The globalized nature of the world economy makes diversification a tall task. Although past performance is not indicative of future results, history is a helpful lens to view stock vs bond performance during past recessions or bear markets. Volatility in the financial markets also highlights the benefits—and limitations—that diversification can provide. Do the same investing strategies that apply during strong markets remain true during bear markets, recessions, or ordinary downturns? How do bonds perform during a recession or bear market? Here’s what happened to the bond market in 2008.

Bond vs Stock Performance During a Recession or Bear Market

Bonds can offer some protection—but fixed income has its own challenges

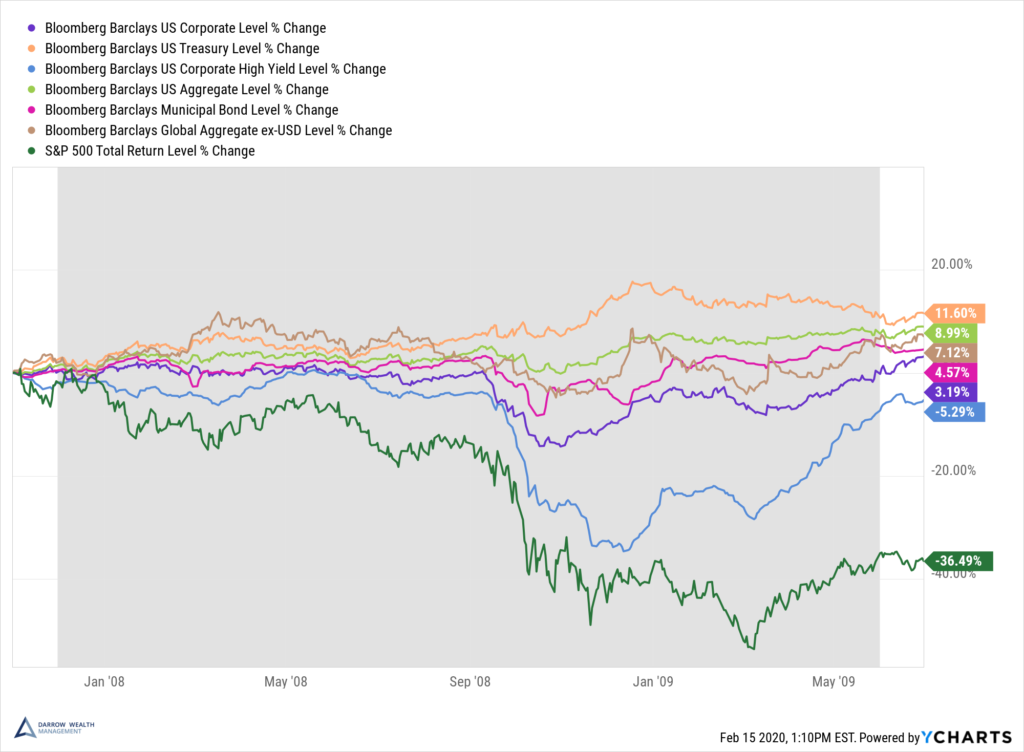

The chart below shows what happened to bonds in 2008. The returns are normalized total returns of various bond indices during the 2008 -2009 financial crisis. The S&P 500 is also included as a basis for comparison. While bonds outperformed equities by a wide margin during this time, there’s still a wide range of returns within the fixed income sector. Changes in monetary policy and the current interest rate and inflationary environment can also impact the correlations between stock and bonds over time.

How to Prepare Your Finances for a Recession or Prolonged Market Downturn

Here’s what happened to the bond market in 2008

The gray shading shows the recession. Though there was a big range of returns for different types of bonds, fixed income did its job in 2008.

Every recession and economic downturn is different. But history offers a helpful lens.

As economic conditions decline and investor uncertainty rises, more investors seek safety in high-quality fixed income investments, particularly U.S. treasuries. This drives bond prices up which pushes returns down. Yields are currently at record lows and there’s no telling where they will go from here. We didn’t enter the 2008 Great Financial Crisis with bond yields this low.

Given the low interest rate environment, corporations have been on a borrowing-binge looking to retire high-cost debt in favor of issuing new bonds at a lower rate and a longer duration to lock in favorable rates. The same thing happens when homeowners refinance their mortgage—debt with high interest rates are dumped and new loans are issued.

As the homeowner, you may be on both sides of this equation: you’re getting a cheaper rate on your mortgage, but there’s a good chance you own mortgage-backed securities as part of your bond portfolio. As the old mortgages are paid off, investors buy new mortgage bonds at lower rates.

Performance of stocks vs bonds during the Covid-19 outbreak of 2020

Here’s the normalized percentage change in 2020 (to 12/29/2020) for various stock and bond indices. It wasn’t until the end of August that the S&P 500 overtook U.S. Treasuries for year-to-date performance. Even then, the stock index still waivered versus bonds until early November. After the election, it was off to the races.

