What’s your post-IPO stock liquidation strategy?

Working for a company as it goes public can be a very exciting and rewarding experience. If you have company stock, an IPO means there will soon be a public market for your shares. IPOs make it much easier to sell stock options after the lockup period. A lockup period typically lasts six months, and during this time company employees and insiders are unable to sell their shares, or at least not without restriction. While you wait, it’s a good time to develop a plan to maximize the value of stock options or awards through financial and tax planning.

What’s a lockup? How lockups work after a company goes public

If you’re a current employee, the company has (hopefully) communicated with you about the lockup period. If you’re a former employee, this may be a bit harder. In a typical IPO, the underwriter may require that the lockup extends to former employees. The company may send you a letter or you may need to reach out and/or sift through SEC filings.

In SPAC deals, the business combination agreement will have details about the lockup, but again, you’ll need to figure out what applies to you. Direct listings don’t have lockup periods.

Lockups can vary: sometimes it’s a stated number of days, event based (such as reaching a target share price or an earnings release), a combination of the two, or a multi-stage release. The terms of the lockup can also change before or after the company goes public!

Due to the complexity, seriously consider working with financial and tax advisors who have experience in the space.

Should You Exercise Stock Options Before or After an IPO?

If you have incentive stock options or non-qualified stock options, you’ll need to decide when to exercise. Exercising very shortly before a company goes public is risky, as the current value of the private shares may be quite close to the expected offering price. This means locking in a spread for tax purposes (AMT or regular) without liquidity or much margin for error. How much upside is already priced in? There’s simply no way to know.

Unlike stock awards, options must be purchased, meaning there’s a potential for your shares to become underwater. This happens when the strike price (the price you paid) is greater than the current fair market value.

What Employees Should Do When Their Company Goes Pubic

Particularly for incentive stock options, which may qualify for more favorable tax treatment, there’s a benefit to starting the clock on your holding period to qualify for more favorable long-term capital gains rates. But the downside of exercising before the lockup is you’re stuck if the IPO pauses or the stock sinks when it hits the market. Exercising and holding ISOs through the end of the year could trigger the alternative minimum tax, too. The AMT may negate the future tax benefits of the early exercise strategy.

Liquidity issues

Before exercising, be aware of a possible liquidity crunch to pay tax. Realize you may not have liquidity when taxes are due if the lockup extends into April. Also consider whether you want to take the risk of exercising (and paying tax or possibly the AMT) at a stock price higher than what the market price might be when the lockup ends. There’s no withholding for ISOs and any withholding for non-qualified options or RSUs is at statutory tax rates, typically 22%. Depending on your income, you may be in a much higher tax bracket, and will need to come up with the cash to pay the tax on the difference.

When Should You Exercise Stock Options?

Video: What to do with stock options and restricted stock before an IPO

If You Quit Before the Lockup Ends

If you plan to leave the company before the initial public offering or during the lockup period, make sure to read your stock agreements as you may lose any unvested and/or unexercised shares. Employees with incentive stock options can generally exercise up to 90 days after your last day with the company, but could be less, perhaps only 30 days.

Non-qualified stock options may be more flexible, but review the terms as outlined in your company’s equity plan.

In either scenario, consider how the lockup period may affect your plan. Employees and former employees can exercise during a lockup period, but they can’t usually take advantage of cashless exercises or other methods where shares can be used to buy the shares and/or potentially pay any required tax withholding.

Underwriters could permit stock plan participants to use shares to pay tax withholding after the company goes public during a lockup period, but it’s not a certainty. Keep in mind, even if you leave the company, you may still be subject to the lockup restrictions.

Any time you exercise stock options at a privately held company or in advance of a lockup there are risks. If you don’t plan to hold the shares for a year, there may be little benefit to exercising stock options before the IPO.

What Happens to Stock Options After an IPO?

Pre-IPO Planning for Restricted Stock Units and Restricted Stock Awards

For employees with RSUs and RSAs, the situation is exceedingly simple. Restricted stock units and awards will continue to vest according to the stated vesting schedule during the lockup period. Unless your company is being bought out by another firm, there are no decisions you’ll need to make regarding your equity compensation, except whether you plan to sell owned shares when restrictions are lifted.

Existing vested shares and new shares that vest during the blackout period can be sold when the lockup expires, usually six months.

Sell or Keep Stock After Your Employer Goes Public?

Many employees with stock at private companies have a very significant amount of their net worth bottled up in company stock. Until you sell the stock and realize the value, you run the risk the windfall won’t materialize.

Starting to Diversify when the Lockup Ends

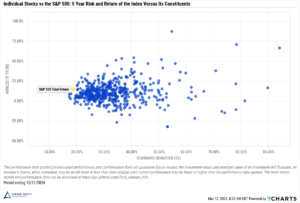

It’s normal to feel bullish about the prospects of the company. But try to remain as objective as possible about your employer. The stock of one company is risky relative to the diversification in a fund that owns thousands of companies. The risk of loss is elevated when you’re too heavily invested in your employer’s stock, as you already rely on the success of the business to pay your salary and benefits.

