Updated for 2024 and 2025. What is a capital gains tax? When you sell an asset like a stock or a home, your gain could be taxable. The tax rate will depend on several factors, such as your holding period, type of asset, and your taxable income for the year. Depending on your income, it’s possible to sell a long-term investment and ‘pay’ tax at a 0% rate. To manage your tax bill, it’s important to understand how capital gains taxes work and how income tax and capital gains tax work together.

What is a capital gains tax?

At a high level, when you sell an asset for more than you bought it for, you may need to pay tax on the difference. The gain for tax purposes isn’t always the same as your profit, but it can be helpful to think of it that way. A wide range of assets may be subject to capital gains tax including real estate, stocks, bonds, ETFs, mutual funds, art, and other types of personal property. You could also be subject to capital gains tax after selling types of inherited assets and gifts you receive.

Note: this article is for general information only and shouldn’t be misconstrued as the rendering of personalized tax advice. Tax laws change and there are many nuances to the tax code, many of which are outside the scope of this article. We encourage you to discuss your situation with a CPA or professional tax preparer. Darrow Wealth Management offers asset management and financial planning services; we do not provide tax advice or tax preparation services.

This article covers the following topics:

- What is a capital gains tax?

- Short-term vs long-term capital gains

- Do capital gains increase your adjusted gross income (AGI)?

- Can capital gains push you into a higher tax bracket?

- Netting capital gains and losses

- What types of assets are subject to capital gains tax?

- States have capital gains tax, too

- Ways to reduce capital gains tax

Short-term vs long-term capital gains

Capital gains tax is considered either short or long-term. In most cases, your holding period (how long you own the asset) will determine whether the gain or loss is classified as short or long-term for tax purposes. Holding period matters a lot as it’s a major factor in your capital gains tax rate. The tax code favors long-term ownership.

Calculate your holding period

In general, if you hold an asset for one year or less, your capital gain (or loss) is short-term. If your holding period is more than one year, your capital gain or loss is long-term. To calculate your holding period, you start counting beginning the day after you purchase or acquire an asset. The day you sell the asset will count towards your holding period.

Short-term vs long-term capital gains tax rates

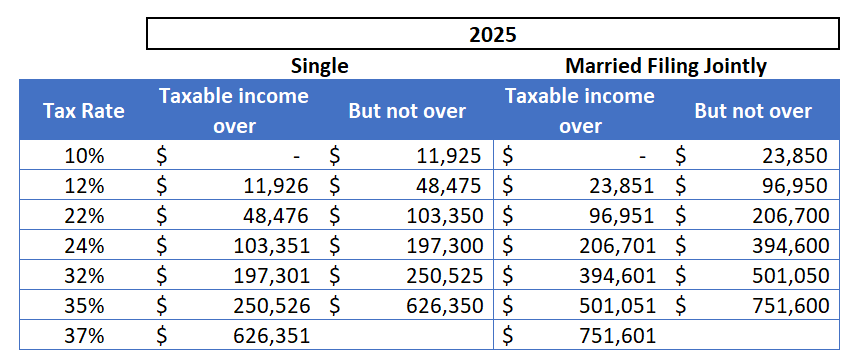

As previously mentioned, the long-term capital gains tax rate is much more favorable than the short-term rate. If you have a short-term capital gain, the tax rate is the same as your regular income tax rate.

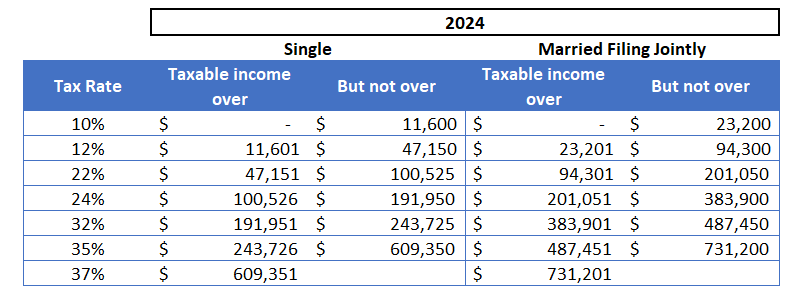

As you may recall, regular tax rates are graduated. Here’s a simple example: if you’re single and have taxable income of $100,000, a portion of your income will be taxed at 10%, 12%, 22%, and 24% as you move through the bands. So you may be in the 24% marginal tax bracket, but your effective tax rate would be closer to 18%.

2024 Tax Brackets for Regular Taxable Income and Ordinary Dividends

2025 Tax Brackets for Regular Taxable Income and Ordinary Dividends

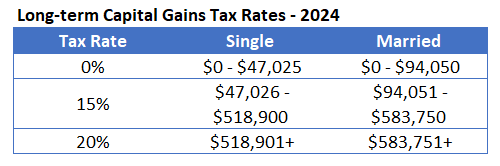

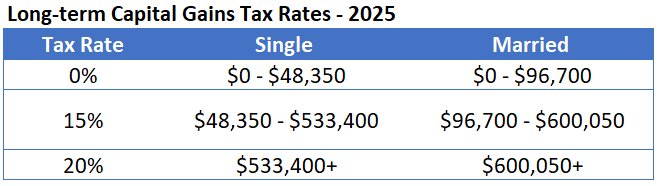

Long-term capital gains rates are lower than ordinary income tax rates. The tax rates are based on taxable income and don’t correspond exactly to regular income rates.

To determine your long-term capital gain tax rate, you’ll stack your long-term capital gain on top of your regular taxable income. The combined total determines the tax bracket(s) the gain falls in.

2024 Tax Rates for Long-Term Capital Gains and Qualified Dividends Based on Taxable Income

2025 Tax Rates for Long-Term Capital Gains and Qualified Dividends Based on Taxable Income

How to determine your long-term capital gains tax bracket

You will want to work with a CPA or use tax preparation software to calculate your taxable gain and the impact on your entire tax situation. However, for illustrative purposes, it may be helpful to know how long-term gains integrate with your regular income. The illustrative examples below are using the 2024 tax year.

Example #1: one tax bracket for long-term capital gains

Married couple filing jointly with taxable regular income of $200,000 and a long-term capital gain of $30,000. Assume the couple takes the standard deduction, $29,200 in 2024, and has no other credits/deductions.

For ordinary income, the couple is close to the top of the 22% tax bracket with net taxable income of $170,800 ($200,000 – $29,200).

For long-term capital gains, this puts the couple in the 15% tax bracket with plenty of room before the next tax rate increase. To estimate the tax due, multiple $30,000 * 15%.

Example #2: two tax brackets for long-term capital gains

Assume the same facts as the previous example, only the couple’s regular taxable income is $100,000. After the standard deduction, the remaining taxable income is $70,200. This is $23,250 below the threshold for the 15% tax rate on long-term capital gains.

The couple now falls into two tax brackets for long-term capital gains. There is $23,250 ‘left’ in the 0% tax rate before triggering the next tax bracket. So of the $30,000 long-term gain, $23,250 is taxed at 0% and $6,750 is taxed at 15%.

Simplified examples and hypothetical calculations for illustrative purposes. Not tax advice.

Do capital gains increase your adjusted gross income (AGI)?

Yes, capital gains can increase your AGI. Taxable capital gains are included in your adjusted gross income (AGI) and modified adjusted gross income (MAGI). There are several reasons you should care about increases to your adjusted gross income:

- Higher income individuals may trigger an additional 3.8% Medicare surtax or federal net investment income (NII) tax. The tax applies to lesser of net investment income or modified AGI in excess of $200,000 (single) or $250,000 (married filing jointly). This can increase the long-term capital gains rate from 15% to 18.8% or from 20% to 23.8%. When applied, tax is also levied on your other income, not just capital gains.

- Your MAGI will help determine eligibility for tax-deductible IRA contributions and ability to make regular contributions to a Roth IRA. Here are the 2024 IRS limits and 2025 IRS limits.

- Medicare Part B and D premiums are also calculated using a taxpayer’s MAGI, so large increases to your income can cause sharp increases to your Medicare costs.

