Wealth Management Insights

Sign Up for Weekly Investing Insights

What’s The Best Thing To Do With A Large Inheritance?

After receiving a large inheritance from a loved one, you may wonder: what’s the best thing to do with it? As you consider what approach

How Are Stock Options Taxed?

Tax implications of exercising and selling stock options If you have stock options as a large part of your income, taxes are especially important. There

Why Non-Deductible IRA Contributions Aren’t Worth It

Updated for 2024 – 2025. Investors often ask: should I be making nondeductible IRA contributions? In the vast majority of cases the answer is no.

What Does an IPO Mean for Stock Options? What Happens to Employees When a Company Goes Public

Whether you work for a private company about to IPO or one that’s recently gone public, you may wonder what that means for employees and

Qualified Small Business Stock: The Section 1202 Gain Exclusion

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business

How to Find a Fiduciary Financial Advisor

Looking to find fiduciary financial advisors and wealth managers? Only fiduciary advisors are legally bound to act in your best interest at all times. Here

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets

The IRS released the 2025 401(k), 403(b), and SEP IRA contribution limits, including a new special catch-up contribution for workers age 60 to 63. The

How Often Should You Rebalance Your 401(k)?

Rebalancing your 401(k) and investment portfolio is an important part of a successful investment strategy. Your asset allocation is the percentage of your portfolio that

What To Do With The Money From The Sale Of Your Business

Selling your business for cash? Deciding how to allocate and invest the proceeds after the sale of your company is a big decision that requires

What Happens to Your Stock When a Company is Bought?

If your company (e.g. the target company) is getting acquired, you’ll want to understand what happens to your stock. When a company buys another company,

Sudden Wealth: Managing a Large Financial Windfall

Next steps after a sudden wealth event or cash windfall Wondering what to do with a sudden financial windfall? Whether the windfall was expected, perhaps

Should I Put My Assets in a Trust? Top 3 Benefits of Living Trusts

Do I need a revocable living trust? Choosing whether to fund a trust with your assets is an important decision in the estate planning process.

What to Do After Maxing Out Your 401(k)

Wondering where to invest after maxing out your 401(k)? If you’re looking for ways to invest after your 401(k) or 403(b) at work, you likely

SEP IRA for the Self-Employed: Tax & Retirement Planning for Small Business Owners

Updated for 2024. The Simplified Employee Pension (SEP IRA) is a type of a traditional IRA adopted by self-employed small business owners (sole proprietors, partnerships, C

What To Do After Inheriting A Retirement Account From A Parent

Just inherited an IRA from a parent? Here are the distribution rules. If you’ve just inherited a retirement account like an IRA or 401(k) from

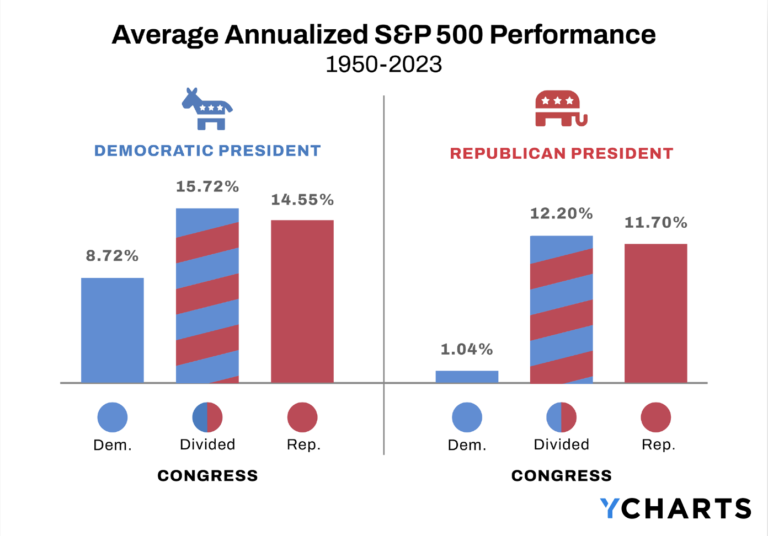

Stock Market Performance by President (in Charts)

How does the stock market perform when Republicans or Democrats have control of Congress vs when it’s mixed? Although volatility is often heightened during an

What to Do When a Parent Dies and You’re the Executor

Losing a parent is emotional. It can also be overwhelming for adult children when they’re the executor of the estate. Settling an estate is a

Incentive Stock Options: Navigating AMT and AMT Credits

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes.