How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors with income, diversification from stocks, and stability compared to riskier asset classes. There’s a lot to know about bonds, but here are the bond basics you need to know before investing.

What are bonds and how do they work?

When you buy a bond, you’re actually buying debt. The bond represents the borrower’s (issuer’s) commitment to repaying that loan with interest over time. Governments and corporations issue bonds to finance spending needs. Bonds are called fixed income because the payments are typically fixed and can provide a steady cash flow for investors. The income component is a key reason investors own bonds in their portfolio.

The global bond market is larger than the global stock market. But despite the prevalence of bonds, investors tend to know much less about them relative to equities. You can buy bonds outright or purchase part of a basket of bonds using an ETF or mutual fund.

Unlike stocks, which are issued by corporations, fixed income issuers are primarily governments. In the U.S. this is the treasury market, but there’s also corporate bonds, mortgage-backed bonds, and other asset classes. U.S. investors can also buy bonds from other countries and foreign corporations.

Types of bonds

Fixed income represents a very large asset class. Within the bond universe are many different types of fixed income investments. The distinct types of bonds also have varying risk-reward metrics, maturities, income yields, and diversification properties. Here are some of the most common types of bonds:

- U.S. Treasuries (short-term T-bills all the way up to 30-year Treasuries)

- Corporate bonds (Investment-grade or high-yield)

- Municipal debt

- Mortgage-backed securities and asset-backed securities

- International bonds (corporate or government, emerging market or developed economies, local currency or hedged to the dollar)

- Treasury Inflation-Protected Securities (TIPS)

Key bond terms

- Par value. The par value of a bond is its face value. The par value is usually what an investor receives when the bond matures. When investors buy new bonds in the primary market (directly from government auction or a corporation), they’re purchased at par.

- Discount or premium. Each bond has a par value, but once they enter the secondary market, they don’t usually trade at face value. When bonds change hands between investors (vs initially sold by the issuer), they usually trade at a discount (lower) or premium (higher) from their par value. We’ll discuss why later.

- Coupon. A bond’s coupon is a fixed interest rate and represents a percentage of the par value that the buyer will receive in ongoing interest payments. For example, a bond with a $1,000 par value and a 5% coupon will make interest payments (often semi-annually or annually) of $50 until the bond matures.

- Yield to maturity. The bond’s expected return if held until maturity is called the yield. It factors in all the coupon payments plus the repayment of principal. If you hold a bond until maturity, at the end of the loan the issuer will pay the bond’s par value and the debt will be cancelled. If you sell the bond before maturity, it will trade at a discount or premium to par depending on prevailing interest rates at the time. Bonds aren’t often held until maturity.

- Current yield. Since investors typically sell bonds before they mature, the yield to maturity isn’t always a helpful metric. The current yield is the return a buyer could expect if they hold the bond for a year. The current yield is calculated as the bond’s annual income, divided by the current price.

The relationship between bond prices, interest rates, and bond yields

One of the most important things to know about bonds is how changes in interest rates impact bond prices, and therefore yields (unless held to maturity). Bond prices move inversely to interest rates. As interest rates rise, bond prices decline. If rates decline, bond prices will increase. The current yield (e.g. return) decreases as prices increase. As bond prices decrease, the yield increases.

Here’s a simple example:

Bond K, a newly issued bond, has a 5% coupon payment and trades for $1,000, its par value. The current yield is 5% ($50 / $1,000).

If prevailing interest rates decline 1%, the same issuer could sell a new bond, Bond M, with a 4% coupon, $1,000 par value, and a 4% current yield. The decline in rates make Bond K more valuable, so buyers in the secondary market are willing to pay more for it. Bond K now sells for $1,050 at a premium. Bond K’s coupon payment is still 5% as it’s based on par, but the current yield declines from 5% to 4.76% ($50 / $1,050). The yield goes down because the buyer had to pay more for the bond. Whoever owns the bond at maturity will receive the par value.

If prevailing interest rates increase 1% instead, the cost of borrowing would increase for the issuer. Bond D is a new issue with a 6% coupon, $1,000 par value and 6% current yield. Rising rates make Bond K less valuable, so buyers won’t pay as much for it. Bond K now sells at a discount for $950. The coupon payment is still 5%, but the current yield increases from 5% to 5.26%% ($50 / $950). The yield goes up because the buyer pays less for the bond. Whoever owns the bond at maturity will receive the par value.

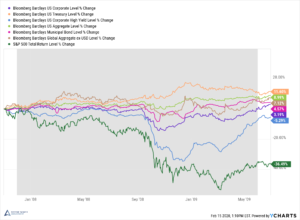

The sharp drop in yields in 2020 have left some investors questioning their reasons for owning bonds. But although the relationship has changed, there are still several key benefits to owning bonds.

What Happens to Bond Prices and Yields When Interest Rates Change (actual charts)

Stocks vs. bonds: how are they different?

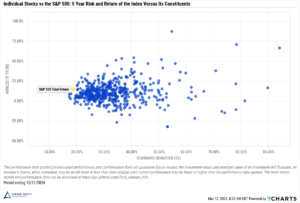

Stocks and bonds are very different types of investments. When you own a stock, you’re buying a piece of equity ownership in the company. With a bond, you’re buying the issuer’s debt. Stocks have greater growth potential but also more volatility, which can hurt an investor’s financial goals and erode returns. Bonds are more stable investments that can provide income but have much less upside.

It’s important for investors to understand that stocks and bonds accomplish different things in an asset allocation. They both have a place, though in different weightings, which change over time. Equities are often key to help investors keep pace with inflation over the long-term.

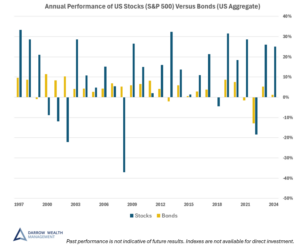

Stock vs Bond Performance Over Time

Stocks and bonds vary in terms of how correlated the asset classes are. Utilizing asset classes that aren’t perfectly correlated helps provide protection as securities in a portfolio respond differently to changing market conditions. The principles of diversification support investing in both stocks and bonds. Correlations are important to keep in mind as you build a diversified portfolio.

It doesn’t always pay to clip the coupon: dividends vs income and what happens when stocks beat bonds at their own game

Recall the earlier discussion on the relationship between interest rates and yields. When rates decline and yields drop to today’s historic lows, it supports equities, as investors may feel they have no alternative to stocks for yield. The 10-year treasury is currently yielding .9% (as of December 2020). The forward dividend yield on the S&P 500 is 1.6%. Back in October 2007, the 10-year yield was 4.7% when the forward dividend yield on the S&P 500 was 1.9%. The stock market stayed pretty consistent; it’s the bond market that changed.

It’s this dynamic, among others, that helped support equities during 2020, despite the economic and health crisis. Low yields certainly hurt one of the main benefits of investing in bonds. However, there are still reasons to own bonds.

4 benefits of investing in bonds

1. A major benefit of investing in bonds is help limiting your downside

Imagine it’s January 2007 and you invest a lump sum in the S&P 500 (SPY). By the end of 2009, your total loss is a little more than -16%. Now suppose you invested 70% of the money in the S&P 500 and 30% in the Bloomberg Barclays Aggregate (AGG). Your total loss would be cut to -5.7%. The difference is over -10%! If you only had 10% invested in bonds, your loss would be roughly -12.6% while a 50/50 portfolio would actually have a 1.2% gain. Bonds can help hedge your risk.

This is not to say everyone should put half of their money in bonds, either. Investors have different needs, risk tolerances, time horizons, and financial situations which require a custom asset allocation. While bonds can help limit portfolio drawdowns, they also limit investment gains.

In the three-year period between 12/29/2017 and 12/28/2020, a 100% S&P 500 stock account would have returned 13.8% on an annualized basis, versus 9.5% on a 50/50 portfolio.

2. Bonds help mitigate sequence risk

Sequence risk describes how the order of investment gains or losses and timing of cash flows affect portfolio values. The figures above ignore any new investments or withdrawals, which are parts of any real life scenario. Overspending in retirement or just ordinary cash needs during down markets exacerbate the drawdown on a portfolio.

Allocating a percentage of your investments to bonds could help avoid unnecessary drawdowns to your assets if you need money while the market is down. Since fixed income is historically less volatile than equity, the reasoning is that those assets shouldn’t experience such a severe drawdown, forcing you to sell at a low point.