- Eligibility for many tax deductions or credits, including itemized deductions, also use AGI or MAGI.

Can capital gains push you into a higher tax bracket?

Capital gains will not affect your tax rate for regular income. But it can increase your tax rate for capital gains and prompt the 3.8% Medicare surtax. Recall the order in which the tax rates are calculated: regular income first and then capital gains. Accordingly, capital gains won’t change your tax bracket for ordinary income. However, your short-term capital gains could be taxed at a higher rate than your regular income, depending on where you fall in the bracket.

For example, if you are at the last dollar of the 12% tax bracket for regular income, and add $1 of short-term gains, the gain will be taxed at the 22% rate. Your regular income will stay at the 12% rate. If your regular income was $1 less, adding $1 of short-term gains would keep you in the 12% bracket for everything. Obviously this is hypothetical and assumes no other changes to your tax situation.

Long-term gains aren’t directly linked to the tax brackets for regular income. However, increases to your short-term gains and regular income could push you into a higher tax bracket for long-term capital gains.

Capital gains can also increase your overall tax bill if your AGI triggers the 3.8% Medicare surtax.

Netting capital gains and losses

If you have capital losses and gains, you will need to find the net gain or loss before you can determine the impact to your tax situation. The process for netting capital gains first applies to gains and losses of the same holding period. For example, long-term gains and losses are netted against each other, and separately, short-term losses reduce short-term gains.

If the resulting short-term and long-term figures involve a gain and a loss, they are netted again.

Example: netting gains and losses

Short-term calculation

A ETF = $40

X ETF = ($50)

Total short-term loss = ($10)

Long-term calculation

D Mutual Fund = $5

H ETF = $10

Total long-term gain = $15

The short-term loss ($10) is netted against the long-term gain of $15 to result in a net long-term gain of $5 and no short-term gain. If the long-term figure above been a loss instead of a gain, the taxpayer would have had both a short and a long-term loss.

Net losses can potentially reduce ordinary income by up to $3,000 in the current tax year. The remainder (if any) can be carried forward as a deduction in future years.

Note that this is a highly simplified example and on your tax return, gains and losses from most other asset types are included in the calculation, not just stocks and bonds.

Simplified examples and hypothetical calculations for illustrative purposes. Not tax advice.

What types of assets are subject to capital gains tax?

Most assets are subject to tax if sold for a profit. Depending on the asset, the tax treatment may be quite unique. Here are some of the more common types of assets subject to capital gains tax, but not an exhaustive list.

Taxable investment accounts (e.g. the brokerage account)

When you sell a stock, bond, mutual fund or ETF in a brokerage account, you may have a taxable gain or loss depending on how your gains and losses net out at the end of the year. Recall the 0% tax bracket for long-term capital gains, so even if you have a taxable gain, you may not actually owe tax on it.

Unlike tax-deferred retirement accounts, when you put money in a brokerage account, there are no tax advantages. So you might have a taxable event even if you don’t sell any of your holdings. Dividends, interest, and capital gains distributions are taxable, whether you take the cash or reinvest cash or shares. This article has more on how a brokerage account is taxed.

In most cases, ordinary dividends and interest are treated as short-term capital gains. Qualified dividends receive more favorable long-term tax rates.

Your home

A primary residence is an example of an asset with unique tax rules. Under current law, if homeowners own and live in their home for at least 2 of the last 5 years, all, or a portion of, the gain can be excluded from tax. The maximum gain exclusion on the sale of a primary residence is $250,000 for single filers and $500,000 for married taxpayers.

If the net profit (which you’ll want to work with an accountant to calculate as it isn’t as straightforward as the cash that hits your bank account), is less than the maximum gain exclusion, then in all likelihood you won’t have to pay tax on the sale.

To the extend the gain exceeds the limits, or does not qualify for the shelter, it’s typically considered a taxable capital gain. The tax rate will depend on your holding period.

The IRS considers a home used as a primary residence personal property. Unlike investment assets, like a rental property or stocks, you cannot deduct losses on personal property.

