What is a brokerage account?

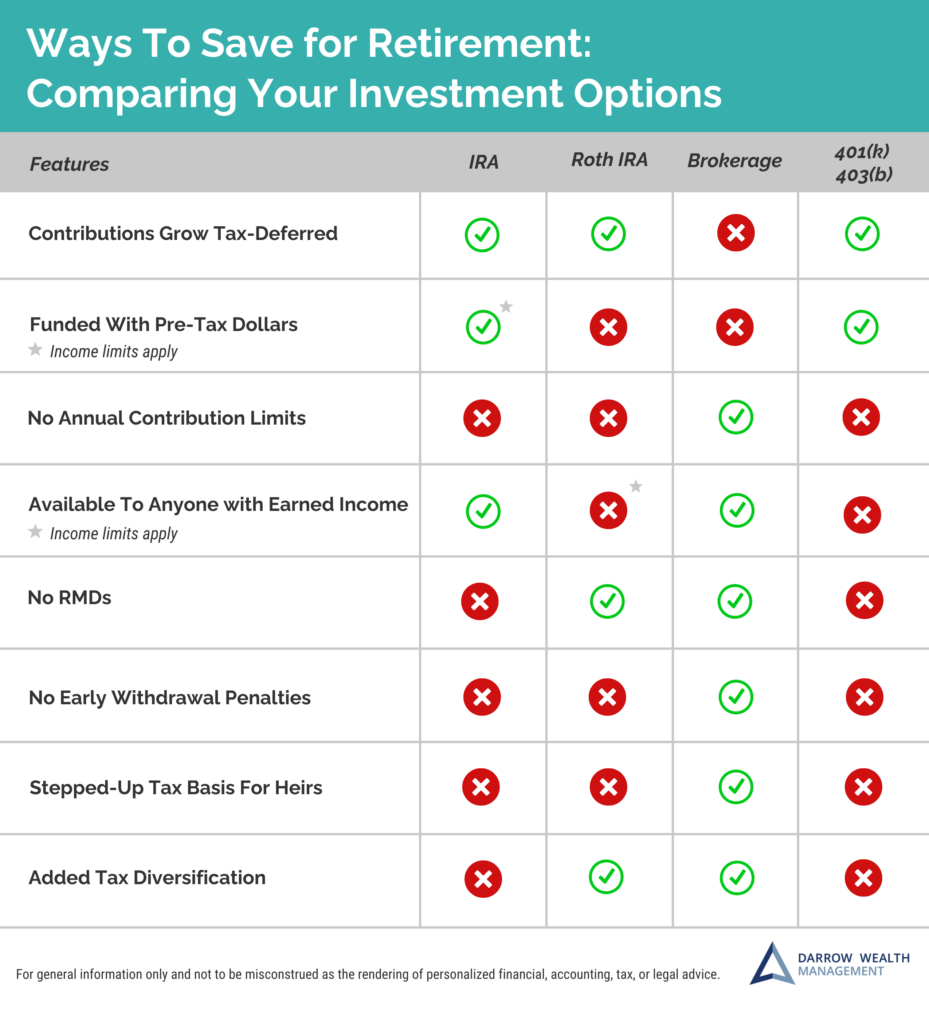

Updated in 2025. A brokerage account is a non-retirement investment account. Essentially, a brokerage account is the opposite of a retirement account like an IRA or 401(k) in nearly every way. There are no restrictions (income, investment options, limited additions, access, etc.) or tax benefits.

Because there are no income restrictions or funding limits, a taxable account provides the most flexible option for investing extra money. Unlike retirement accounts, there are no rules about when you can take money from a brokerage account or requirements forcing you to do so.

Investing money in a brokerage account gives you the most flexibility compared to other types of investment accounts. The account is funded with after-tax dollars, like savings in your bank account. There’s no tax deduction for contributions. You can invest money as often or infrequently as you like. Open a brokerage account at one of the major financial institutions or with the help of a fee-only financial advisor.

A brokerage account is usually the best way for individuals to invest for medium-term non-retirement goals such as college, a home, major asset purchase, or just because they have extra cash flow or savings. For retirement goals, a brokerage account is often key in helping fund an early retirement or supplement retirement savings so affluent individuals can maintain their lifestyle.

Why should you open a brokerage account?

