Tax implications of exercising and selling stock options

If you have stock options as a large part of your income, taxes are especially important. There are two types of stock options: incentive stock options and non-qualified stock options. How stock options are taxed depends on the type of options you have and your sale and exercise strategy. However, the general rules can change during a merger or acquisition.

In most cases, incentive stock options receive more favorable tax treatment compared to non-qualified stock options. Here’s a primer on how employee stock options are taxed at exercise and sale.

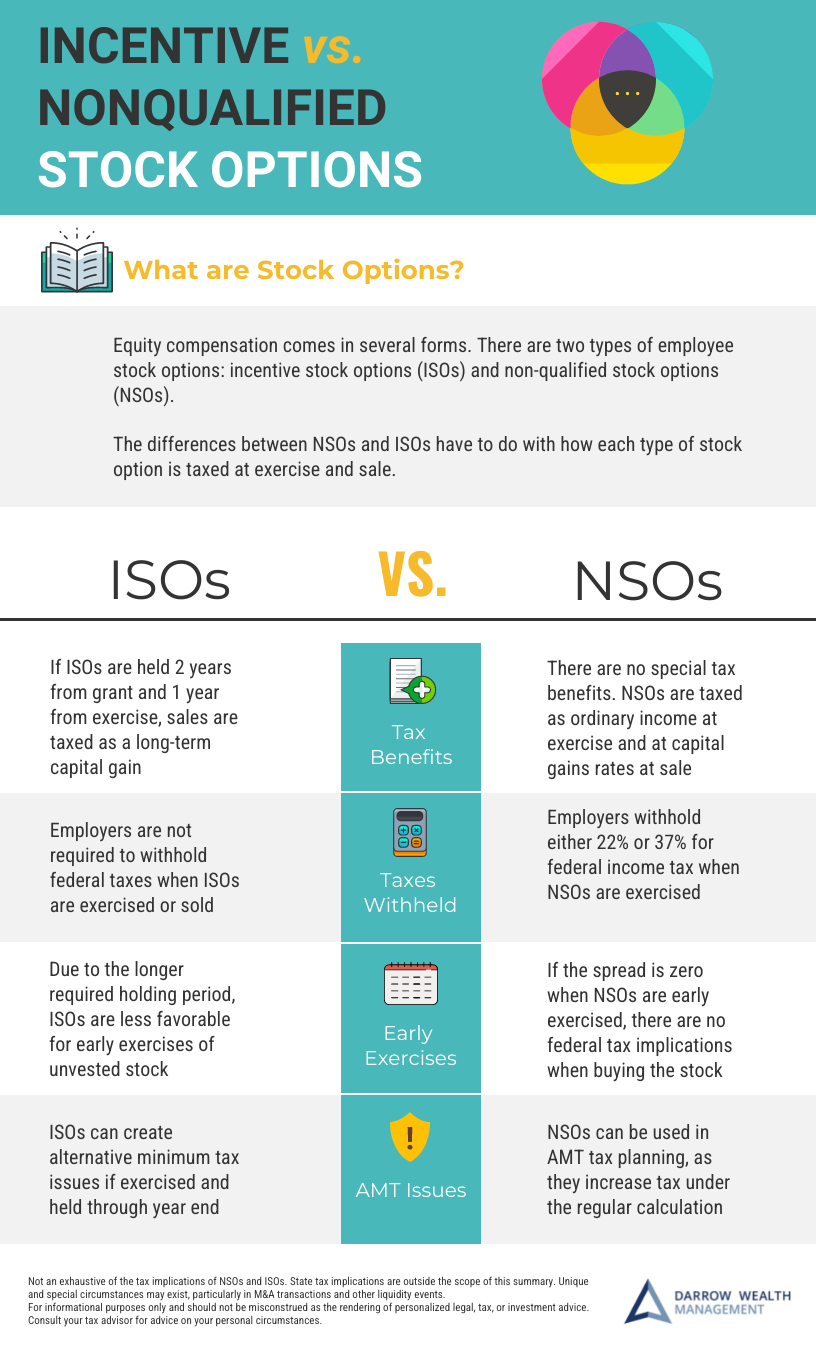

NSO vs ISO tax treatment

How are nonqualified stock options different from incentive stock options? Here’s an infographic to compare the two different types of stock options.

