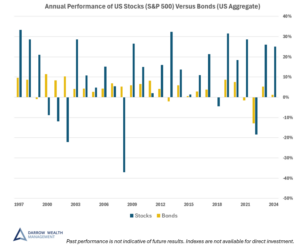

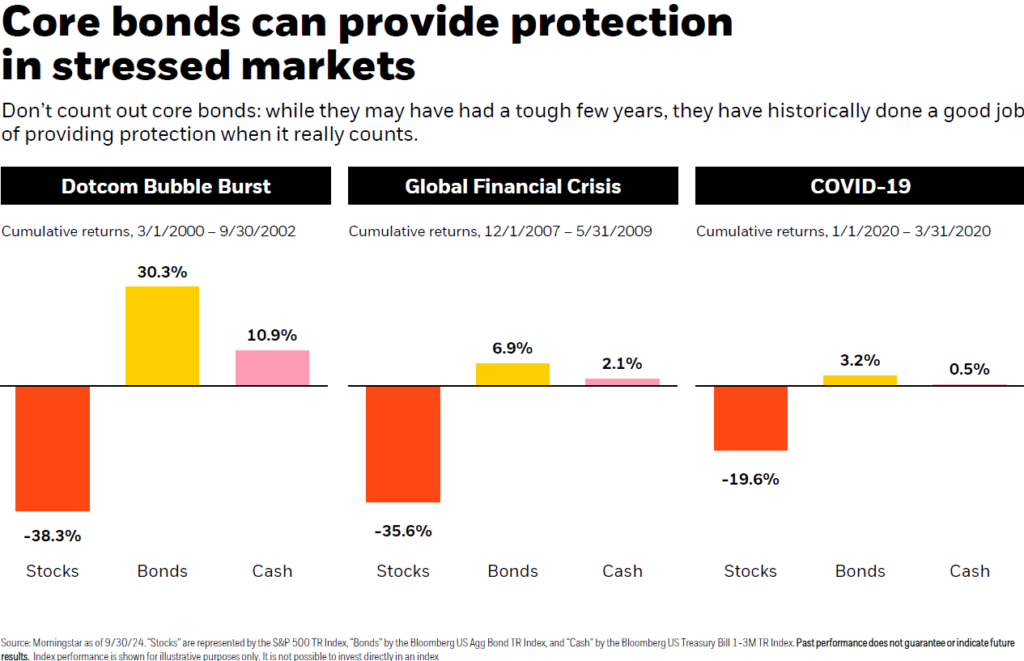

Although past performance is not indicative of future results, history can be a helpful lens to view bond performance during past recessions and bouts of volatility. Swings in the financial markets also highlight the benefits—and limitations—of diversification. During times of economic, financial, and political uncertainty, investors often wonder where to invest or what changes to make to their portfolio. Making knee-jerk reactions to headlines usually isn’t the best approach. Safety is relative and investors should always understand that any investment involves risk.

But to illustrate the relative protection that bonds may be able to provide compared to stocks, here’s what happened to the bond market in the 2008 great financial crisis and recession and 2020 market crash.

How do bonds perform during a recession?

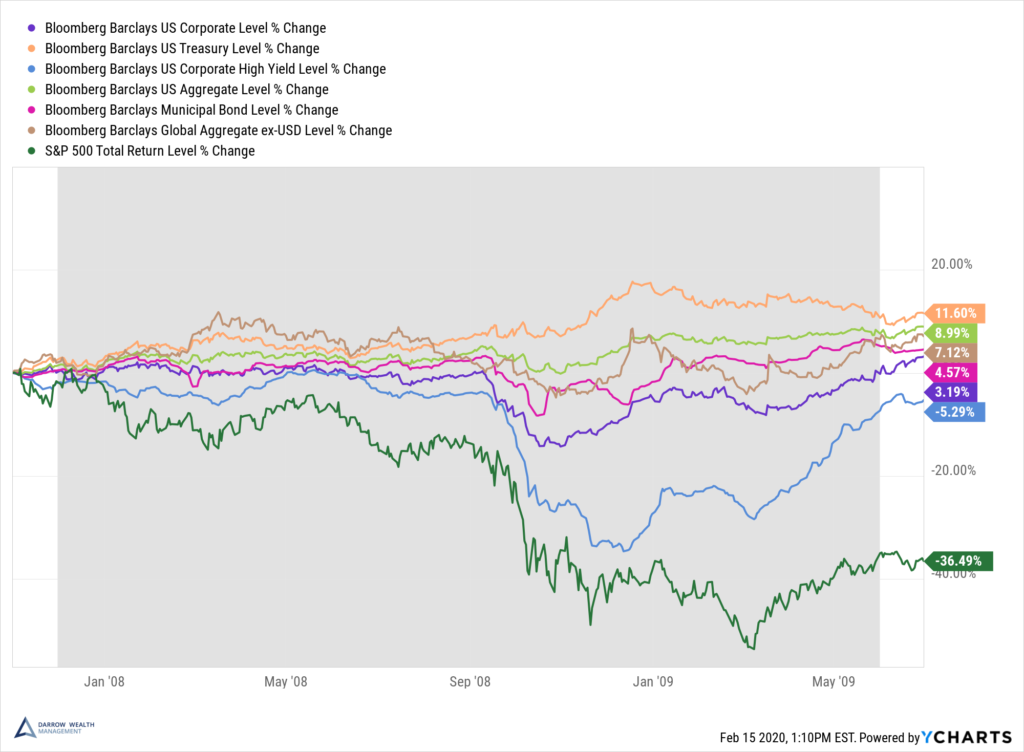

The chart below shows what happened to fixed income (bonds) in 2008. The returns are normalized total returns of various bond indices during the 2008 -2009 financial crisis. The S&P 500 is also included as a basis for comparison. Overall, while bonds outperformed stocks by a wide margin during this time, there’s still a large range of returns within the fixed income sector.

Changes in monetary policy and the current interest rate and inflationary environment can also impact the correlations between stock and bonds over time.

Bond performance during the 2008 recession

Did bonds do well in 2008? Yes, even though the stock market got all the headlines. Here’s a chart of the S&P 500 and various Bloomberg Barclays U.S. Bond indices during the 2008 recession (gray).

Past performance is not indicative of future results. For illustrative purposes only. Indices not available for direct investment.

Again, every recession or economic downturn is different. But history offers a helpful lens. Bonds don’t perform uniformly during a recession, selloff, or calm markets. Within the fixed income market, sector performance will vary depending on market conditions, the yield curve, and economic cycle, and so on.

During recessions, investors tend to seek the relative safety of Treasury bonds compared to investment grade corporate bonds (or high yield bonds, not pictured).

Why do investors seek high quality bonds during a recession or market downturn?

As economic conditions decline and investor uncertainty grows, more investors seek safety in high-quality fixed income investments, particularly U.S. treasuries. This drives bond prices up, which pushes returns down.

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Prices and Yields

The interest rate environment will also affect the appetite for borrowing. When rates are low, corporations often retire high-cost debt in favor of issuing new bonds at a lower rate and a longer duration to lock in favorable rates. The same thing happens when homeowners refinance their mortgage—debt with high interest rates is repaid through the issuance of new loans.

As the homeowner, you may be on both sides of this equation. On one hand, you’re getting a lower rate on your mortgage, but on the other, you may own mortgage-backed securities as part of your bond portfolio. As the old mortgages are paid off, investors buy new mortgage bonds at lower rates, which can hurt investment performance.

