A new job can be exciting: a fresh start, new title, and (hopefully) more money. But changing jobs also means navigating a new retirement plan and benefit package as well as tying up loose financial ends with your former employer. Although it isn’t always quick and easy, properly assessing your new benefits and transitioning away from your old ones is a critical (and often overlooked) part of the job transition process. Transferring benefits when switching jobs is a key part of the job transition process.

Money Moves for Professionals During a Job Transition

Gone are the days where it’s commonplace to spend your entire career with one company. Today, it can be advantageous to move around, as a new job is usually a step-up in title or salary. Especially in certain industries, like biotech and tech, frequent job changes are just par for the course. Whether you’ve been at your old job for one year or twenty, you will still need to prepare to financially transition to your new employer and tie up loose ends at your old job.

Unfortunately, it is usually during a job transition where costly financial mistakes are made. Don’t overlook the importance of properly transferring your benefits when switching jobs.

Here are some of the most important tasks to tackle when switching jobs:

- What to do with your old retirement plan

- Setting up your new 401(k)

- What happens to stock options and equity at your old job?

- Stock options as part of your new job offer

- What to do with your old life and disability insurance

- Enrolling in health insurance at your new job

- Deferred compensation plans

- Other financial considerations

Should you leave your 401(k) at your old job?

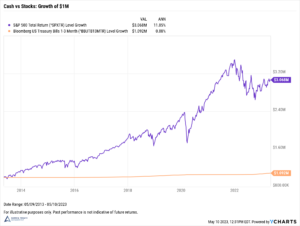

In reality, it typically takes a month from your last day before your retirement plan can be rolled over. It’s also usually during this time where people forget about their old plan. Consider the pros and cons of leaving your old 401(k) or 403(b) at your old job, transferring it to the new plan, converting to a Roth, or rolling an old 401(k) over into an IRA.

With a traditional IRA, there are no tax consequences and you will be able to continue the tax-deferred growth. You’ll also have more control over your investment expenses and options. Consolidating your accounts at one institution is another benefit.

Roth conversions have also become more popular since the passing of the new tax code, as most investors able to take advantage of lower marginal tax brackets. Although there are income limitations on who can contribute to a Roth IRA, anyone can make one Roth conversion per year regardless of income.

Setting up and managing your new 401(k)

Getting familiar with a new retirement plan can be daunting. A new interface, financial institution, menu of investment options, and documents to sign can leave do-it-yourself investors feeling overwhelmed and rushing through it.

As you begin to set up and contribute to your new 401(k) or 403(b) retirement plan, keep the following considerations in mind:

How much should you contribute?

In 2022, the IRS limit for contributions to a 401(k) or 403(b) retirement (if under age 50) is $20,500, plus a $6,500 catch-up contribution if 50+. In most situations, maxing this out should be the goal. If you’re not able to max it out, consider increasing your contribution at least 2%, especially if you got a pay increase.

If you start a new job mid-year, make sure you don’t accidentally over-contribute to your 401(k). The IRS limits apply per individual, not per plan.

Should you use a Roth 401(k) if offered?

Some 401(k) plans offer a Roth component. This allows participants to diversify their retirement savings with after-tax contributions, which can then grow tax-free if certain conditions are met. A Roth 401(k) could be advantageous while tax rates are low. But if not part of an ongoing tax diversification strategy, it may not be worth it.

Make your beneficiary designations.

Don’t forget to update your beneficiary designations as you move to a new plan. You will need to have the social security number of each named beneficiary, and can select both primary and contingent beneficiaries, as well as their allocated percentage. (Estate planning note: Make sure your beneficiary designations are consistent with your estate plan. If you’ve set up a trust, failing to set your beneficiary designations properly can undermine your estate plan!)

Setting your asset allocation.

Choosing your investment mix will probably be the most difficult part of setting up your new retirement plan. Target date funds can be efficient when your account balance is still relatively small. But as you continue to save it may be beneficial to fully evaluate the investment options in your plan and create your own asset allocation. This article has more on setting up and managing a new 401(k) plan.

What happens to stock options at your old job?

If stock is a big part of your income, switching jobs may require careful timing or leaving money on the table. There are a wide range of potential outcomes for your stock options after you leave a company.

Here are some key factors when you change jobs:

- Whether your shares are vested and whether or not you’ve exercised

- What type of equity compensation you have (stock options, restricted stock units, employee stock purchase plan, stock appreciation rights, phantom stock)

- Whether your employer is public or private

- Why you’re leaving the company (a new job, laid off, terminated with/without cause)

- What (if any) specific terms you negotiated with the company

This article has much more on what happens to stock options and RSUs after you leave the company. Employment agreements and equity incentive plans are very specific to your company/situation. We suggest you consider working with a financial advisor and attorney to fully understand the implications of taking a new job.

If your new job offer includes stock options, restricted stock, or other forms of equity

If your new job offers incentive or nonqualified stock options, restricted stock units, or other forms of equity, it is important to understand what these benefits may mean and what, if any, value it may provide. While the basics of your award or grant will usually be given before the time you’re hired, your new employer may not offer the full details of the equity incentive plan.

The terms and provisions will be key in understanding the potential value, especially if you expect equity-based compensation to be a large part of your overall income. To discuss your personal situation, please contact us to schedule an introductory call.

Maintaining adequate life and disability insurance coverage

It is common for companies to offer term life and disability insurance as part of their benefits package. Employers may pay for all or a portion of your coverage, but even when employees are responsible for premium payments, many companies are able to negotiate attractive rates.