How incentive stock options (ISOs) are taxed

Summary of ISO taxation:

- Grant: No tax

- Vesting: No tax

- Exercise: No tax implications under the regular federal tax system, but the spread is income for the alternative minimum tax (AMT) calculation. This is why it’s sometimes called phantom income.

- Sale: When you sell the company stock, the gain or loss is taxed as a short or long-term capital gain or loss depending on how long you held the shares after the exercise date

Tax withholding at exercise and sale:

There is no employer requirement to withhold federal taxes when you exercise ISOs (and buy company stock) or sell the shares. However, that doesn’t mean you won’t need to pay taxes! Coordinate your plans with your financial and tax advisor prior to exercising or selling employee stock options. Incentive stock option tax rules are complex and you’ll want upfront advice and help filing your tax return.

Video: How ISOs are taxed

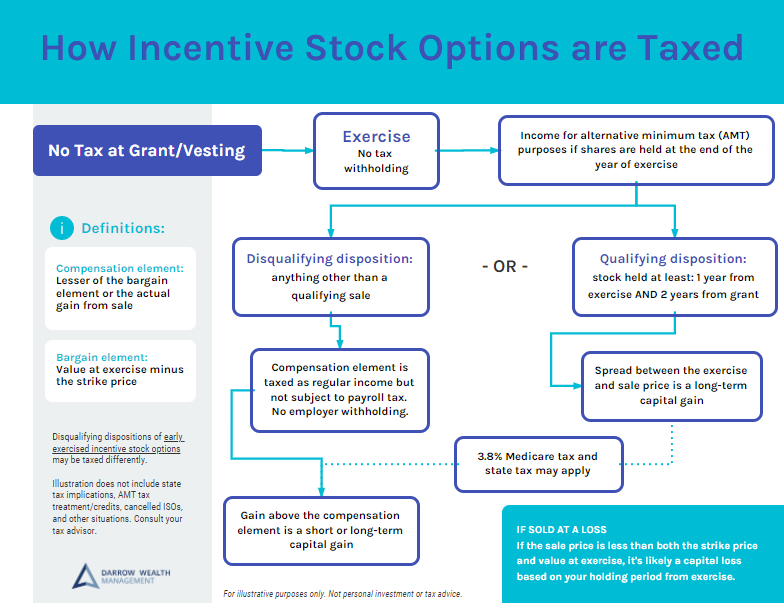

Infographic: How ISOs are taxed at grant, exercise, and sale

Exercising incentive stock options and the alternative minimum tax

The AMT is a parallel tax calculation to the regular method. In the AMT calculation, certain income is added back (AMT adjustment) and some tax deductions aren’t allowed. If the tax due under the alternative minimum tax is higher than the traditional system, then AMT is triggered for that tax year. The taxpayer must pay the greater of the two.

Because of this, exercising and holding shares through the end of the year can trigger the alternative minimum tax. If the stock is sold before the end of the year of exercise, there’s no AMT, but there are tax implications from the sale (discussed below).

AMT is essentially a prepayment of tax. So it isn’t the end of the world, but you won’t want to do it by accident. And there is some good news: if you do pay AMT, in future years when you’re not subject to it and have regular capital gains, an AMT tax credit may be available.

But to recoup any prepaid tax, taxpayers must track two different sets of cost basis. Again, you’ll want to work with your accountant in advance to run the numbers. A handful of states, such as California, also impose a state level alternative minimum tax.

