).

Although uncommon, other stock purchase arrangements are possible, including the current market price of the underlying stock or some discounted stock price. Again, this is more typically found in other forms of equity compensation, though it is possible with restricted stock awards too.

Vesting schedule

Vesting of restricted stock is often time-based but it could be performance-based or a combination of the two. Schedules are typically graded, so stock is earned in increments over time (examples: equal monthly/annually or one-year cliff then monthly). The most common vesting period is three years, going as high as five years. Longer vesting dates are uncommon.

The shares granted in a restricted stock award are kept in escrow by the company until the award vests or unvested shares are forfeited or repurchased. You may be entitled to vote or receive dividends on unvested shares during the restricted period.

Vested shares

Once vesting requirements are met and restrictions lapse, you may receive shares of company stock, a cash equivalent, or a combination. In most cases, actual shares of common stock will be delivered.

If you work for a startup or private company, you might not be able to sell stock even after shares vest. Not having a liquid market to sell your shares can create major cash issues for employees if you need to pay taxes. It also means shareholders can’t control when, if ever, they’ll have a sudden wealth or liquidity event from the company stock.

It’s easier to sell your shares if the stock is publicly-traded, though you’ll need to consider blackout windows, insider trading rules, and other restrictions.

If you leave the company

If you leave the company before the vesting period is up, you will typically forfeit unvested shares. At private companies, it is also possible that vested equity awards are clawed back and repurchased. If that happens, it’s often for the lesser of your purchase price or the current stock price.

Again, refer to the plan documents and your grant agreement and situational changes. For example, the rules might be different if you leave to work for a competitor or are fired versus company layoffs.

Restricted stock tax treatment

A video from Darrow Wealth Management walking through how RSAs are taxed.

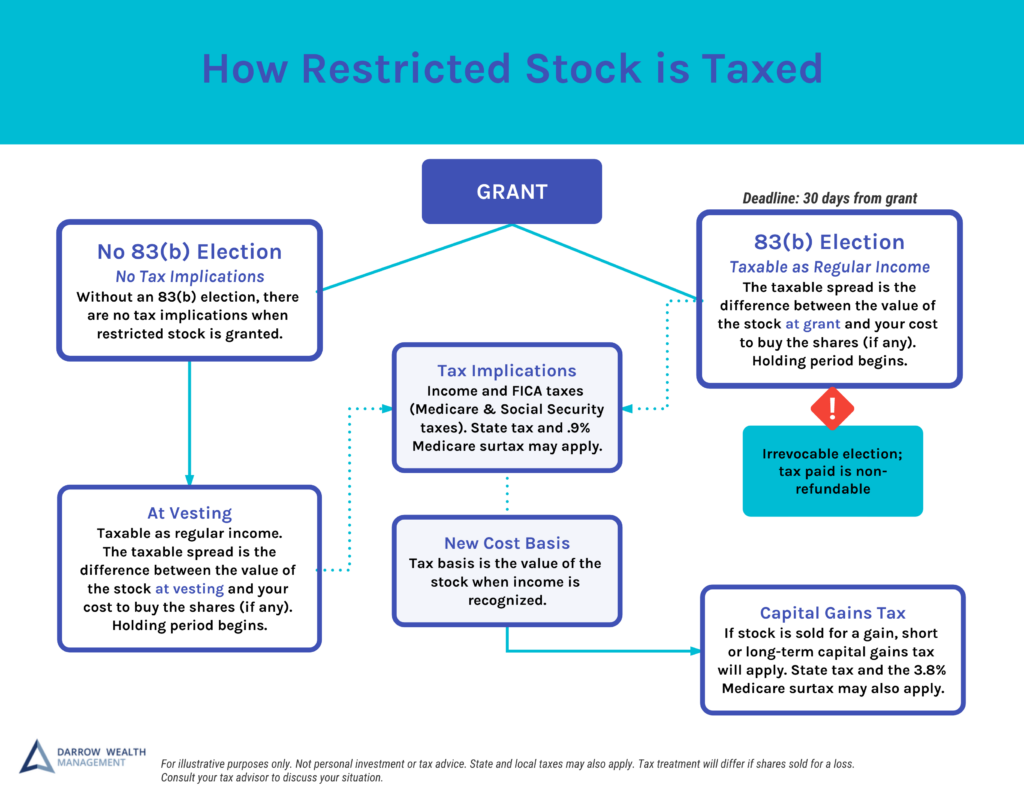

Tax implications

Assuming an 83(b) election is not made (discussed below), no income tax is due when a restricted stock grant is accepted. However, at vesting, the difference between the fair market value of the stock when it vests and the amount you paid for the shares (your cost basis) is subject to ordinary income tax and tax withholding.

