For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. When you purchase unvested stock compensation and make the election, you recognize the taxable gain now (if any), instead of when the shares vest.

What is an 83(b) election?

Section 83(b) of the tax code gives individuals the ability to accelerate the taxation of their unvested equity grant. When elected, recipients of restricted stock or stock options can opt to recognize income and be taxed on the difference between the fair market value of the shares when purchased and the cost to buy the stock. This is only relevant for property subject to vesting requirements.

The 83(b) election has the potential to significantly reduce the overall tax liability, especially for startup founders and employees who receive stock-based compensation. It’s usually a key part of pre-IPO tax planning and exit strategies.

In the optimal scenario:

- The employee recognizes no ordinary income when making the 83(b) election on unvested stock options because the fair market value equals the exercise price (which typically happens when the early exercise occurs around the grant date)

- The future gain (above the cost basis) shifts to more favorable capital gains tax rates

- The exercise price is low, resulting in a small cash outlay

- Shares eventually vest in full and the company is successful, eventually leading to a liquid market for the stock (assuming the company is private)

Why make an 83(b) election?

An 83(b) election can lead to more favorable tax treatment if a taxpayer can exercise company stock grants before the shares vest, assuming the stock appreciates and the shares vest.

When shares are purchased, equity compensation is taxed as ordinary income (or subject to alternative minimum tax if incentive stock options) on the spread between the purchase price and the stock’s fair market value.

Since the purchase price (or strike price) of restricted stock grants and options are fixed, any future appreciation in the stock value will widen the taxable spread, thus adding to the employee’s overall tax exposure. In fact, as startups mature, it’s not uncommon to see employees unable to exercise options until there’s a liquid market for the shares, as the tax due and/or exercise price become prohibitive.

However, by recognizing that income now, and paying tax at a lower market value, the taxpayer has the potential to significantly reduce their tax bill. That’s where the 83(b) election comes in.

An 83(b) tax election can also help ensure eligibility is met for tax-free sales under qualified small business stock (Section 1202).

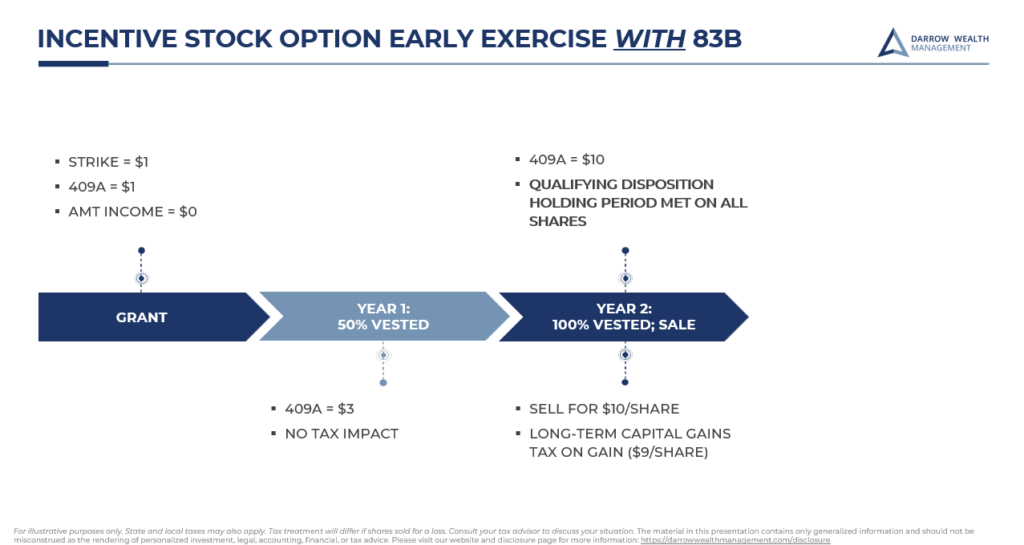

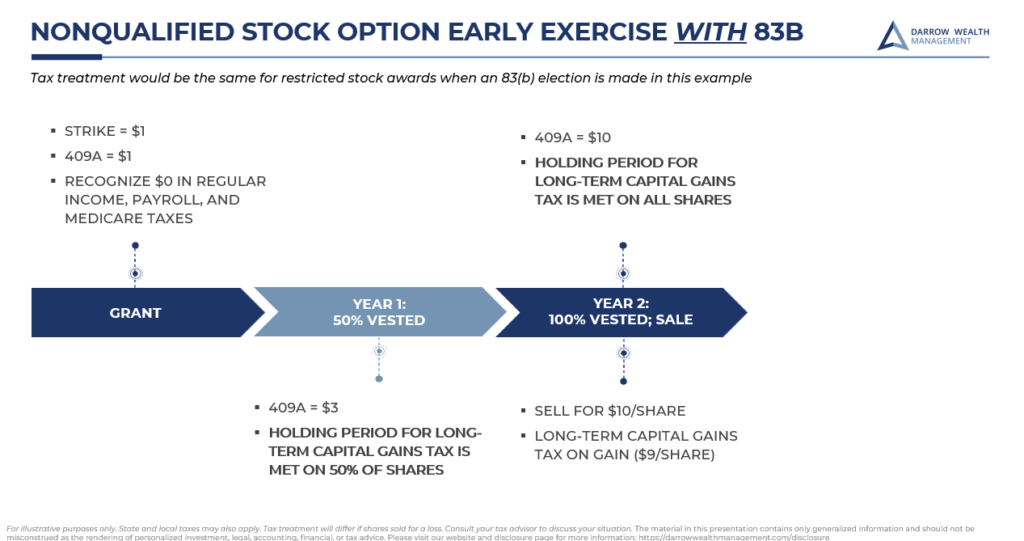

Illustrative examples: benefits of an 83(b) election and early exercise

The following illustrative examples came from our video on pre-IPO exercise strategies. As illustrated in the examples below, making an 83(b) election can drastically reduce tax in certain circumstances. An 83(b) is typically most advantageous if accelerating income when the taxable option spread is at or near zero and the future stock price is likely to increase significantly.

