Wondering where to invest after maxing out your 401(k)? If you’re looking for ways to invest after your 401(k) or 403(b) at work, you likely have three options: a brokerage account, IRA, or Roth IRA. Investing after maxing out a 401(k) is smart, especially since your retirement accounts may not be enough to fully fund the lifestyle you want.

Key takeaway (TLDR): For individuals with a high income and significant excess cash flow, a brokerage account is likely the best place to invest after maxing out your 401(k).

If you have time to dig into the details, here’s a primer on what you can do after maxing out a 401(k) including the tax advantages of each account type.

3 ways to invest after maxing out retirement savings in an employer plan

- A brokerage account (taxable investment account)

- Traditional IRA (pre-tax retirement account)

- Roth IRA (subject to income limits; after-tax retirement savings)

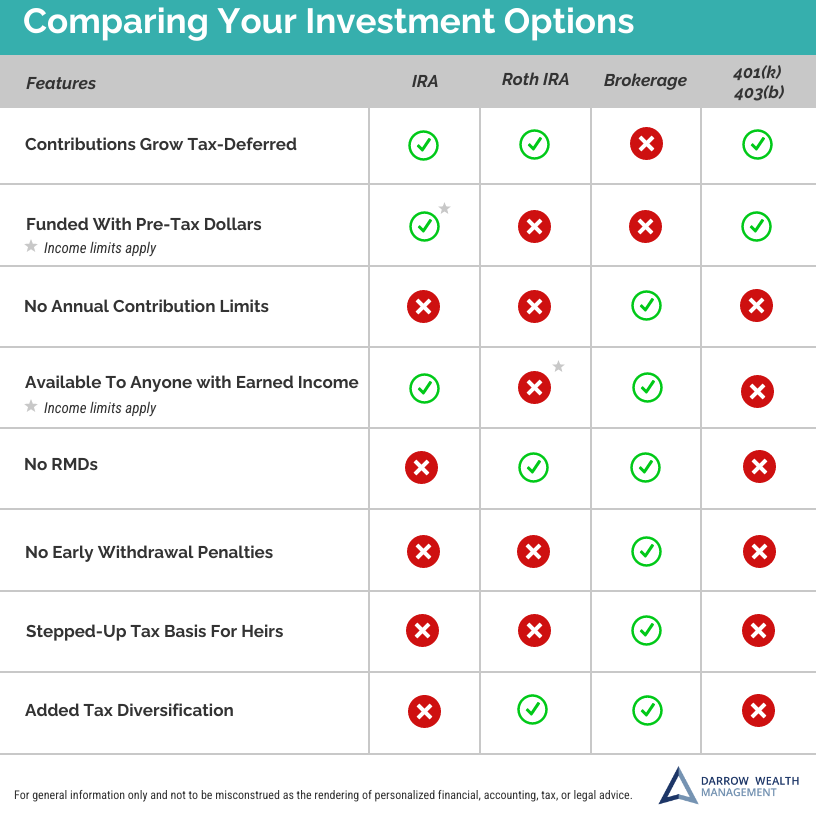

Comparing investment options after maxing out a 401(k) or 403(b)

The investment options after maxing out your 401(k) have varying tax advantages. Contrary to popular opinion, investors shouldn’t always contribute the maximum amount to retirement accounts, particularly pre-tax accounts.

Brokerage account

A brokerage account is a popular type of investment account due to the flexibility it affords. With no income restrictions or funding limits, a taxable account provides the most options for investors. Further, unlike retirement accounts, assets in a brokerage account can be used for any purpose at any time without early withdrawal penalties.

