One of the most important things to know about bonds is how changes in interest rates affect bond prices, and therefore yields (unless held to maturity). The relationship between interest rates, bond prices, and bond yields is based on a few simple investing principles. Bond prices move inversely to interest rates and bond yields move in the same direction as rates. As interest rates rise, bond prices decline. If rates decline, bond prices will increase. An investor’s current yield will decrease as bond prices increase. As bond prices decrease, the yield increases. The current yield is the return a buyer could expect if they hold the bond for a year.

How do interest rates affect bonds?

To illustrate the relationship between interest rates, bond prices, and bond yields, consider the following simplified example.

Bond K, a newly issued bond, has a 5% coupon payment and trades for $1,000, its par value. The current yield is 5% ($50 / $1,000). The current yield is calculated as the bond’s annual income, divided by the current price.

If interest rates decline 1%, the same issuer could sell a new bond, Bond M, with a 4% coupon, $1,000 par value, and a 4% current yield. The decline in rates make Bond K more valuable, so buyers in the secondary market are willing to pay more for it. Bond K now sells for $1,050 at a premium. Bond K’s coupon payment is still 5% as it’s based on par, but the current yield declines from 5% to 4.76% ($50 / $1,050). The yield goes down because the buyer had to pay more for the bond. Whoever owns the bond at maturity will receive the par value.

If interest rates increase 1% instead, the cost of borrowing would increase for the issuer. Bond D is a new issue with a 6% coupon, $1,000 par value and 6% current yield. Rising rates make Bond K less valuable, so buyers won’t pay as much for it. Bond K now sells at a discount for $950. The coupon payment is still 5%, but the current yield increases from 5% to 5.26%% ($50 / $950). The yield goes up because the buyer pays less for the bond. Whoever owns the bond at maturity will receive the par value.

Bond Basics: How Bonds Work and Reasons to Add Bonds to Your Portfolio

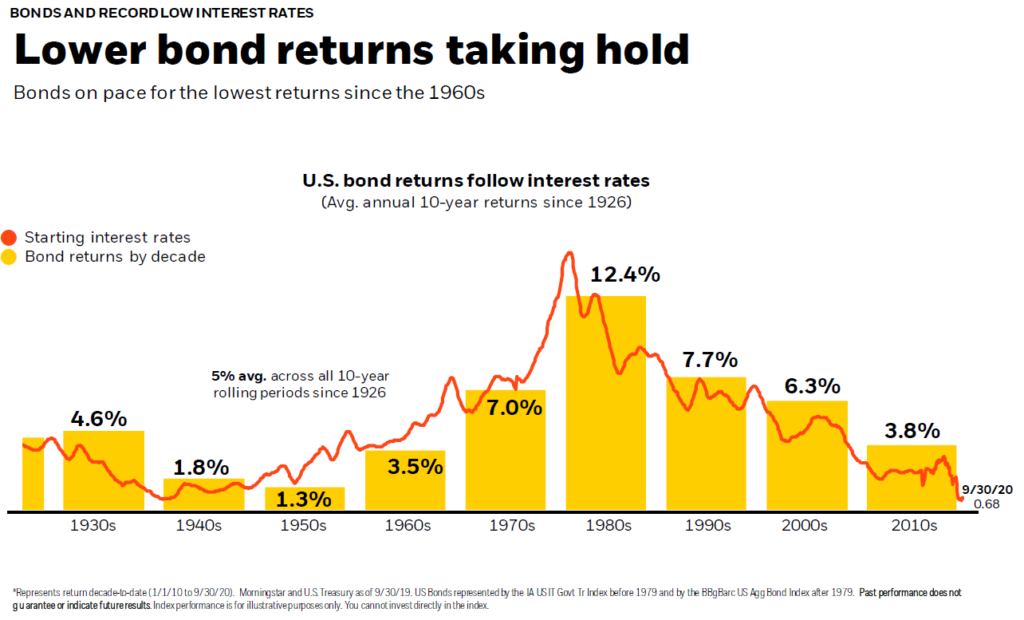

Interest rates and bond returns in the U.S.

How Do Bonds Perform During a Recession?

Real example of what happens to bond prices and yields when interest rates change