There are many other factors and caveats to consider when selling your home, so it’s advisable to speak with an accountant about your specific situation.

Stock options

If you have stock options or equity-based compensation as a large part of your income, you’ll want to do some tax planning with your financial advisor and accountant before a taxable event. How stock options are taxed depends on the type of options you have (incentive or non-qualified) and your sale and exercise strategy.

The tax implications may range considerably: from 100% ordinary income to 100% long-term capital gain and variations in between. Again, you’ll need to balance the tax benefits of a longer holding period with the risks of holding onto the stock. If you’re facing a big on-paper windfall, paying some additional tax to lock in your profits may not be such a bad thing.

Restricted stock units and restricted stock

The full value of restricted stock units are considered regular income when they vest. If you don’t sell right away, the tax treatment of any additional gain or loss will follow your holding period. If RSUs are a big part of your income, you’ll want to develop a tax plan. Assuming time-based vesting, the increases to your income will be somewhat predictable.

Restricted stock is taxed differently, depending on whether you opted for an 83(b) election.

Collectibles

Capital gains on collectibles, such as art, antiques, jewelry, metals, and other assets are taxed at a 28% rate, regardless of your income or other tax brackets.

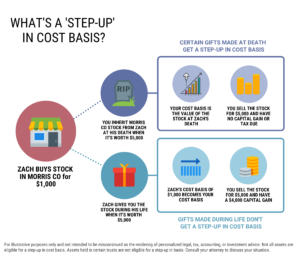

An inheritance

Whether you’ll need to pay capital gains tax on an inheritance will depend on the type of asset you inherited. Inheritances of non-retirement assets like a brokerage account, home, antiques/art/collectables, or other real estate, will receive a “step-up” in cost basis. When these assets are inherited, the beneficiary’s cost basis is increased, or stepped-up, to the market value of the asset at the date of death.

When the asset is eventually sold at a gain, the beneficiary will pay capital gains taxes on the difference between the inherited step-up cost basis and the sale price. The holding period for inherited property is always considered long-term, regardless of when it was purchased by the decedent.

Other types of tax may apply to inheritances too, so be sure to work with your financial advisor, CPA, and estate attorney to understand your options.

Gifts you receive from someone else during their life

Generally, if someone gives you an asset during their lifetime, you (the beneficiary) will assume the donor’s cost basis. When you sell the gifted asset later on, you will use the donor’s holding period and cost basis to determine your capital gain or loss. If there is any tax due, it will be assessed at your tax rate for short or long-term capital gains. Gifts made during someone’s life are not eligible for step-up treatment.

States have capital gains tax, too

To this point, the discussion on capital gains tax has been limited to federal tax law. But it’s important to note that you may also have to pay tax to your state, too. The majority of states have their own tax on capital gains, in addition to the federal tax. Several states don’t have a tax.

As you might imagine, laws vary considerably between states. Consider working with a CPA to discuss your situation.

Ways to reduce capital gains tax

There are several strategies you can consider to help reduce the amount you’ll owe in federal capital gains tax.

Develop a plan for realizing gains

Proper planning can significantly reduce your tax bill. For example, if you are in a lower tax bracket one year and have been delaying realizing gains, it may be a good time to do it. You will also want to limit short-term gains to the extent you are able.

If you are looking to diversify a large taxable account, consider spreading the gain across two or more tax years. Of course, you’ll need to weigh the pros and cons of holding onto an investment for longer simply to achieve tax benefits. In most cases, you’ll want to avoid tax-savings that stem from investments losing value.

Consider tax-loss harvesting

Tax-loss harvesting means selling an investment that has lost value to ‘realize’ the loss for tax purposes. Since investment losses can reduce gains, investors with large taxable gains from investment activity may consider tax-loss harvesting. There are pros and cons to this approach, so you’ll want to make sure harvesting losses makes sense in the context of your whole financial situation. Realizing losses just for tax purposes might not be a good idea.