6 Tax Strategies for Incentive Stock Options and AMT

How ISOs are taxed when you sell the shares

When you sell incentive stock options, it’s considered either a qualifying or disqualifying sale depending on how long you held the stock. A qualifying disposition has tax benefits and a disqualifying disposition does not.

Qualifying sale

To qualify, you must hold your stock for at least two years from the grant date and at least one year after exercise. Everything else is disqualifying.

In meeting the requirements for a qualified sale, then you will generally only pay long-term capital gains tax on the gain. For tax purposes, the gain is typically the sale price minus the purchase price (e.g. exercise price) multiplied by the number of shares sold.

In this way, ISOs have tax advantages as employees have the potential to exercise and sell their options and only incur a long term capital gain.

Disqualifying sale

If you exercise and hold the shares, the disqualifying disposition is typically taxed as part ordinary income and part capital gains (if there’s a gain). This is all based on the time between the exercise date and when the stock is sold. With ISOs, the difference between the fair market value of the stock at exercise and your strike price is taxed as regular income, but not subject to payroll taxes.

If you hold the stock for less than a year before selling, the gain (the difference between the sale price and the value at exercise) is a short-term capital gain. Currently, short-term capital gains rates are taxes the same as regular income. If you keep the stock for more than a year, it’s a long-term capital gain.

But if you exercise and sell right away, in a cashless exercise and same-day sale for example, you shouldn’t have a capital gain to report, just regular income.

However, if ISOs are cancelled and paid out (typically in conjunction with an acquisition), payroll taxes are generally assessed on the spread in addition to ordinary income tax.

Tax treatment of non-qualified stock options (NSOs)

Summary of NSO taxation:

- Grant: No tax

- Vesting: No tax

- Exercise: Exercising NSOs is a taxable event at ordinary income tax rates. At exercise, ordinary income will typically be: (current market price – the strike price) * number of shares. This is called the compensation element or spread). Payroll taxes also apply.

- Sale: Gain or loss is taxed as a short or long-term capital gain or loss depending on how long you held the shares after the date of exercise

Tax withholding at exercise and sale:

When you exercise NSOs, the spread between the exercise price and the current value of the stock is taxable at ordinary income rates for federal tax purposes. For employees, federal tax withholding at exercise is typically required.

When you sell the stock, there’s no required tax withholding, but you’ll still want to seek tax advice. Again, coordinate your plans with your financial advisor and CPA prior to exercising or selling stock options.

Video: How NSOs are taxed

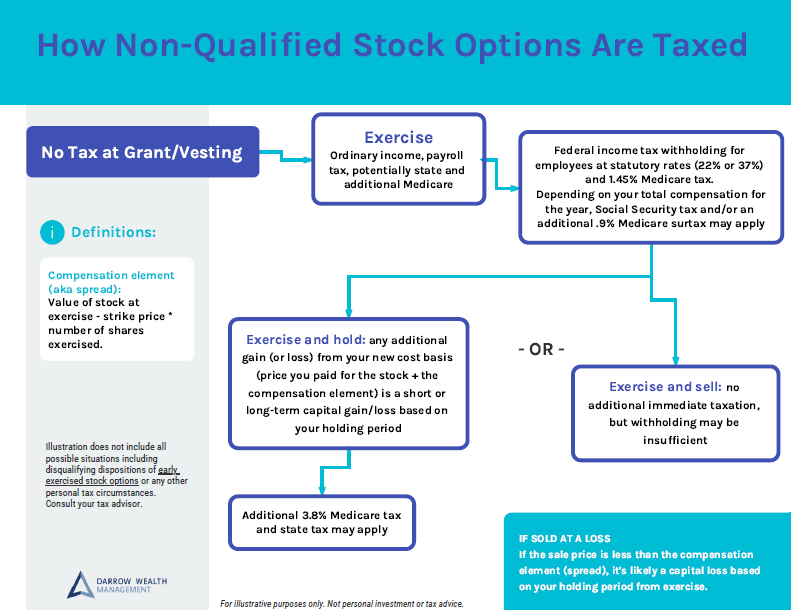

Infographic: non-qualified stock options tax at grant, vesting, exercise, and sale

How non-qualified stock options are taxed at exercise

As explained above, at exercise, the spread is included in your taxable income. This equals the current market price minus exercise price, multiplied by the number of shares you’re exercising. If the company is private, the 409a valuation is used as the current price at exercise.