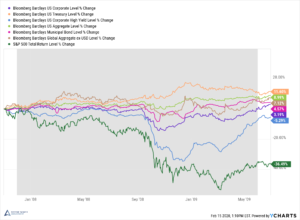

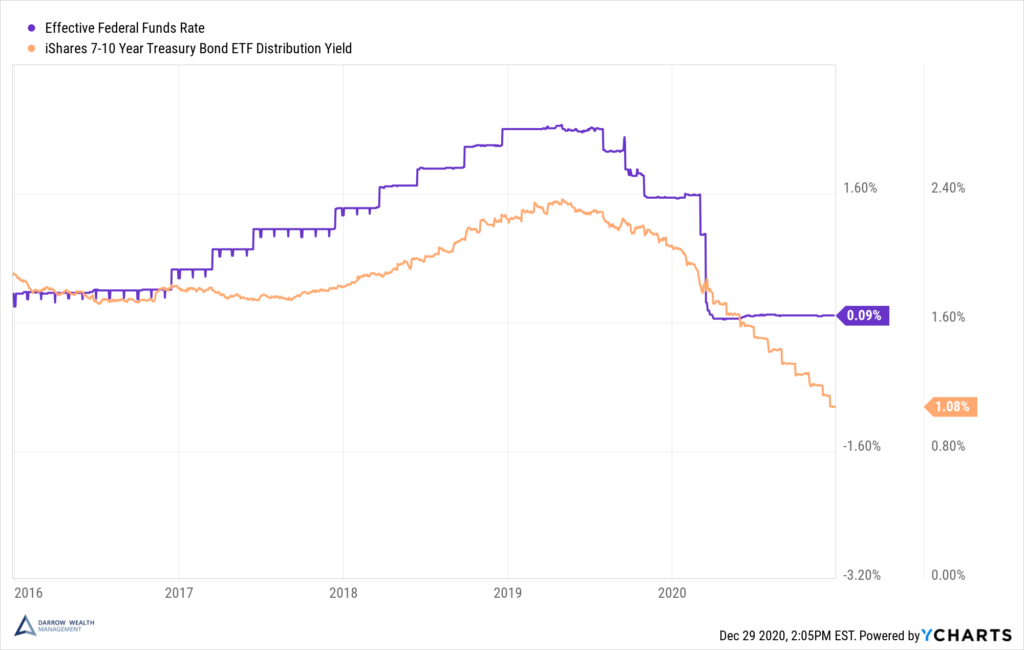

The market impact following the Covid-19 outbreak is a great example of what happens to bond prices and yields when there’s a change in interest rates. When rates go down, yields go in the same direction, while bond prices move in the opposite direction and go up.

Federal Reserve’s decision to cut target rates to 0% overnight quickly played out in the bond market. When the Federal Funds rate (purple line) decreases, you’ll notice bond yields, represented by the distribution yield for U.S. treasuries (orange line), also goes down.

What Are Negative-Yielding Bonds?

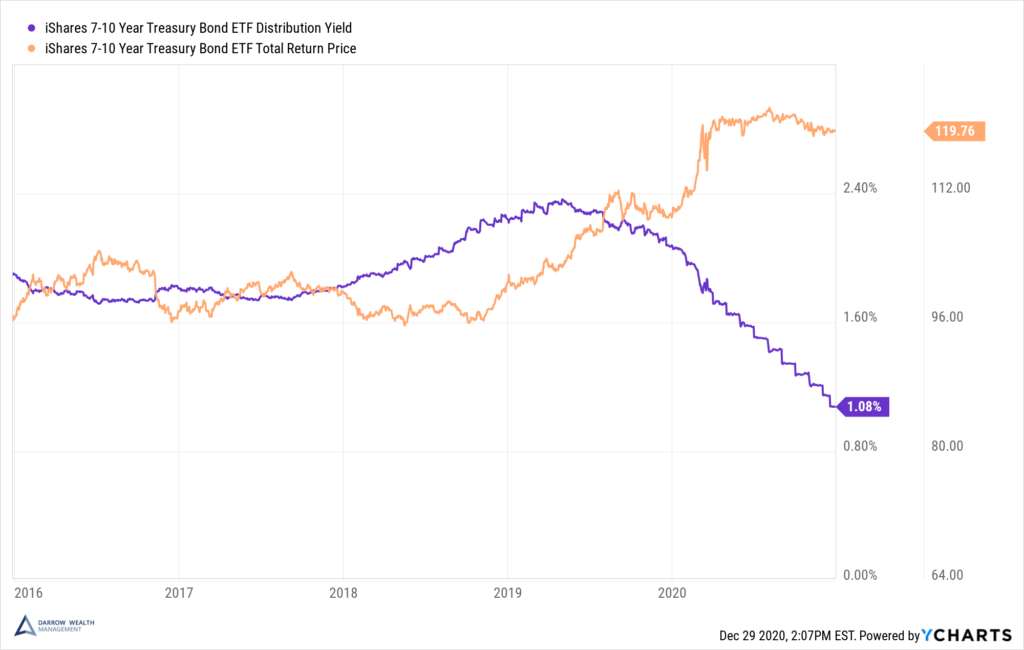

When interest rates go down, bond yields decrease and bond prices increase

When bond prices increase, bond yields decrease

As the price of bonds increase, returns decrease in the form of lower yields. This is because the coupon payment is fixed, but the cost to buy the asset goes up. For existing bondholders, this makes their bond to appreciate in price, as other investors are willing to pay more for a higher income stream.

It may sound like this is a good thing for existing bondholders, but it really hurts all bondholders.

If an investor takes advantage of the price appreciation and sells their bond, they’ll be in the same position as everyone else when they want to reinvest the profits. The options are to pay up for bonds with higher coupon payments or accept newer bonds with a smaller income stream.

Even if bondholders don’t sell their bonds, they’ll face the same situation when reinvesting coupon payments. As the cost of borrowing gets cheaper, there’s less upside for debtholders. Some investors turn to riskier assets, like stocks, for growth.

When the Federal Reserve cuts interest rates, the cost of borrowing usually decreases for companies, governments, and individuals, in the form of mortgages and other household debt. Issuers retire high-cost debt where possible using a call option while retail borrowers refinance mortgages and other consumer debt. So even when investors don’t want to sell their bonds, they may have no choice if the bonds are callable.

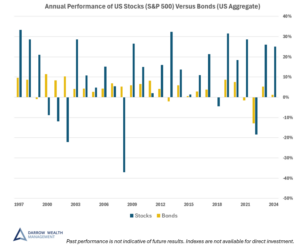

The sharp drop in yields in 2020 have left some investors questioning their reasons for owning bonds. But although the relationship has changed, there are still benefits to owning bonds as part of a diversified asset allocation.

Stocks vs. Bonds: Differences in Risk and Return Make a Case for Both

Important Disclosures

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Both past performance and yields are not reliable indicators of current and future results. Examples in this article are generic, hypothetical and for illustration purposes only. This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.