The 4% rule is one of the most well-known rules of thumb in personal finance. The premise is simple: retirees can withdraw 4% of their starting retirement portfolio annually, plus inflation, for 30 years with a high probability they won’t run out of money. Unfortunately, in practice, this withdrawal strategy isn’t ideal or accurate for many retirees. Here’s what the 4% rule gets wrong about retirement income.

The 4% Rule

Here’s an example of how the rule is intended to work. Assume an individual retires with a $1M investment portfolio. Their first year retirement withdrawal is $40,000. If inflation is 2.1% (the average between 2001 – 2020), then next year the retiree can spend $40,840.

This method is helpful in that it provides a back-of-the-envelope way to estimate how long a retirement portfolio may last. But there are downsides, such as the lumpy nature of income and expenses.

6 Things the 4% Rule Gets Wrong About Retirement Income

Sources of income change in retirement

The 4% rule assumes one steady stream of income throughout retirement: your portfolio. In reality, many retirees have will experience new or changing sources of income over time.

Social Security benefits, a pension, and required minimum distributions from retirement accounts often occur over time, not on day one of retirement. As a result, portfolio withdrawals may need to be much larger in the beginning of retirement, only to decrease as other sources of income become available.

Given that retirement expenses tend to decrease over time (overall) and new sources of income often become available, in many situations, the 4% rule underestimates the true safe withdrawal rate. Further, the 4% rule assumes a very high probability of success, perhaps unreasonably so. As discussed below, the best retirement plans are flexible and dynamic, allowing you to enjoy more of your success as conditions warrant and cut back if necessary.

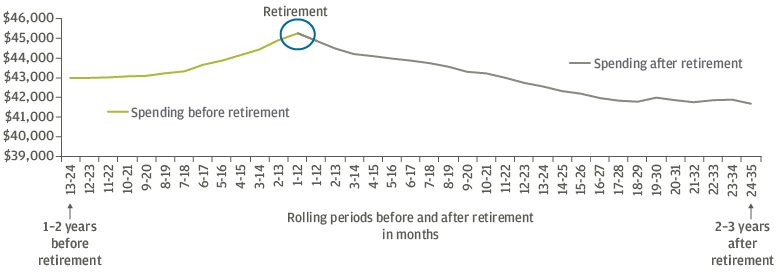

Expenses aren’t even

If you don’t have a good handle on how much you’re spending before retirement, how will you know what you need in retirement? Another challenge: as some costs increase (like healthcare), other expenses (like food and travel) decrease. But not necessarily on a 1-for-1 basis. The 4% method may result in years where portfolio isn’t enough, or is too much, to meet your actual needs.

Rolling Monthly 1-Year Median Spending Before and After Retirement (Retirement age 60-69)

What about taxes?

There is only so much we can control. Unfortunately, future tax rates isn’t one of them. The 4% rule doesn’t include any ‘inflationary’ adjustment for taxes. Further, depending on the types of accounts you have, taxes could significantly change your after-tax income.

For example, in 2021, the capital gains tax rate is 0% for married couples until their income exceeds $80,800, when the bracket increases to 15% until income exceeds $500,000 and a 20% rate applies.

So taking money from a brokerage account could potentially result in no taxable gain or perhaps even a capital loss. Compare that to distributions from retirement accounts funded with pre-tax dollars and taxed as ordinary income when withdrawn. Using the same income bands, the marginal tax rate falls between 22% and 35%, and 37% if income exceeds $628,300.

Another Retirement Myth: Living Off Dividend Income

The 4% rule doesn’t account for market volatility

Imagine two individuals about to retire. For simplicity, assume they both have a $1M portfolio on February 19, 2020, and are 100% invested in the S&P 500¹. One retires. The other retires March 23, 2020. In this time the S&P 500 drops nearly 34%.

Using the 4% rule, the person who retired first can take $40,000/year every year for 30 years (plus inflation) while the second person can only take $26,484/year, plus inflation.

In reality, both figures are probably wrong. In practice, retirement spending should be monitored on an ongoing basis to help ensure alignment with real life.

