Wealth Management Insights

Sign Up for Weekly Investing Insights

What Happens To Stock Options If You Are Laid Off?

Losing your job is stressful. If you’ve been laid off, you may be wondering what will happen to your stock options or restricted stock units.

During Times of Market Volatility, Focus on What You Can Control

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

Should You Start Saving for College Before You Have Kids?

Couples with strong cash flows may be eager to start planning for the future. With extra cash laying around, some investors may decide to start

Are Financial Advisors Worth the Cost? It’s Not Just the Value of Your Time

Are Financial Advisors Worth the Cost? How much does it cost to work with a financial planner? And is it worth it? For some, not

Should You Take a Pension or a Lump Sum?

Should You Take a Pension or a Lump Sum? Deciding between a lump sum or receiving pension benefits monthly requires careful planning and consideration. Though

Investing Beyond Your 401(k): How To Do It And Why You Should

This article was written by Darrow advisor Kristin McKenna, CFP® and originally published by Forbes.

Should Married Couples Use Joint or Separate Trusts?

Revocable or living trusts play an important role in many estate plans. Married couples utilizing trusts in their estate plan need to consider if it’s

What Happens to Stock Options After a Failed IPO?

What Happens to Stock Options After a Failed IPO? WeWork (now called The We Company) was just steps from a historic initial public offering when

Is Tax-Loss Harvesting a Good Idea?

Tax-loss harvesting is the process of selling an investment that has lost value in your portfolio to ‘realize’ the loss for tax purposes. Investors can

How a Roth IRA Could Make Your Kid a Millionaire

Updated for 2023. For most parents, it’s a trifecta: help your kids learn about investing, save for retirement, and get fast-tracked to becoming a millionaire.

Should You Sell Stock Options After The IPO Lockup Period?

What’s your post-IPO stock liquidation strategy? Working for a company as it goes public can be a very exciting and rewarding experience. If you have

Is it Better to Buy a Home with Cash or a Mortgage?

Should you get a mortgage if you can buy the home with cash? The idea of living mortgage-free can be particularly enticing for individuals nearing

Should You Pay Off Your Mortgage Early or Invest Extra Cash?

Should You Pay Off Your Mortgage Early or Invest Extra Cash? It’s true: the idea of living without a mortgage payment sounds enticing. On the

Calculating How Much Charitable Donations Will Reduce Taxes

How much charitable giving will reduce taxes depends on what you donate. The tax deductions for charitable giving will vary for donations of cash, stock,

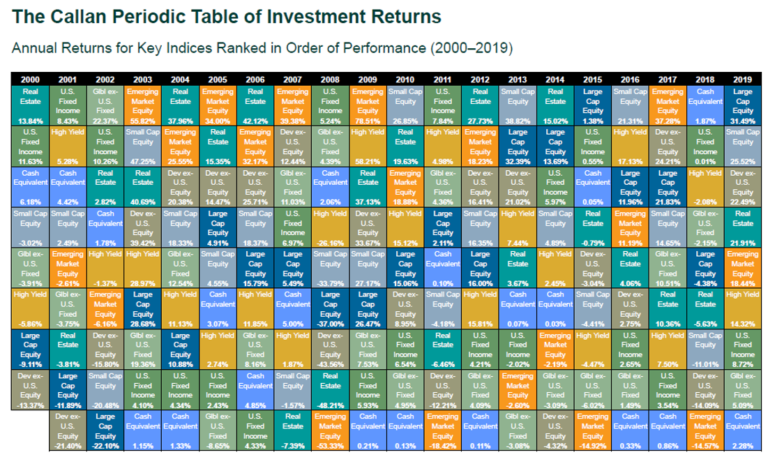

What History Can Teach Us About Asset Class Diversification in 4 Charts

Setting your asset allocation is like drafting architectural plans when building a home; it provides a map to guide the construction of your investment portfolio.

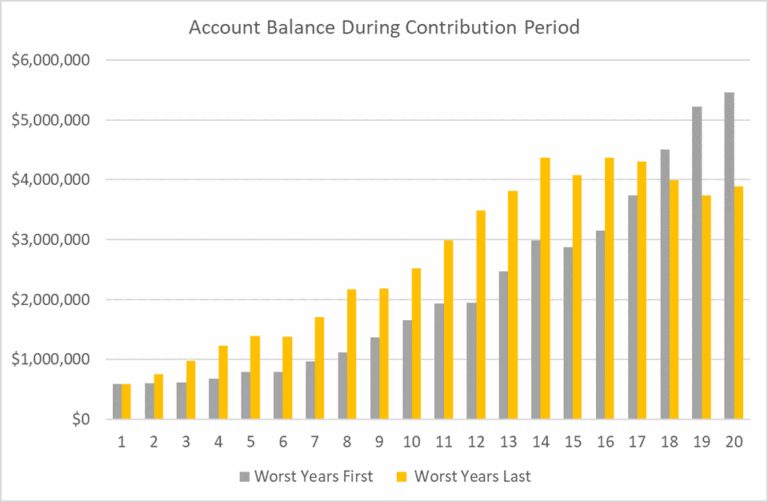

How the Timing of a Stock Market Crash Can Impact a Retirement Plan

There’s plenty for investors to worry about when their financial livelihood is on the line. When planning for major financial decisions such as retirement, individuals

Investing Outside of the S&P 500

If you’ve ever heard excerpts from the latest Apple earnings report, you may have thought, ‘so what?’ Well, for many investors, Apple’s relative performance could

Social Security Strategies for Married Couples with Unequal Incomes

How should couples file for Social Security benefits if they have unequal incomes? It isn’t always advantageous to wait until age 70 to file for