The taxable income is treated as regular wage income, subject to federal income tax, FICA payroll taxes, and possibly state and local tax, depending on where you live.

Importantly, under this method, the tax due is not dependent on whether or not you sell your shares. It’s based on when the shares are delivered. This can be extremely challenging from a liquidity standpoint and costly from a tax perspective. After all, there’s no way to know what the stock is going to be worth years into the future.

Given these challenges and potential tax implications, employees may be advised to file an 83(b) election when receiving restricted stock awards. Some companies may even require it. So if you’re getting RSAs, discuss your tax situation with a tax professional right away.

Withholding options when shares vest (no 83(b))

The company’s specific rules will address what options you have (if any) to satisfy tax withholding at vesting.

At startups and private companies, since there’s no public market for the stock, employees need other sources of cash to pay income taxes. That’s why restricted stock is typically awarded at or near the stock’s fair market value (which itself is usually very low). The goal is usually for the employee to file an 83(b) election, recognizing little, if any, taxable income in the year. Otherwise it could be a major taxable event at vesting.

At public companies, there are usually more options:

- Share withholding or sell-to-cover (most common). Here, a portion of the shares awarded are kept by the company or sold to cover tax withholding requirements. The remaining shares is deposited to your stock plan account.

- Same-day sale. If offered, when shares are delivered at vesting, all the company stock is sold. A portion of the cash proceeds are kept to pay taxes and the remaining is distributed to you.

- Cash. Although unusual, it may be possible to transfer cash to your stock plan to pay the tax, and retain all the shares you were initially granted.

83(b) tax election

An 83(b) election allows you to pay ordinary income tax on the award when it is granted, rather than when it vests. To make the election, you must file an 83(b) election within 30 days of the grant.

Reasons to consider making an 83(b) election

Without an 83(b) election, every time your restricted stock award vests, you’ll have an uncontrollable tax burden. You won’t know how much you’ll owe until the shares vest. Avoiding these tax consequences is a key reason to consider an 83(b) election.

- Start the long-term holding period. With an 83(b) election, the holding period begins when the election is made, instead of at vesting. This can be advantageous since stock must be held for more than a year to benefit from long-term capital gains tax rates.

- Potential to reduce your overall tax liability by shifting income to capital gains. All else equal, it’s usually best to skew as much of the spread towards long-term capital gains instead of regular income. In 2025, the highest long-term capital gains tax rate is 20% versus the highest marginal income tax bracket of 37%. There also might be an opportunity to avoid ordinary income entirely. If the value of the stock equals your purchase price, filing the election results in no regular income.

- Control increases to your ordinary income. Because the current value and purchase price at grant are known inputs, before making an 83(b) election, work with your tax advisor to assess the impact and make an informed decision.

- Potential for tax-free gains under Section 1202 (QSBS). An 83(b) tax election can also help lock in eligibility for tax-free sales under qualified small business stock (Section 1202). Again, the 83(b) election starts the holding period. So it can be a critical factor in meeting some of the eligibility criteria for qualified small business stock, notably the 5-year holding period and asset test. There are other factors though, so consult your tax advisor.

Drawbacks:

- Risk of vesting. Making an 83(b) election does not ensure your shares will vest.

- Risk of overpaying. You won’t be better off if the share price at vesting is below the value at grant or if the company fails before your shares vest. Remember, stocks don’t only go up, and concentration risk can be significant. Also, consider what happens to shares during mergers and acquisitions.

- Irrevocable and non-refundable. Even if the shares are clawed back by the company or don’t vest, any income tax paid is non-refundable.

Learn more about 83(b) elections including illustrative examples of the tax implications and potential benefits.

Capital gains taxes

Restricted stock can be subject to two types of tax: ordinary income tax (either at grant if you make an 83(b) election, or at vesting if you don’t) and capital gains tax if you later sell the shares for a profit.