Stocks vs. Bonds: Differences in Risk and Return Make a Case for Both

Bonds alone probably aren’t enough to help you reach your goals

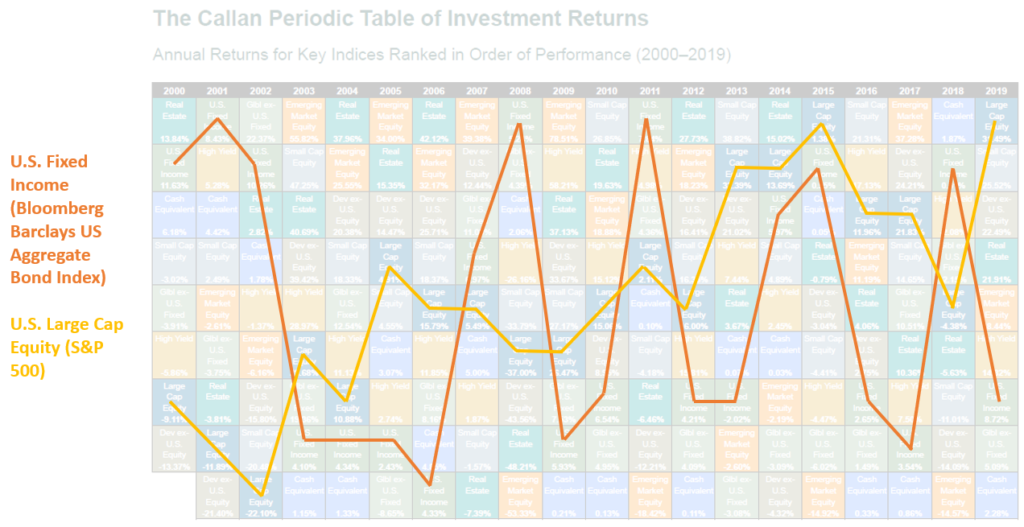

Consider the Callan Periodic Table of Investment Returns which ranks the returns of various asset classes annually from highest to lowest. The table below includes various cash, fixed income, equity, and real estate.

Highlighted below are the ranked returns of U.S. bonds (Bloomberg Barclays U.S. Aggregate Bond Index) and U.S. Stocks (S&P 500) to illustrate how significantly asset classes can fluctuate year-over-year.

The volatility can be drastic: in 2002 U.S. equity was down -22.10% only to come back the next year and with a 28.68% return! It’s also worth noting that despite the stellar return in 2003, U.S. stocks landed in the bottom third of ranked returns for the year.

Simply holding a fund that tracks the S&P 500 and the Bloomberg Barclays U.S. Aggregate Bond Index isn’t enough to ensure your portfolio is properly diversified. The correlation between bonds and stocks change over time and there’s still a range of returns within an asset class itself.

Even for the most risk-averse investors who prefer the relative safety of fixed income, the challenge becomes ensuring you can outpace inflation (whenever it returns) and grow your portfolio enough to support withdrawals in retirement. For these reasons, global bond and equity exposure are keys to achieving a diversified asset allocation for the long-term investor.

Get help investing in down markets with a comprehensive wealth management strategy

Unfortunately, there aren’t many shortcuts in building wealth that will last a lifetime. An ongoing dedication to saving, investing, and planning for the future are the keys to success. Retirement planning, like any type of robust financial planning, should include stress testing your investment strategy and financial plan.

During challenging times in the global financial markets, bonds help protect investors against acute losses on their portfolio, but it’s important to realize that there isn’t always somewhere to hide.

Going to cash or trying to time the market by buying low and selling high can actually magnify losses. As evidenced in 2020 during the coronavirus outbreak, the market can turn on a dime. If you miss even a few of the best days of the year, you can miss out big time. The best and worst days often happen very close to each other, too: between 1999 and 2018, six of the best 10 days for the S&P 500 fell within two weeks of the 10 worst days.

Volatility in your portfolio can be hard to stomach, particularly for investors who have recently retired or are on the cusp of retirement face additional market risks.

Wealth and asset management at Darrow Wealth Management

By integrating financial planning with investment management and ongoing advisory counsel, our wealth management program aims to help ensure our clients have the freedom to enjoy their success without concern about where they stand financially, no matter what the future brings. The Darrow Private Wealth Management program offers clients a complete solution to their asset management and comprehensive financial planning needs.

The Darrow team of financial advisors are CERTIFIED FINANCIAL PLANNER™ professionals and a CFA® charterholder. We have the experience, skills, and resources to offer our clients a breadth of wealth management services and solutions to meet each client’s unique financial needs. As your financial advisor, we will centralize the components of your custom wealth strategy by being the single point of contact to ensure client financial decisions are well-integrated with their lifestyle decisions.

Private Wealth Management Services

- Investment management

- Financial advisory support

- Retirement planning

- Tax-minded guidance

- Proactive support and ongoing review meetings

- Financial modeling

- Situational Counsel as unexpected changes occur

Transparency

Work with an advisor – not a salesperson. As a client, you will never have to worry that your advisor may try to sell you a financial product for their own personal gain. Why? As a fee-only financial advisor, we do not sell securities, investment products, or receive commissions or compensation from 3rd parties.

Always Working In Your Best Interest

A fiduciary duty means we are legally bound to act at all times for the sole benefit and interest of our clients. This is the highest act of loyalty, trust and care as established by law. Unfortunately, many advisors are not fiduciaries or they are only required to wear their “fiduciary hat” in certain situations. As a full-time fiduciary, we don’t change our standards with the circumstances of the situation.