When tax withholding is required, it’s typically done using a flat tax rate. When you exercise the option, if the spread is less than $1M, tax withholding is often 22%, if above, 37%. If your state has an income tax, withholding is likely required too.

The compensation element is also subject to payroll taxes (Social Security and Medicare). Keep in mind, this withholding may not be enough depending on your situation. Further, there may not be withholding for individuals who were/are not classified as employees, such as independent contractors or consultants.

How are NSOs taxed at sale?

After exercising NSOs, your strike price becomes your cost basis for tax purposes. So when you sell the shares, any increase in the stock price above your basis is a taxable short or long-term capital gain depending on your holding period. However, if you exercise and sell the stock immediately, you should only pay ordinary income tax.

If you’ve kept the stock for less than one year after exercise, it will trigger short-term capital gains tax. The tax rates on short-term capital gains are the same as regular compensation income. If your holding period is more than a year, more favorable long-term capital gains rates apply.

Again, it’s important to work with a tax and financial advisor to assess your specific tax situation.

Reducing tax on company stock options

Especially for early employees of a startup, there are some great ways to reduce or even eliminate all taxes on the exercise and even sale of stock options.

Early exercise with an 83(b) election

In most stock plans, option grants vest over time. Exercising isn’t possible until those restrictions lapse. But if the plan permits early exercises, employees can buy the stock before the vesting period is complete. Early exercises can offer significant tax savings in certain situations. Making an 83(b) election is typically a key part of that.

With an 83(b) election, taxpayers elect to accelerate the tax treatment of exercising their options, even though the shares haven’t vested. At grant, the strike price usually equals the current value of the stock. In another words, the spread for AMT or federal income tax is zero.

In this example, it’s possible to exercise unvested stock options with an 83(b) election without any taxable gain for AMT or federal tax purposes. Due to the differences in holding periods for ISOs and NSOs to reach long-term capital gains tax status, non-qualified stock options actually have an edge with this strategy.

Here’s a video on how this strategy works. There’s a lot to consider before exercising stock options and strict rules that apply in filing an 83(b) election. Speak with your advisory team before moving forward.

Qualified small business stock

Qualified small business stock (also called QSBS or Section 1202) has the potential to save millions (even tens of millions) in taxes. If eligible, you may be able to exclude up to 100% of the taxable gain from federal taxes when you sell your shares, up to the greater of $10 million or 10 times your basis in the stock.

Not every company is eligible for QSBS so it’s important to know the rules and requirements. Two key components of eligibility are a five-year holding period and the company’s aggregate assets must have been less than $50 million when the shares were purchased. For employees with stock options, the date of exercise starts the clock and can lock in eligibility for the asset test.

Stock and equity compensation specialists

There’s a lot of nuance when it comes to how stock options are taxed, well beyond the scope of this article. And planning strategies, risks, and other considerations will vary with each unique set of circumstances. It’s also key to not let the tax tail wag the dog when making financial decisions. To discuss your situation, please contact us today.

Darrow Wealth Management specializes in stock options and equity compensation. Especially for founders and early employees, stock options can create a major liquidity event that transforms your financial life. To maximize the opportunity, it’s critical to get the right team of advisors in place before making irreversible decisions with your shares.

Important note

This article is for informational purposes only and should not be misinterpreted as personalized advice of any kind or a recommendation for any specific investment product, financial or tax strategy. This is a general communication should not be used as the basis for making any type of tax, financial, legal, or investment decision. Disclosure

[Last reviewed November 2024]