Capital gains taxes are realized when:

- RSAs use the Section 83(b) election and are sold at a future date once vesting is complete

- Shares are held after the vesting date (no 83(b)) and eventually sold

In these cases, capital gains tax will apply to the subsequent gain (if any) above your cost basis when the shares are later sold. If shares are not sold for a gain, it’ll likely be a capital loss for tax purposes.

The capital gains tax rate depends on your holding period and the magnitude of the gain. Long-term capital gains are taxed more favorably than short-term. Short-term capital gains tax rates are the same as ordinary income rates. You must own the shares for more than a year to receive favorable long-term capital gains tax treatment.

You can estimate your approximate capital gain by taking your sale price and subtracting your tax basis (which is either the fair market value of the stock at vesting or when the 83(b) election was made).

Even if you owe taxes from capital gains, there is no required withholding at sale. Discuss your situation with your tax advisor as estimated payments may be necessary.

Restricted stock units vs restricted stock

What is the difference between RSA and RSU? While restricted stock units (RSUs) share some similarities with RSAs, there are key differences.

With both restricted stock units and awards, vesting may be time or performance-based and cash or shares could be delivered upon vesting. Both are eligible to receive dividends (or cash equivalents) on unvested shares (either as they’re issued or at vesting). However, this is subject to plan terms.

But unlike restricted stock, where there can be a purchase price, employees don’t buy RSUs. So unless the stock goes to zero, vested RSUs always have value. Employees with RSUs cannot make an 83(b) election and since grants of restricted stock units don’t represent an ownership interest until shares vest, there are no voting rights.

Assuming a restricted stock award recipient doesn’t make an 83(b) election, the tax treatment is the same for employees of public companies. When restricted stock units are given at private companies, they’re almost always subject to double-trigger vesting. This delays income tax implications until the company has a liquidity event.

Performance stock units and awards vs RSUs and RSAs

Performance stock awards (PSAs) and performance stock units (PSUs) are variations of RSAs and RSUs, respectively. Like RSUs compared to RSAs, PSUs are generally more common than PSAs.

The key differences between restricted and performance stock awards/units are the vesting requirements which determines how many shares will be distributed. Performance stock only vests if company and/or individual business milestones or goals are met within a specified time frame.

Further, the number of shares (or cash equivalent) you might receive is usually based on actual performance relative to target. For example, if the company exceeds earnings per share (EPS) goals, you could be given over 100% of the target grant amount. Or if EPS fell short of the target but was still within a certain range (as stated in your grant), then fewer shares could be released. If performance goals are missed, you may get nothing.

Otherwise, the tax implications for PSUs are generally similar to RSUs, and the taxation of PSAs (including the potential for an 83(b) election) are generally similar to RSAs.

Restricted stock vs stock options

Restricted stock awards and stock options are both forms of equity compensation. There are two kinds of stock options: nonqualified (NQSOs) and incentive stock options (ISOs). Here are the key differences between restricted stock and stock options:

- Restricted stock awards are typically given at no cost the employee. Stock options must be purchased at a set price, called the exercise price or strike price.

- Stock options are only worth something if the market value at vesting (and later, sale) is greater than the exercise price. If restricted stock is given to you, shares will always be worth something unless the stock goes to zero.

- With stock options, the employee decides when to exercise which can trigger taxes. It doesn’t happen automatically when the options vest, as it does with RSAs without an 83(b).

- An 83(b) election can also be made when exercising stock options early (before they’re fully vested). And when doing so, option holders decide how many shares to exercise. This is unlike RSAs, where the election applies to the entire grant.

Stock compensation specialists

Navigating the complexities of restricted stock and the universe of stock-based compensation can be challenging. Especially at early-stage startups, the potential for wealth creation can be significant. That’s why it’s important to ensure you’re making the right financial decisions.

Darrow Wealth Management specializes in stock options and equity compensation. Especially for founders and early employees, restricted stock can provide a major liquidity event that transforms your financial life. To maximize the opportunity, it’s critical to get the right team of advisors in place before making irreversible decisions with your shares.

Schedule a call with a wealth advisor to discuss your situation.

[Last reviewed May 2025]