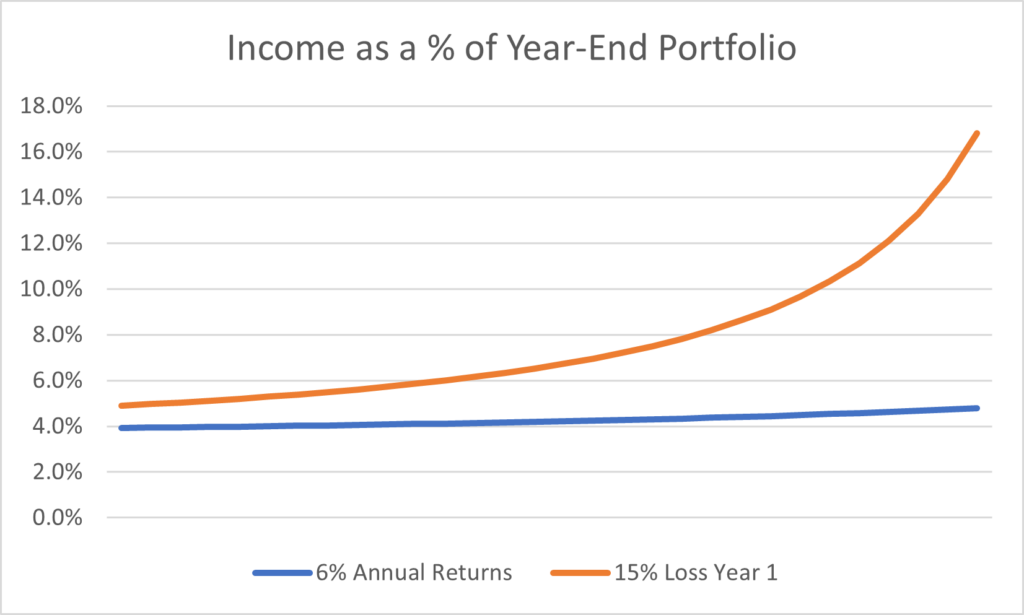

To illustrate the impact over time, here’s a hypothetical account balance of someone who retires and experiences a market crash the same year vs a retiree with steady annual returns.

The chart reflects annual withdrawals as a percentage of the year-end portfolio value between two portfolios: one portfolio enjoys 6% annual returns for 30 years while the other portfolio suffers a -15% loss in year one, before returning 6% annually.

It’s worth nothing that while neither portfolio was $0 at the end of 30 years, assuming a steady, equal return every year is unrealistic. Markets are volatile. Stocks don’t always go up. For retirees, sequence risk and volatility drag are especially important in retirement. This is yet another limitation of the 4% rule.

In addition to market risk, also consider the impact of inflation. If inflation spikes, then the 4% rule says you can increase your annual income to compensate. Especially if a spike in the cost of living coincides with a market downturn, the impact on your retirement assets could be significant.

Is 30 years enough?

According to J.P. Morgan, for couples currently 65, there’s a 49% chance at least one partner lives until age 90 and a 20% probability at 95. In another words, if you retired at 60 using the 4% rule, the odds are 1-in-2 that a key assumption of your retirement plan is wrong. Early retirees should be especially wary of being led astray by the 4% rule. Since you don’t know how long you’ll live, it’s important to consider longevity in your projections.

A 50/50 portfolio may not cut it

A key assumption of the 4% rule is the portfolio is a conservative mix of 50% equities and 50% bonds. Back in 1994 when the rule was born, bond yields² were close to 8%. After ending 2020 below 1%, the US 10-year treasury is now around 1.6%.

Markets change over time. People live longer. Interest rates aren’t stagnant. Correlations among asset classes shift. These are just a few of the factors that make professional asset managers call the traditional 60/40 retirement portfolio into question. If a 60/40 mix doesn’t cut it, the 50/50 portfolio would fare even worse.

Retirement plans that don’t bend, break

While it’d be nice to set it and forget it, your retirement income strategy needs to be dynamic and flexible. To be clear: projecting a level annual retirement income, increasing by inflation, is helpful when beginning to assess the type of lifestyle your assets may be able to support. But tailor the assumptions to your income needs, risk tolerance, time in retirement, and lifestyle goals for a more accurate picture. And be prepared to adjust your plan throughout retirement as goals, expenses, and market conditions require.

¹ For illustration purposes only. The 4% rule assumes a portfolio 50% in stocks and 50% bonds.

² US 10-year treasury yield.