Try to avoid the required minimum distribution tax cliff in retirement

For wealthy retirees, mandatory distributions from retirement accounts can cause taxes to increase sharply. As with all financial planning, to get the best results you’ll want to start early. For investors with $1M+ in tax-deferred retirement accounts, RMDs may push you into a higher tax bracket for regular income. This, in turn impacts short-term taxable gains, which has implications for your long-term tax rates too.

Diversifying your retirement savings outside of a 401(k) and IRA can help you avoid big increases in ordinary income when RMDs begin. Saving with a Roth IRA and brokerage account can give you more control over your tax brackets in retirement.

Give your required minimum distribution to charity

Although RMDs are treated as regular income for tax purposes, your AGI helps determine your tax rate for capital gains. Reducing your taxable income to stay within the 0% tax rate for long-term capital gains is a big benefit!

What many retirees don’t know is that they can donate all, or a portion of, their required minimum distribution (RMD) directly to charity, through a qualified charitable distribution, or QCD. In 2025, the limit is $108,000 per person per year. Instead of a tax deduction, a qualified charitable distribution allows your RMD to bypass your income, going directly to charity.

Donating appreciated assets

In line with the giving spirit, if you have taxable assets and a charity you wish to support, rather than sell the asset, pay tax, and donate the proceeds, consider giving the asset directly to charity. In doing so, you not only avoid incurring the capital gain, but you can also receive a tax deduction.

If you itemize your deductions, you may also take a charitable deduction. The tax deduction is the fair market value of the asset at the time of donation, up to of 30% of your AGI. As with cash donations, there is a five-year carry forward for unused deductions. The asset must qualify for the long-term holding period.

A donor-advised fund is a great way to donate appreciated securities. A financial advisor can help you set this up.

Using asset location to reduce tax

As you consider ways to reduce your overall tax, review how efficient your asset location is. By holding tax-efficient investments in taxable accounts, you can keep more tax-inefficient funds in tax-deferred retirement accounts and avoid paying tax annually until the funds are withdrawn.

It may seem easier to manage each investment account on its own, but it’s hardly the most efficient way. By considering your entire portfolio of accounts (taxable and tax-deferred) as one pool of investable assets, you can choose which funds are best suited for each account type.

For example, ETFs are very tax-efficient investments, so it can be a good choice for taxable brokerage accounts. Index funds typically have lower turnover than an active fund manager. Keeping relatively tax inefficient investments, such as high dividend yield mutual funds, REITs, and bond funds, in retirement accounts also has its advantages.

Contribute to retirement accounts

Pre-tax contributions to an IRA or 401(k) can increase a tax bill when required minimum distributions begin. But it’s still a powerful way to reduce your taxable income, and in turn, the tax rate on your capital gains. If you’re not already maxing out your retirement account, consider doing so. Especially in years where you have a large taxable gain.

Carefully time Roth conversions

There are income limits on regular contributions to a Roth IRA, but any taxpayer can make one Roth IRA conversion per year, regardless of income. When you convert a pre-tax retirement account to a Roth, the amount is part of your regular taxable income for the year. This could push your regular tax bracket and rate you pay on capital gains higher.

To minimize the tax impact of a Roth conversion, try to plan it during a year where your income is lower or you’re not also incurring a capital gain.

Taxable Social Security Benefits

Even modest withdrawals from a retirement account can cause Social Security benefits to become taxable, with limits. Up to 85% of benefits could be taxable for single filers with income above $34,000 annually or $44,000 for married couples. Taxable benefits are a factor that could push you out of the 0% rate for long-term capital gains and impact your tax situation in other ways.

Don’t let the tax-tail wag the dog

It’s important to educate yourself about your tax situation and how one aspect of your finances can affect another. But making decisions with only tax-savings in mind can be short-sighted.

Our approach to comprehensive wealth management aims to bring your entire financial life together and help clients make big decisions. Working in conjunction with your CPA and attorney as needed helps ensure everyone is on the same page. Contact a financial advisor today to discuss your situation.

This article is for general information only and shouldn’t be misconstrued as the rendering of personalized tax advice. Darrow Wealth Management is not an accounting firm and does not offer tax advice or tax services. We encourage you to discuss your situation with a CPA or professional tax preparer.

Last reviewed January 2025