The problem is when individuals decide to leave the company. If your new employer offers life insurance with the same carrier, it may be possible to transfer your coverage. However, in many cases, there are two choices: let the policy lapse and purchase private insurance (if necessary) or continue the policy as an individual (often at higher rates).

It is important to note that this is not strictly a financial decision. Depending on your age and health, you may not qualify for a new life insurance policy, even if offered. In this case, assess whether you should keep your current policy or whether you still need life insurance at all. There’s a common misconception that everyone needs to carry a big life insurance policy forever.

Should you buy supplemental disability insurance or private life insurance?

Regardless of your age, it is prudent to obtain adequate short and long-term disability coverage for your situation. Although self-funding may be a viable option for some short-term disability situations, long-term disability coverage remains essential.

As you review the life and disability insurance options at your new job, weigh the pros and cons of obtaining private insurance vs coverage at work. Although the employer-provided policy is often cheaper in the short-term, if you’re no longer insurable or will need coverage more than five years, it may be more expensive.

Enrolling in health insurance at your new job

If you utilize your employer’s health insurance plan, switching jobs will also mean switching your health insurance plan. If your new company offers pre-tax benefits like a flexible spending account or a health savings account – strongly consider enrolling. Individuals are often reluctant to opt for “yet another” deduction from their paycheck, even if it reduces tax. But participating in these plans can offer savings of over 37% for investors in the highest income tax brackets.

Leaving your old plan:

- If you were enrolled in a high-deductible health plan (HDHP) and used a health savings account (HSA) as a way to save for medical expenses on a pre-tax basis, the good news is that you won’t lose your contributions to the HSA. Much like your old 401(k), your health savings account may be rolled over and into a new plan.

- If you contributed to a flexible spending account (FSA) for medical expenses or dependent care expenses, you will forfeit any funds left in your account when you terminate your employment. FSAs are “use it or lose it” accounts, so pre-planning is essential to ensure you’re not leaving money behind.

- Ask your HR department when your health insurance coverage will end. Some plans will end on the day you leave your old job; others will end the last day of that month. If you’re taking time off between jobs or if there’s a waiting period until health insurance coverage can begin at your new job, you may find yourself uninsured during this time. If your old employer had at least 20 employees, you may elect to continue your health insurance (at your own expense) through COBRA.

Enrolling in your new plan:

- Depending on the coverage options and cost of your new employer’s health insurance plan, it may be advantageous to consider getting coverage on a spouse’s health insurance plan (assuming you’re married and that’s an option). Smaller companies may not offer benefits like vision and dental insurance, which can really add up for families.

- If you’re using a high-deductible health plan, take advantage of a health savings account, as it functions similar to an IRA with investment options and pre-tax contributions.

- If you’re not on a HDHP and your new company offers a flexible spending account, consider whether you should enroll. Contributions to a FSA are also made on a pre-tax basis and can be used for qualified medical expenses and qualified expenses associated with caring for a dependent (typically kids under 13).

Here’s more information on 2022 annual contribution limits.

Deferred compensation plans

Nonqualified deferred compensation plans are often offered to high-earning employees and executives, to defer additional income on a pre-tax basis. Since 401(k) plans limit your annual contributions, NQDC plans can help supplement savings, as there is no annual contribution limit.

If you are participating in a supplemental executive retirement plan (SERP) or other form of nonqualified deferred compensation plan at your old job, review the plan documents to see if these assets may be paid out if you voluntarily leave the company.

If you have the choice of participating in a deferred compensation plan or SERP at your new job, do your homework before making a decision. These plans do offer benefits, but the terms of the plan can get quite complex. Further, individuals who already have a high concentration in tax-deferred retirement assets (e.g. traditional/rollover IRA, 401(k), 403(b), pension plan, etc.) may benefit more from diversifying in taxable or tax-free accounts, such as a brokerage account or a Roth IRA.

Impact on your entire financial situation when switching jobs

Getting a new job is a big deal. When you change jobs, much of your financial stability and security also moves with you to the new company. As your income, compensation and benefit package start fresh, consider how these changes may trickle down into the other aspects of your financial plan and investment strategy.

Other considerations when changing jobs:

- Should you consult an employment attorney? Make sure you’re not violating any non-compete agreements. Consider asking an employment attorney to review contracts before signing.

- Does the new job change the estate plan? If your new role offers new benefits, you may want to account for them in your estate plan. So if you receive stock options, it consider including a section on equity compensation in your estate plan. Discuss these changes with your attorney.

- How complicated will your tax return be? Are you going from being a W-2 employee to a partner receiving a K-1 from an LLC or LLP? If so, your tax situation is going to become much more complex. If you want to exercise stock options, particularly incentive stock options, you should consider working with a CPA before exercising.

- How does this change cash flows? After a significant raise, investors should consider where to save after maxing out their 401(k). If someone transitions from a salaried position to a more variable-based role dependent on commissions, equity, or other type of bonus income, it makes sense to revisit how much cash should be kept on hand.

Starting a new job can be an exciting, but busy time. Transferring benefits when switching jobs may seem overwhelming. Since time is our most precious (and limited) commodity, consider whether it makes sense to work with a CERTIFIED FINANCIAL PLANNER™ professional if you’re not working with a financial advisor already.

Darrow Wealth Management is an independent, fee-only wealth management firm with offices in Greater Boston. To learn more about the benefits of working with a full-time fiduciary or to speak with an advisor, please contact us today.