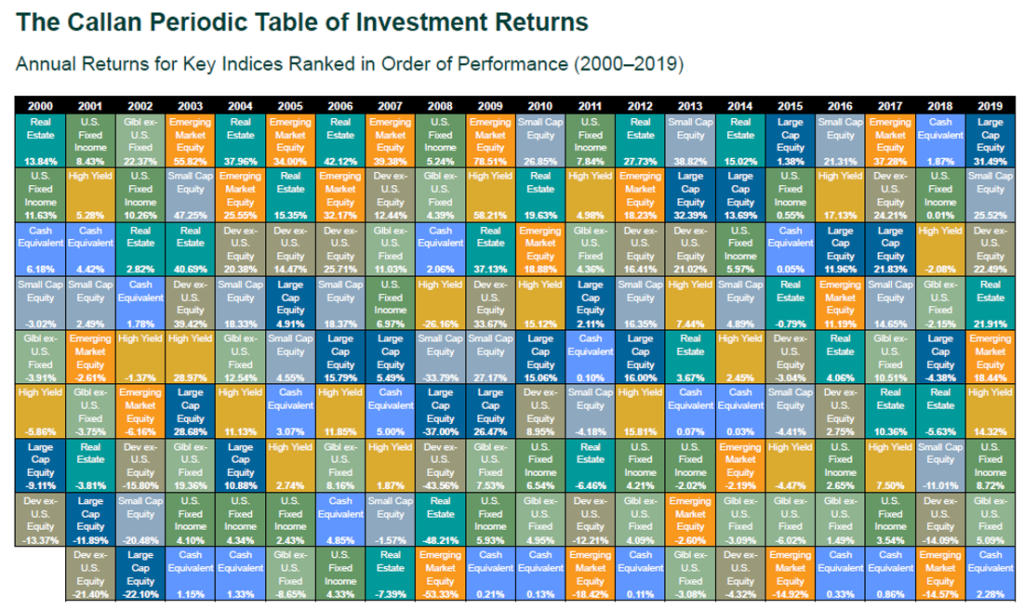

3. Fixed income is just one part of a diversified portfolio

To highlight the merits of diversification, consider the Callan Periodic Table of Investment Returns which ranks the returns of various asset classes annually from highest to lowest. The table below includes various asset classes such as cash, fixed income, equity, and real estate.

The chart illustrates how significantly one asset class can (and often does) fluctuate year-over-year, both on its own and on a relative basis compared to other asset classes.

The chart illustrates how significantly one asset class can (and often does) fluctuate year-over-year, both on its own and on a relative basis compared to other asset classes.

4. There aren’t many other options for safety

It’s worth repeating: bonds help protect your portfolio. But all investments carry risk, including fixed income. The financial markets are very efficient. There’s no such thing as a risk-free investment that produces an outsized return…or much of a return at all. The only true risk-free asset class is cash, but even that’s a misnomer. Cash in a mattress or bank account earning next-to-nothing can’t keep pace with inflation, so its value is constantly being eroded. Rates on CDs are extremely low as well. Investors searching for yield and income need to accept at least some risk, and bonds have historically been a good way to accomplish exactly that.

Should you own individual bonds or invest with bond funds?

Are there benefits to investing in single bonds vs shares of a bond fund? There are a number of important differences between owning individual bonds and investing in bond funds. For individual investors, investing in bond mutual funds or ETFs is often the best way to gain exposure. Here are the key differences between bond funds and individual bonds.

Individual bonds

- Minimum purchase. The minimum purchase amount to buy one Treasury bond is $1,000. Some corporate bonds may require a minimum purchase of $250,000 or more. Small buyers won’t be given as favorable pricing offers from dealers as large institutional purchasers.

- Liquidity. Treasuries are very liquid – if you want to sell Treasury bonds, there will almost always be a buyer. But other types of bonds, like municipals, don’t trade very often. So they can take time to sell and you may end up doing so at a discount. If news comes out about changes to a company’s or country’s financial position that results in a downgrade of their credit rating, it can also impact your ability to sell the bond and for how much.

- Diversification. Due to the minimum purchase amount, it’s much harder to diversify your bond holdings without a significant amount of money to invest.

- Control of holdings. When you own bonds outright, you have the most control over how long you hold that particular security. Holding to maturity gives investors a reliable payment of par.

- Cash flow. Most bonds make their coupon payments semi-annually or annually.

Bond funds

- Minimum purchase. Shares of a bond mutual fund or ETF can be purchased for small dollars, like $100. This makes it much easier for investors to invest in the types of bonds they want.

- Liquidity. Most mutual funds and ETFs are very liquid. ETFs trade like stocks, so you can buy and sell bond funds during trading hours and you’ll instantly know the price you’ll pay/receive. Mutual funds trade at the end of the day when all the trades are settled. The inner workings of mutual funds and ETFs are outside the scope of this article, but the important thing to remember is unlike individual bonds, when you own a bond fund, you’re not responsible for finding the buyer. You simply redeem your shares.

- Diversification. With a bond fund, it’s very easy to diversify. There are bond funds for nearly every investment objective: TIPS, high yield, emerging market sovereign debt, the entire U.S. aggregate bond market, etc. Given the cost to buy a bond fund, investors can easily diversify in several bond asset classes. Given a major benefit of bonds is diversification, this is a very important consideration.

- Control of holdings. When you buy a bond fund, you outsource the management to the fund manager. Professional managers must adhere to the investment mandate in their prospectus, but they also have latitude if the fund has an active manager vs tracking an index. The managers will conduct all the credit research and trade bonds as they wish.

- Cash flow. Because bond funds hold a basket of bonds with different maturities, the income stream is fairly constant. Most bond funds pay investors monthly, and coupon payments can automatically be reinvested or paid out as income.

Bond basics: next steps

Before investing in bonds, you’ll need to think big picture about your financial situation and overall asset allocation. While there are several reasons to own bonds, the benefits of investing in fixed income changes over time, especially relative to other asset classes. With the old conventional wisdom of a 60/40 portfolio on life support, having a fiduciary financial advisor help you develop and manage your investments in retirement is critical.

Important Disclosures

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Both past performance and yields are not reliable indicators of current and future results. Examples in this article are generic, hypothetical and for illustration purposes only. This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.