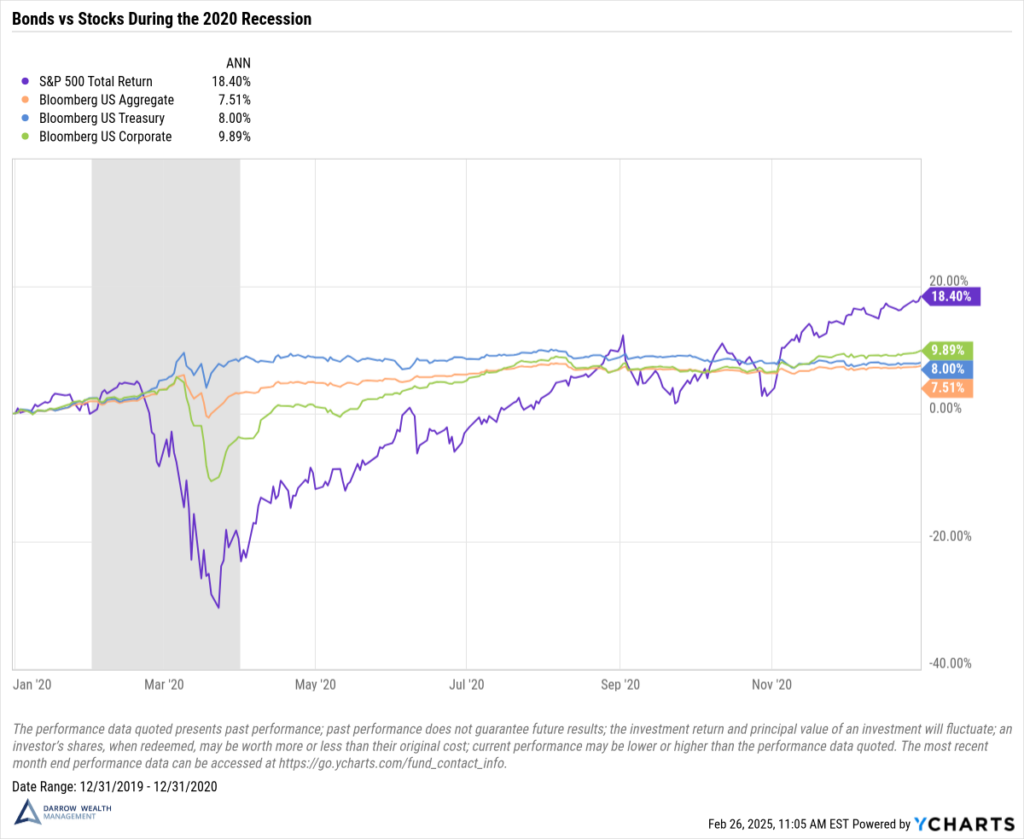

Stock versus bond returns during the 2020 recession and market crash

The market crash and recession of 2020 was as short-lived as it was severe. Similar to the 2008 global financial crisis, in 2020 investors were grappling with a long list of concerns, including an inevitable economic slowdown. This led to a selloff of risk assets, resulting in a significant decline in the stock market, but mostly stable bond performance.

Stocks vs. Bonds: Differences in Risk and Return Make a Case for Both

While there wasn’t much that went according to plan in 2020, when we zoom out, this is a picture of a diversified portfolio performing as we might expect. As stock market losses mounted and turned into a bear market, US government bonds (Treasury bonds) performed well as investors sought stability and hoped to preserve capital.

Since Treasuries are considered the safest investment, it isn’t unsurprising that other areas of the bond market didn’t perform as well during the recession. However, by the end of the year, risk assets were back in favor.

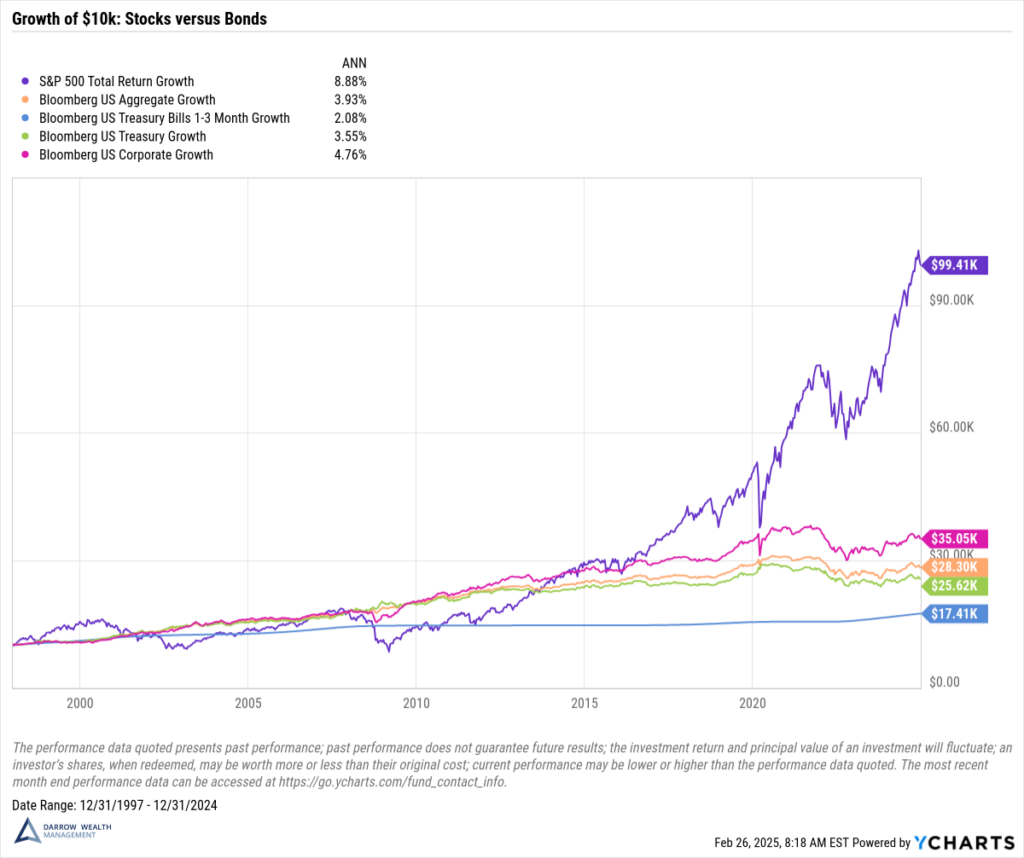

Diversified portfolios help balance risk and reward

Yes, bonds tend to perform better during a recession than stocks. However, to reach your long term financial goals, your investment strategy likely needs a mix of both. For most investors, their financial situation requires more growth than bonds alone can typically provide to outpace inflation and support retirement goals. Recessions are temporary, but your portfolio needs to last a lifetime.

Long-term growth of $10,000: stocks versus bonds (1998 – 2024)

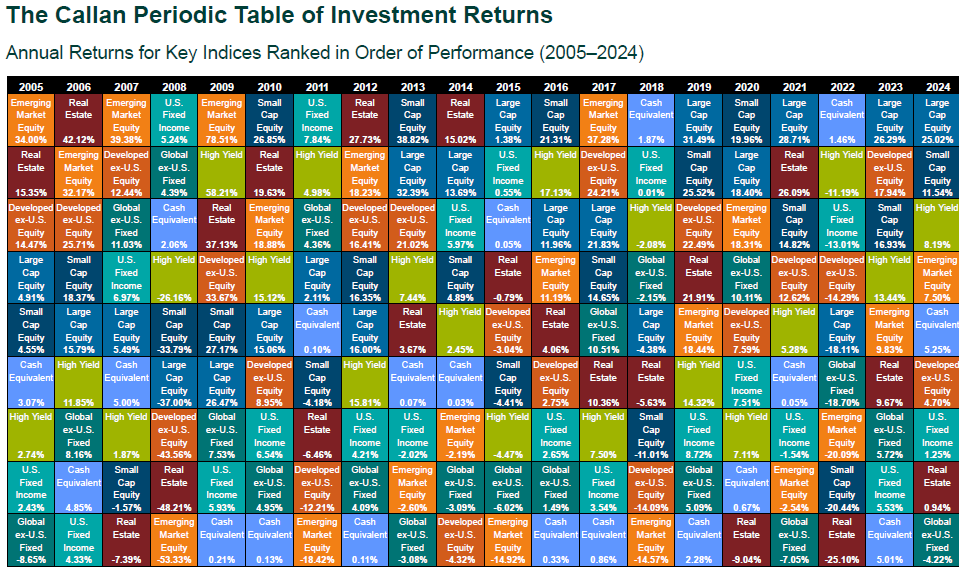

Ranked asset class returns

Investors generally shouldn’t take on more risk than is necessary to meet their financial goals. The Callan Periodic Table ranks calendar year returns for various asset classes. As the colors indicate, there’s a lot of variability year over year. But due to their relative stability and safety, the majority of US bond returns (teal) fall in the bottom half versus US stocks and other asset classes.

The table reinforces the importance of diversification. Although the focus of this article is about how bonds have reacted to recessions and market crashes in the past compared to stocks, only holding funds that track the S&P 500 and Bloomberg Barclays U.S. Aggregate Bond Index isn’t enough to ensure your portfolio is properly diversified.

Further, the correlation between bonds and stocks change over time and there’s still a range of returns within an asset class itself. Even for the most risk-averse investors who prefer the relative safety of fixed income, the challenge becomes ensuring you can outpace inflation over time and grow your portfolio enough to support withdrawals in retirement.

Proper planning and the right investment strategy can help you navigate economic downturns and uncertainty

An ongoing dedication to saving, investing, and planning for the future are the keys to success. Although it can be tempting to go to cash during a bear market, recession, or periods of economic or political uncertainty, the time to protect your portfolio is before these inevitable events take place. After all, volatility is a when, not an if. Retirement planning, like any type of robust financial planning, should include stress testing your investment strategy and financial plan.

Bonds help protect investors against extreme losses on their portfolio, but it’s important to realize that there isn’t always somewhere to hide. Volatility in your portfolio can be hard to stomach, particularly for investors who have recently retired or are on the cusp of retirement face additional market risks.

Disclosures

Examples in this article are generic, hypothetical and for illustration purposes only. Both past performance and yields are not reliable indicators of current and future results. This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Past performance is not indicative of future results.

[Last reviewed February 2025]