Wealth Management Insights

Sign Up for Weekly Investing Insights

Explaining the Backdoor Roth and Mega Backdoor Roth IRA

Updated for 2024. Many individuals have heard of the backdoor Roth before, but the mega backdoor Roth is getting a lot of attention recently. Here

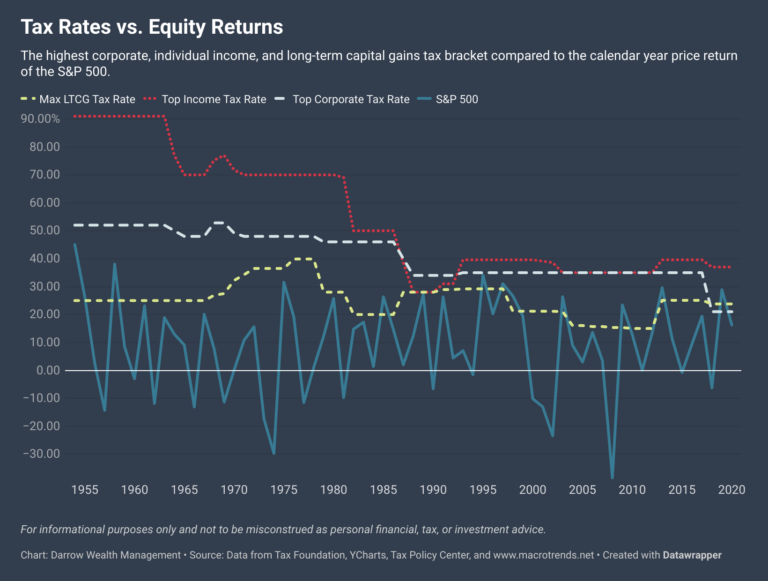

Will Tax Hikes Hurt Stocks? Impact of Tax Rates on the S&P 500

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

What Happens to Stock Options in a SPAC Merger?

Although the most common way for a company to go public is through the traditional initial public offering (IPO) process, it’s not the only method.

Managing Stock Options in a Direct Listing – Going Public Without an IPO

What happens to stock options if a company goes public without an IPO? A Direct Public Offering (DPO) or direct listing is a way for

How to Apply an Asset Allocation to Multiple Investment Accounts

Whether you’re managing your own investments or working with a financial advisor, setting the right asset allocation is key. But what’s the best way to

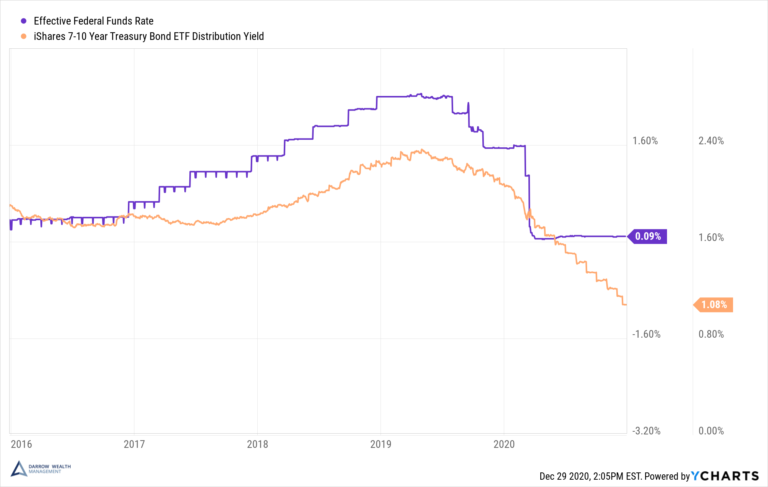

Bond Basics: How Bonds Work and the Benefits of Investing in Bonds

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Prices and Yields

One of the most important things to know about bonds is how changes in interest rates affect bond prices, and therefore yields (unless held to

How Much Money Do You Need to Retire Comfortably At 60?

How much money do you need to retire at 60? That depends entirely on how much you plan to spend in retirement. Absent a large

What Happens to Stock Options When a Public Company Goes Private?

With so much emphasis on IPOs, investors are sometimes surprised when publicly traded companies decide to go private. There are many reasons a company may

What is a Brokerage Account? 7 Key Benefits in 2025

What is a brokerage account? Updated in 2025. A brokerage account is a non-retirement investment account. Essentially, a brokerage account is the opposite of a

Putting A Lump Sum Towards Your Mortgage Won’t Lower Your Payment

Putting extra cash towards your mortgage doesn’t lower your payment If you have extra cash and are considering putting it towards paying down your mortgage

Inheriting a Trust Fund: Distributions to Beneficiaries

If you’re inheriting a trust fund, you likely have questions about how the distribution payouts to beneficiaries work and the tax implications. While general information

Should You Take an Early Retirement Package? What to Look for in a Buyout Offer

Deciding whether or not to take the offer of a voluntary early retirement package or buyout from an employer is a big decision. Taking an

Should You Use Retirement Accounts to Delay Social Security Benefits?

When your paychecks stop, you’ll have to decide where to turn for retirement income. Many individuals have several options: cash savings, IRAs and retirement accounts,

What To Do With Excess Cash: 7 Ways to Use Extra Savings

Updated for 2025. What should you do with excess cash? If you are holding too much cash, consider how to use the extra money to

3 Strategies to Minimize Taxes on Required Minimum Distributions (RMDs)

Looking for ways to minimize taxes on RMDs? For wealthy retirees, mandatory distributions from retirement accounts can cause taxes to increase sharply. As with all

How Does an IRA Rollover Work?

How to roll over a 401(k) to an IRA in 5 steps Rolling over an old 401(k) after you leave your job is easy, but

Asset Management vs Wealth Management: What’s the Difference?

Asset Management vs Wealth Management When searching for a financial professional, you may wonder whether you need asset management vs wealth management. How are they