IPOs Have Underperformed In the Short Term

Professor Jay Ritter from the University of Florida is perhaps the preeminent expert in IPO data and trends. His research showed that between 1980 and 2019 IPOs have underperformed other firms of the same size by an average of -2.4% per year during the five years after issuing, excluding the first-day return.

His research also shows average returns over the first six months generally outperformed similarly-sized firms by 1.2%, while performance during months 6-12 typically underperformed by -4.6%. And returns in the first and second years after going public lagged by -3.4% and -7.2%, respectively.

Although employees with very low strike prices relative to the fair market value of the stock will fare better than individuals buying the stock at full price on the open market, it may still not be advantageous to hold the stock if it could be sold and put into diversified investments with less risk and a higher expected return. That’s investing 101!

Developing a Strategy for Stock Options or Awards After the Lockup

As you wait for the blackout to end, develop a plan before you’re able to sell your stock. Consider the possible tax benefits of spreading sales over one or more tax years versus the risk of holding the shares longer or the tax laws changing in the interim.

As a financial advisor who specializes in working with clients who have stock options and equity compensation, we have a process to help with the analysis. Please contact us directly to discuss your personal financial situation.

What Not to Do with Stock When the Lockup Period Ends

Allocating the potential proceeds between paying down debt, other investments, saving in cash for other goals, lifestyle expenditures, and keeping your positions in company stock is often the hardest yet most important part of the process. Naturally, the prospect of a large windfall is exciting and the lifestyle improvements tempting.

As with nearly everything in life, the best plans often involve a balanced strategy between saving, spending, and investing. The best approach for the proceeds will really depend on your unique personal financial situation and expectation for the future.

With that, there are several mistakes individuals commonly make with their stock when the lockup period ends.

Work with a Stock Option Advisor

Kristin McKenna for Forbes: Top 5 Stock Options Mistakes During an IPO

6 Common Post-IPO Mistakes

- Using substantially all the after-tax cash on real estate. Buying a new home, investment property, or aggressively paying down a low-to-moderate interest rate mortgage on a current home are often at the top of the financial wishlist. Though there can certainly be cases made for any of the above, don’t let emotions drive you to enter into a new lockup with your newfound liquidity on illiquid (and often cash-intensive) investments. More on lifestyle spending and good debt below.

- Selling everything at once the first day the lockup ends. Market timing is notoriously tough and usually leads to mixed or disappointing outcomes. Especially for highly publicized IPOs like Uber, Lyft, and Snap, the market closely tracks the blackout period in anticipation of a surge of new shares. This can result in downward price pressure on the stock. Consider a strategy that balances systematically liquidating shares with the pros and cons of waiting for long-term capital gains.

- Locking in high fixed costs on a new lifestyle asset. Have your finances changed, aside from the windfall? If not, buying an expensive new home or car could have a negative impact on your cash flows. It also limits your ability to save in the future. (Who wants to downgrade from a Tesla, anyways?) Simple message: lifestyle inflation can erode your wealth over time, leaving you worse off in the long run.

- Selling and staying in cash for an extended period of time. Unless you need money soon, it likely doesn’t make sense to keep a pile of cash in a bank account. Lacking a plan for reinvestment is a big risk, the opportunity cost can be steep. Consider working with a fee-only wealth advisor to develop a diversified investment strategy.

- Not paying off debt on high interest rate loans OR paying off debt on very low interest loans. Not all debt is equal! Some loans (like mortgages) can offer tax benefits while other debts provide leverage through low interest rates. These debts might actually be worth keeping even if you have the cash to pay them off. Other debt, like credit card debts, carries very high rates and should be paid off/down as soon as it is feasible.

- The do-nothing strategy. We can’t be experts at everything, and that’s ok. Don’t shy away from making a decision if you’re unsure of how to manage your stock; engage a professional to help.

Before mentally pre-spending your proceeds, keep in mind that sizable windfalls from a company going public don’t happen every day. You are likely on the cusp of a major financial milestone in your life – one that might not repeat itself. That isn’t to say that you cannot – or should not – do something enjoyable with the proceeds. But try to strike a balance between your current and future wants and needs.

Financial advisor for stock options and sudden wealth

Darrow Wealth Management specializes in stock options and equity compensation. If your employer is going public, work with an advisor experienced with strategic stock option planning, tax implications, and strategies to best manage sudden wealth. You only get one shot at this.

Here are some of the ways we work to help executives, founders, and employees navigate an IPO:

- Exercise strategies

- Trading plan and execution

- Assist with identifying and tracking shares likely to qualify for the tax-free sale of qualified small business stock

- Decide on a strategy to best use the proceeds, including funding multiple goals and investment management services to help you diversify sudden wealth

- Incorporating the proceeds from a major liquidity event into your financial goals and projections

- 10b5-1 plan provisions

Schedule a call with an advisor

Last reviewed March 2024