Here are 7 common reasons investors use a taxable investment account:

- Invest for pre-retirement goals like a home or college

- Way to save after maxing out your retirement account (or, in some cases, instead of a retirement account)

- Provide income for an early retirement

- Create additional tax planning opportunities in retirement

- Invest extra cash flow, savings, or proceeds from selling a home or business

- Diversify after selling stock options or a concentrated stock holding

- To maintain their lifestyle in retirement

Invest without locking the money up until retirement

You may have a lot of time between now and retirement. Chances are, you’ll need savings for many of these goals. A brokerage account is a way to invest for things like college, home renovation, or anything else you might need before retirement.

A brokerage account can also be a great way to invest extra savings. Whether you’ve saved up a chunk of cash or have extra money each month, a brokerage account gives you the flexibility to invest as much or little as you want.

Diversify proceeds from selling stock options or a concentrated stock holding

Generally, if the stock of one company makes up more than 10% of your investments, it may be too much. Diversifying your holdings typically means reducing your investment risk and locking in gains.

When you sell company stock or part of a concentrated holding, you need to consider where to reinvest the proceeds. You won’t be able to put the money into your 401(k) and the IRA contribution limit is pretty low.

Investing the proceeds in a brokerage account means you can create a diversified asset allocation. Diversification helps reduce investment risk and volatility, both of which can impact returns.

Invest a lump sum

If you have sold a business, a home or other asset, you may have a lump sum to put to work. Since there are no limits on how much you can invest, a brokerage account can be a great option to invest or reinvest the cash.

After a windfall, you’ll need to decide how much to invest, where to invest it, and when to do it. Because it might not make sense to put all the proceeds in the market. A financial plan can help you figure out how to allocate a one-off windfall across multiple goals.

Further, when you have a large amount of money to invest, you don’t have to put it in the market all at once. Dollar-cost averaging over a few months can help reduce the risk of investing during volatile markets.

Provide income for individuals retiring early

Even after you retire, you might still not be able to access money in an IRA without incurring a 10% penalty. Taking an early retirement is not one of the exceptions to the 10% penalty for early withdrawals from a traditional or Roth IRA. So you may need to wait until you turn 59 1/2 to access these accounts.

If you want to retire early, you might need income to bridge the gap. Saving money in a brokerage account helps make it easier to retire early as you not only have more saved for retirement, but there are no restrictions on when you can access it. Retiring early is difficult, particularly due to the cost of health insurance before Medicare.

Maintain your pre-retirement lifestyle in retirement

When estimating your retirement expenses, you’ll likely want to maintain your current standard of living. As your living expenses increase, your savings rate must as well to accommodate additional income needs in retirement.

But high-earners need to remember they’re limited to the same 401(k) contribution limits as individuals who earn significantly less. Because expenses tend to increase with income, wealthier individuals generally require more savings to continue their living expenses in retirement. So all else equal, if your lifestyle cost is above average, your savings rate to maintain it needs to be too. For this reason, 401(k) contributions alone usually aren’t enough to maintain a pre-retirement lifestyle.

A brokerage account is often the best way to supplement retirement savings in a 401(k) or IRA. Money invested in a brokerage account is available if you needed it (subject to the prevailing market prices and taxes), but it’s not as accessible as a cash account, which is a feature not a bug.

Investing only an extra $2,000 per month would equal about $536,000 after 15 years, assuming a 15% tax rate and 6% annual return. By dollar-cost averaging money from savings into your brokerage account each month, you don’t need to be overly concerned about current market conditions or whether it’s a good time to invest.

Adding tax diversification for more tax planning opportunities in retirement

When investors only save with pre-tax deferrals to retirement accounts, all withdrawals are taxable as ordinary income. At higher tax rates, you’ll deplete the account more quickly. But you might also miss out on potential tax planning opportunities available by having different types of accounts and ways to prepare for taxable required minimum distributions.

For example, rather than take all your annual income needs from an IRA, you may consider drawing from your brokerage account and IRA. Depending on your situation, this could help you stay within the 0% tax rate for long-term capital gains or take advantage of it. Also consider state tax rates and tax treatment of income and capital gains.

Benefits of a brokerage account compared to a retirement account

Investors sometimes wonder what’s the purpose of a brokerage account. As discussed above, there are many reasons to use a brokerage account as circumstances arise. But there are also several unique benefits when investing with this type of account compared to retirement accounts.

No early withdrawal penalties or required minimum distributions

No early withdrawal penalties or required minimum distributions

A taxable investment account gives you total flexibility. You can access the account before retirement without incurring a penalty. But keep in mind, you won’t want to invest money you need in the short-term. Investment growth is expected over time, but market volatility should be considered when deciding how to save for near-term goals.