Stock at early-stage startups usually will have a very, very low valuation, making this tax strategy most advantageous. After meeting capital gains holding periods, taxable income shifts entirely to more favorable long-term rates through an 83(b) election.

It’s crucial to consult with a tax professional to understand the specific tax implications of an 83(b) election for your situation.

Incentive stock options (ISOs)

As indicated above, there are several notable benefits of an early exercise of unvested ISOs in this example:

- Strike price and current fair market value (or 409a for private company grants) are equal, which typically happens right after a stock grant. Therefore, there is no spread for alternative minimum taxable income

- The section 83(b) election starts the clock for qualifying incentive stock option sales. Qualifying sales follow long-term capital gains tax treatment, so the rates are between 0% and 20% if you hold the stock at least two years from grant and one year from exercise. In this example, the employee is able to shift all income to a capital gain and recognizes no ordinary income or alternative minimum taxable income (AMTI)

- Using the example above, had the employee waited until year two to exercise their options, they’d have AMT income of $9 per share which could potentially trigger the alternative minimum tax that calendar year (at 26% or 28% rates). They’d need to wait another year to benefit from long-term capital gains tax rates. Or alternatively, the taxpayer could exercise and sell at once, and pay ordinary income tax on the $9/share spread

Nonqualified stock options and restricted stock grants

Nonqualified stock options and restricted stock are often even better candidates for an 83(b) election

- Again, there’s no spread in this example, so no income tax generated with the early exercise

- Start the clock for long-term capital gains tax rates (0% to 20% tax rates) which applies to shares with a holding period more than one year. Again, since there’s no spread, all income shifts to a capital gain. In comparison to higher ordinary income rates, capital gains rates are much lower, so the resulting tax liability will follow

- Had the employee waited until year two to exercise their NSOs, they would have to pay tax (including required employer withholding) at higher ordinary income tax rates on $9/share (or could do a same day sale for the same impact).

- With restricted stock, you must file an 83(b) election within 30 days of the grant or the spread is subject to regular income tax when it vests. Grants often have a requirement to make the election.

Who can make an 83(b) election and for what type of stock?

Startup founders, early employees, executives, and other service providers can make an 83(b) election. For stock option holders, the company must permit an early exercise.

Again, regardless of the type of equity or employee stock options at stake, the shares must still be vesting when making the election. Until the shares vest (or you exercise, if stock options), there are no tax implications. That’s because the taxpayer risks losing the stock until the shares are vested. This is known as substantial risk of forfeiture, and you need it to make the tax election.

Here are the types of stock compensation that are eligible for the election:

- Restricted stock (not restricted stock units)

- Founders shares (this isn’t a legal term and is typically just common stock)

- Incentive stock options

- Non-qualified stock options

- Profits interests in an LLC or partnership

Filing requirements

To make a section 83(b) election for tax purposes, the taxpayer must mail a completed election form with the IRS within 30 days of the restricted stock grant or exercise. In 2024, the IRS came out with Form 15620, the first official form taxpayers can use to make an 83(b) election. Before, it was up to the taxpayer to create their own form.

Always keep copies of the signed election form for your records and request a return receipt. Sending via certified mail is recommended. Again, it is crucial to ensure you submit the 83(b) election form correctly and timely within the 30 day window. Ensure your employer has a copy of the election also.

83(b) election risks

Like anything in personal finance, an 83(b) election isn’t always a good idea. Here are some things to consider.

- Company’s growth prospects. There’s a big risk of over-paying tax if the valuation doesn’t go up or if the company simply fails. Also consider forces outside the company’s control, such as economic or legal headwinds, and industry-wide setbacks.

- Your shares still need to vest. An 83(b) election is irrevocable. Make sure you’re comfortable with the vesting requirements. If you plan on leaving the company before vesting, this is likely not a good strategy.

- M&A implications. Regardless of how long you want to hold the stock, M&A activity, repurchase rights, and other events can interfere.

- Cash requirements. As the cost to buy the shares and/or the taxable spread increase, so too does the risk of filing an 83(b) election, as you have more cash on the line. If an 83(b) election on stock options means realizing a significant amount of taxable or AMT income, it may not make sense from a cash flow, risk, or tax standpoint. Make sure it makes sense within the context of your financial situation and goals.

Equity compensation planning

Our team of stock compensation specialists can provide you with the knowledge and expertise you need to make informed decisions about your stock-based compensation, including the potential benefits and risks of making an 83(b) election.

To discuss how we may be able to help you maximize the benefits of equity compensation, schedule a phone consultation today.

Article is for informational purposes only and should not be misinterpreted as personalized advice of any kind or a recommendation for any specific financial or tax strategy. This is a general communication should not be used as the basis for making any type of tax, financial, legal, or investment decision.

[Last reviewed April 2025]