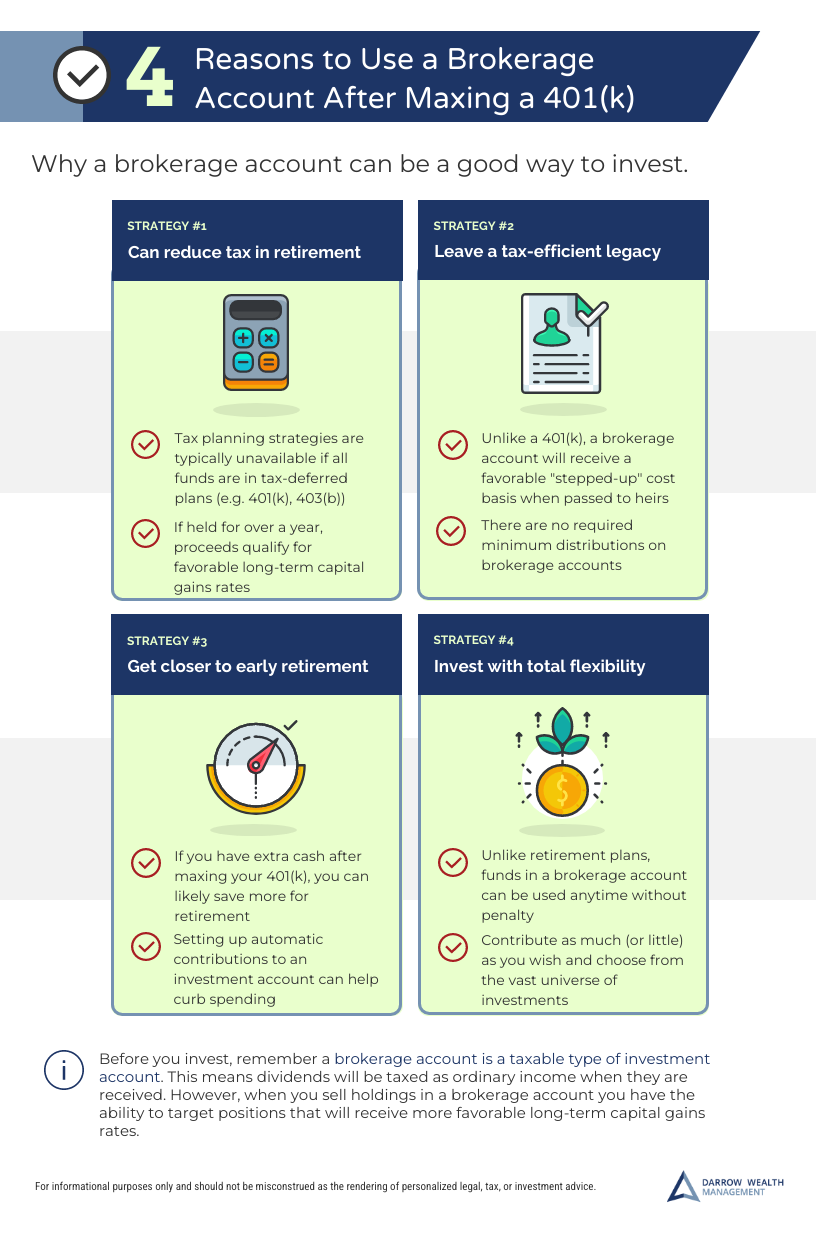

Key benefits of putting savings in a brokerage account after maxing out your 401(k)

- No contribution limit

- Flexibility to use the money when you want without penalties

- Potential to benefit from more favorable long-term capital gains tax rates

- No required minimum distributions in retirement

- Tax-efficient way to leave a legacy due to the step-up in cost basis

- More options for income tax planning in retirement

Main drawbacks of taxable accounts

- No tax deduction for contributions

- Account does not grow tax-deferred

Detailed look: investing outside of retirement accounts

With a 401(k), IRA, or Roth IRA, there are limits as to when you can use the funds – and for what purpose – without incurring a penalty. A brokerage account is free from these restrictions.

Individuals often use a brokerage account to save for medium to long-term goals such as college (to avoid over-funding a 529 plan), a new or second home, major asset purchase, or just because they have extra cash flow to put to work.

For high-income individuals, maxing out annual 401(k) contributions likely won’t be enough to maintain an equal lifestyle in retirement, especially if you wish to retire early.

Retiring early is also even more difficult without taxable assets as you’ll need to bridge the gap before penalty-free distributions from 401(k)s or IRAs begin, perhaps to cover medical expenses.

Indirect tax benefits of a brokerage account

You make contributions to a brokerage account with after-tax dollars, so there is no tax deduction. Dividends, interest, or capital gains distributions from mutual funds and ETFs received during the year are taxable annually. Taxes can be a factor even if you don’t sell funds and elect dividend reinvestment.

When you sell a fund in your account, there will usually be a capital gain or loss depending on your purchase price and cost basis which will be taxable in the current year. This infographic has more on how a brokerage account is taxed.

Tax planning opportunities in retirement

If you only have assets in tax-deferred accounts, you may have fewer tax planning options in retirement. Tax-deductible contributions means distributions in retirement are taxable as regular income. If taxable or tax-free assets are available, you could consider other planning opportunities as your situation changes each year.

You could work with your financial advisor and CPA on an analysis to determine the optimal withdrawal strategy, perhaps blending withdrawals from different types of accounts or choosing tax-deferred assets in years where you’re in a lower marginal tax bracket.

The tax code is always subject to change and tax diversification provides added flexibility. Using different tax vehicles also helps reduce the risk that unfavorable changes to tax laws pertaining to one type of account will impact your whole financial plan.

No required minimum distributions

Unlike Traditional IRAs, 401(k)s, 403(b), pension plans, etc., there are no required minimum distribution (RMD) rules on assets in a brokerage account. Retirees who don’t need the income can preserve wealth to pass onto heirs and avoid unnecessary tax consequences, and the reinvestment risk by staying invested.

Traditional IRA

Key benefits of putting money in a traditional IRA after maxing out your 401(k)

- Anyone can make contributions to a traditional IRA up to the lesser of their earned income or the annual contribution limit

- Potential tax deduction

- Tax-deferred growth

Main drawbacks of saving in an individual retirement account after an employer’s plan

- Not everyone is eligible for tax deductions and making after-tax non-Roth contributions usually isn’t the best option

- No tax diversity for planning in retirement

- Money cannot be withdrawn before age 59 1/2 without taxes and possible penalties

- Relatively small annual contribution limits

Detailed look: traditional IRA

Tax-deferred growth is so powerful due to compounded investment growth, but unless you’re only focused on ways to save for retirement, an IRA may not be the right choice due to early withdrawal penalties. There are some exceptions, but having flexibility is valuable.

Anyone can make contributions to a traditional IRA up to the lesser of their earned income or the annual contribution limit. Whether you can make a tax deductible contribution depends on if you’re covered by a retirement plan at work, your income, and tax filing status. See 2025 limits to determine whether you’re eligible.

Though it’s possible to make an after-tax contribution to an IRA, there are several big drawbacks that make this strategy less advantageous. Investors sometimes doesn’t realize they’re responsible for tracking non-deductible contributions, not the IRS or a financial institution. Unless they can keep proper records over time, they could end up paying tax twice.

Should you always max out your 401(k)? Actually, no.

Making the most of an employer match by timing your 401(k) contributions

Roth IRA

Key benefits of putting money in a Roth IRA after maxing out your 401(k)

- Tax-deferred growth

- Tax-free withdrawals if 5-year holding period is met and you reach retirement age at 59 1/2

- Another lever to potentially reduce income taxes in retirement

Main drawbacks of saving in a Roth IRA

- Not everyone is eligible to save in a Roth IRA as income limits apply

- Early withdrawals subject to possible penalties

- After-tax contributions

- Relatively small annual contribution limits

- If Roth assets are small relative to your entire portfolio, tax benefits may not be as meaningful

Detailed look: Roth IRA

The primary feature of a Roth IRA is that provided a five-year holding period is met since your first contribution and you’re age 59 1/2 or older, withdrawals will be completely tax-free (though there are several penalty exceptions to the age and five-year holding period requirements and only the investment growth portion of the account is subject to taxes or penalties).

Otherwise, a Roth IRA shares features of both a brokerage account and an IRA. Contributions are made after-tax and there are no required minimum distributions in retirement like a brokerage account. Like an IRA, funds enjoy tax-deferred growth and early withdrawal penalties may apply before age 59 1/2.

Non-spouse beneficiaries of retirement accounts must take the money by the end of the 10th year after inheriting the account.

Income limitations apply which preclude wealthier individuals from making regular contributions to a Roth IRA. Contribution limits decrease as taxpayers move through the ranges until they become disqualified. Earn too much? Consider a backdoor or mega backdoor Roth.

Where to invest after maxing out 401(k)

If you have extra income and the ability to put more money towards increasing your savings rate, you should. Even though there’s no tax break for funding taxable accounts, the flexibility it offers investors, particularly high earners, is incredibly valuable. Most savers don’t have crystal clear financial goals and objectives change over time. Having the ability to use money at any time for any purpose, or not making withdrawals at all, are key reasons to consider a taxable investment account after maxing out a 401(k).

[Last reviewed January 2025]