Asset Management vs Wealth Management

When searching for a financial professional, you may wonder whether you need asset management vs wealth management. How are they different? Advisory firms offer a range of services and may specialize in one area too. With so many synonyms for financial advisors, it’s hard to find what differences exist. While there is not a formal definition, here’s how we view asset management vs wealth management and the differences between the two services.

Wealth Management vs Asset Management: What’s the Difference?

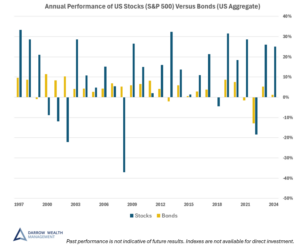

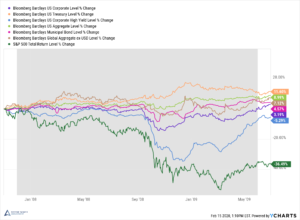

Asset management focuses on managing the money in your investment accounts, such as an IRA or brokerage account. Investment management is everything from setting your asset allocation, managing ongoing investment risk by diversifying, rebalancing, tax-loss harvesting, to working to ensure your accounts are structured so your overall investment portfolio is aligned with your goals and income needs.

Aside from portfolio structure and investment selection, asset management also includes how and when to invest in the market. This is especially important to help investors manage market volatility.

Wealth management includes asset management but expands to encompass financial planning, retirement planning, tax planning, and ongoing advice. Since investing and financial planning are intertwined, it’s often best to look at everything together. This includes retirement planning, tax considerations, and robust financial modeling and stress-test simulations.

For example, a wealth advisor could help you figure out what to do with an old 401(k) by considering whether to leave the account in the old plan or move it to your new one, roll it over to an IRA, or convert the account to a Roth IRA. This decision involves many financial planning considerations.

For example: Which option is best given your current and future tax situation? What are the investment options in each scenario? Do you plan to retire early, before 59 1/2? Would your Roth account be large enough to make a meaningful difference in your financial situation in retirement? What about asset protection?

In any case, the asset manager or wealth manager could manage the investment account.

Do You Need a Asset Manager, Wealth Manager, or Financial Planner?

Wealth management = asset management + financial planning

Wealth management is often thought of as comprehensive or holistic. This is because wealth managers usually manage their client’s entire financial lives, which includes financial planning and managing money. Because we like math: asset management + financial planning = wealth management.

Asset management vs wealth management: a simple hypothetical case study

The client is Marlow. He has a 401(k), inherited IRA, and brokerage account. Marlow is married, works full time, and has two kids in high school.

Asset management

An asset manager would manage the investments in his accounts which includes setting and maintaining an appropriate asset allocation on an ongoing basis. If Marlow needed money from his accounts or wanted to invest more cash, the investment manager could help by raising cash tax-efficiently, exploring tax-loss harvesting opportunities, and ensuring the account is rebalanced periodically so it continues to meet his target investment mix and risk profile.

Marlow might meet with his investment advisor once or twice a year to review account performance and to see if there are any changes to his cash needs, time horizon, or risk profile which might impact the investment strategy.

Financial planning

A financial planner who doesn’t manage money could offer a range of services. One-off planners could answer questions or help advise on issues the client identifies. For example, perhaps Marlow wants to know how to put his kids through college. The planner could put together a plan to pay for college, but miss the risk that Marlow doesn’t have an estate plan or enough life insurance.

Financial planners offering ongoing services may have a bigger picture view of Marlow’s situation and be in a better position to help identify and manage future changes. Because the planner doesn’t manage Marlow’s investments, he needs to be the middleman to make sure everyone is on the same page.

For example, if Marlow’s asset manager doesn’t know the brokerage account is paying for college next year, the money may not be there if the asset allocation is too stock-heavy. Or perhaps there could be a missed opportunity for tax planning when selling positions to pay for school.

With an hourly or stand-alone planning engagement, the client is the only one watching their finances. Laws change and life does too. But since we don’t know what we don’t know, it’s difficult to know you haven’t missed something.

Wealth management brings it all together

A wealth manager could manage Marlow’s investment accounts according to his goals and cash needs, advise on current planning questions, and work to help proactively identify future financial risks. By pulling the investment and planning components together, a wealth management firm acts as a financial quarterback for Marlow.