Unlike retirement accounts, there are no required minimum distribution (RMD) rules on assets in a brokerage account. Traditional IRAs, 401(k), 403(b), pension plans, etc. all force retirees to begin taking the money out at 72 or 73. The IRS rules also dictate how much you need to take, whether you need the cash or not.

A brokerage account doesn’t have any requirements for you to take the money out before or during retirement.

If your kids inherit the money, you’ll have more control with a brokerage account

Starting in 2020, when a retirement account is inherited by a non-spouse, in most cases, the beneficiary is required to take the money within 10 years. There are no such requirements with a brokerage account. Further, by putting your brokerage account in a trust, you’ll maintain maximum control over when your heirs can tap the account.

Opportunity to pay less tax on withdrawals

When you sell stocks or funds in a brokerage account for a gain, it’s usually a capital gain. As long as you’ve held the security for more than a year, the tax rates are currently more favorable than withdrawals from a retirement account that was originally funded with pre-tax dollars as it’s taxable as ordinary income.

Special tax treatment for heirs

If your spouse or heirs inherit a taxable brokerage account, the assets can pass on a “stepped-up” cost basis. This increases or ‘steps up’ their inherited cost basis in the asset to the value on the date of your death. The assets must pass through your estate to receive the step-up in basis.

Paying taxes on investments in a brokerage account

A brokerage account is taxable each year for dividends, interest, and capital gains distributions during the year, even if you did not sell an investment or reinvest the proceeds. When you sell a stock or fund in your account, there will usually be a taxable capital gain or loss depending on your purchase price and cost basis which will be taxable in the current year. The capital gain tax rate depends on your holding period. More than one year qualifies for favorable long-term tax rates.

Consider working with a financial advisor who can help ensure you are taking advantage of all tax planning opportunities including tax-loss harvesting and asset location across your portfolio of accounts.

Investing money in a brokerage account

In a brokerage account, you’ll have access to an expansive mix of investment options. Before simply buying what you know or what’s trending (I see you Tesla), spend the time to develop a proper investment strategy.

Asset class diversification

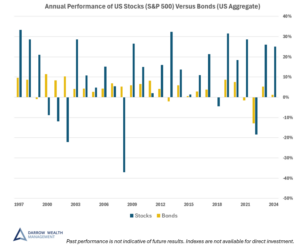

Diversifying means investing across multiple asset classes and within them. Your risk tolerance and time horizon will help determine your allocation towards major asset classes like real estate or stocks and bonds. But you also need to define your allocation within these asset classes.

For example, with equity, consider various market capitalizations (small, mid, large), and regions, like international vs domestic equity. Diversification means investing outside of the S&P 500 too!

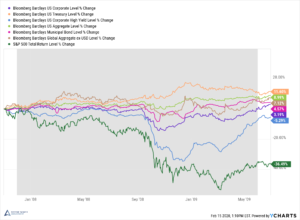

Fund selection

After setting your asset allocation you need to pick which funds to invest in. This can be intimidating as there are so many investment options to choose from. But this is a really important part of the process. After all, asset allocation uses broad-based asset class characteristics. But it’s the actual ETFs, mutual funds, stocks or bonds that you invest your money in.

As you are choosing which funds to consider, there are two key points to keep in mind. First, you may be encouraged to use proprietary products when you open an account with a broker-dealer like Vanguard or Fidelity. Their funds provide a major source of revenue for them. Incentives like free trades or lower fees only available on their funds. This doesn’t mean you should automatically stay away from their fund family, just another factor to consider when you aren’t working with an independent fee-only financial advisor and fiduciary.

The second key point for do-it-yourself investors to remember is that you won’t have access to all investments. Some securities or fund families may require an institutional relationship from an approved advisor. You might also end up paying more for funds as a retail investor due to differences in share classes.

Other investment considerations

Investment management is an ongoing process. Each year, review the percentages you allocate to each asset class. Also consider rebalancing as your investment mix is likely to shift as market values fluctuate. Rebalancing is the process of recalibrating your portfolio back to your initial desired asset class mix.

Over the long term, as your goals become closer or your life stage changes, you may want to consider whether to take some risk off of the table. One way to do this is shift the weightings of your main asset classes (e.g. mix of stocks and bonds).

As you weigh the merits of a brokerage account, also consider whether it’s worth it to work with an investment advisor to help ensure you are making the most of your financial opportunities. As with any financial decision, you’ll want to make sure it aligns with your overall wealth strategy.

[Last reviewed May 2025]