For example, a wealth advisor may prioritize the need for an estate plan. The advisor could suggest an attorney, provide asset and account information, and when the plan is done, do the heavy lifting to retitle Marlow’s brokerage account in his living trust and update beneficiary designations.

A wealth manager may also realize that due to the end of the ‘stretch’ IRA, Marlow’s inherited IRA could create issues with financial aid, and suggest alternative distribution strategies. Perhaps there’s no need to tap his brokerage account and Marlow would be better off suspending contributions to his 401(k) for a year or two instead.

Contact with a wealth advisor is usually more consistent. They might meet at least twice a year, communicate changes to tax and retirement law, and offer ongoing advisory support in the interim. Rather than just look at portfolio holdings, review meetings will focus on the client’s entire financial life: are they staying on track for retirement, was there a sudden layoff or early retirement buyout package, or perhaps a promotion means figuring out the best use of extra savings.

5 Ways to Find a Fiduciary Wealth Management Firm

Do You Need a Wealth Advisor or Should You Do it Yourself?

This is just a simple fictitious example of how wealth management can encompass financial planning and asset management in one collective service. Wealth management can make it easier for individuals and families to get the financial advice and support they need without as much effort and even help reduce the risk of something falling through the cracks if it was outside an advisor’s purview or miscommunication about who was responsible for the oversight.

Fee-only wealth management vs. fee-based investment advice

It’s a difficult question as titles are interchangeable. Of course, that doesn’t mean all financial professionals are the same – far from it. As you consider which advisor is best for you, consider advisor compensation, certifications, and credentials in your decision.

Fee-only wealth management

A fee-only financial advisor is only paid by their clients; they do not sell financial products (like insurance or mutual funds) and they do not receive commissions. Fee-only advisors also don’t accept compensation from third parties, like referral fees or other sales revenue. Fee-only advisors usually base fees on a percentage of the assets they manage for their client.

Fee-based financial advisor

Fee-based advisors are paid by client asset management fees and commissions for selling financial products and securities to clients. The commissions on these products can be substantial which can create concerns about conflicts of interest. This type of advisor can also receive referral fees and other third-party revenue.

Wealth and asset management from a CERTIFIED FINANCIAL PLANNER™ professional

There is no education or licensing requirement to be a financial planner so anyone can hold themselves out to be a financial planner. However, to make securities recommendations or sell insurance, licensing is necessary. Requirements depend on the governing body (e.g. state vs SEC and Finra) and the type of advisory business.

Since anyone can hold themselves out to be a financial planner or advisor, additional credentials can help you compare advisors’ qualifications. For example, the CERTIFIED FINANCIAL PLANNER™ professional designation is typically considered the “gold standard” for financial advisors. Similarly, the Chartered Financial Analyst® designation is top tier for asset management.

Learn more about our team of advisors.

Consider a wealth management firm who has a fiduciary duty to act in your best interest

If a wealth management firm is structured as a registered investment advisor, the advisors have a fiduciary duty to act in the your best interest. Because registered investment advisors are fiduciaries, they must always put their clients’ interests ahead of their own. This is the highest standard of care under the law.

Many fee-only financial advisors are registered investment advisors (and fiduciaries). But it is possible for a firm to be one and not the other. As such, you’ll want to understand when your advisor is (or isn’t) working in your best interest.

Are Financial Advisors Worth the Cost? It’s Not Just the Value of Your Time

Working with an independent wealth management firm and money manager

Independent wealth management firms and financial advisors have no affiliations or allegiances to a particular fund family or financial product. Advisors affiliated with a bank, wirehouse, or large asset manager might not be able to make an independent recommendation.

Consider, for example, if you walked into a Bank of America branch and asked for the best type of savings account on the market. As you’d expect, they’re going to recommend one of their products.

For help building and managing your wealth, please contact us today.

Darrow Wealth Management is proud to be:

-

-

A fiduciary financial advisor

-

Fee-only wealth manager

-

Independent

-

SEC-registered investment advisor

-

CERTIFIED FINANCIAL PLANNER™ professional

-

Private Wealth Management Services