Wealth Management Insights

Sign Up for Weekly Investing Insights

Restricted Stock Awards: Guide to Your Grant

A restricted stock award (RSA) is a form of equity compensation. RSA grants are commonly issued by private companies, particularly early-stage startups, and may be

What You Need to Know About Capital Gains Tax

What is a capital gains tax? When you sell an asset like a stock or a home, your gain could be taxable. The tax rate

Inheriting an IRA from Your Spouse

Losing a spouse is a difficult time, and navigating the complexities of inherited assets can feel overwhelming. If your spouse named you as the sole

Should I Put My House in a Trust?

Why own a home in a revocable trust? There is one main reason to consider putting a house in trust: to avoid probate court. Although

83(b) Election for Stock Options and Restricted Stock

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. When you purchase unvested

When is the Best Time for a Roth Conversion?

Is there an optimal time to convert a traditional IRA or old 401(k) to a Roth IRA? While a Roth conversion may never make sense

What Happens to Your Stock Options When You Quit or Leave the Company?

What happens to employee stock options or equity compensation if you leave the company? Before giving notice, understand how vested and unvested stock options and

Are You Holding Too Much Cash?

You may want to think twice before taking the old saying cash is king too literally. Even though interest rates have risen in the last few

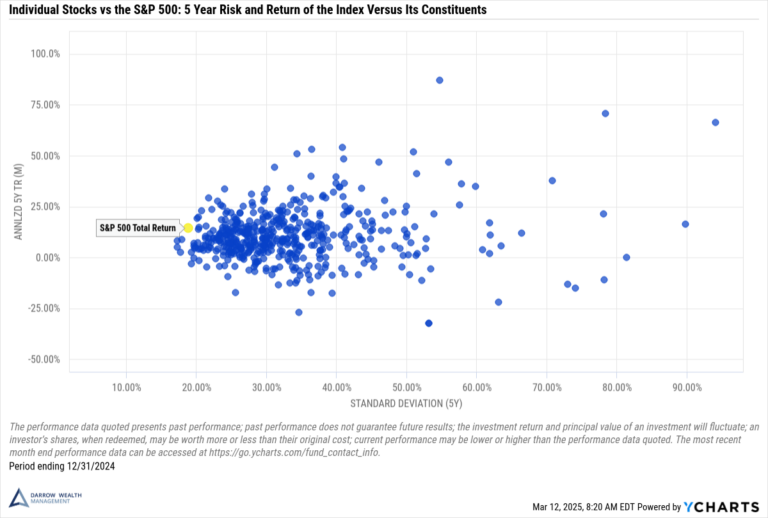

6 Ways to Manage Concentrated Stock Positions

What is a concentrated stock position? If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. A diversified

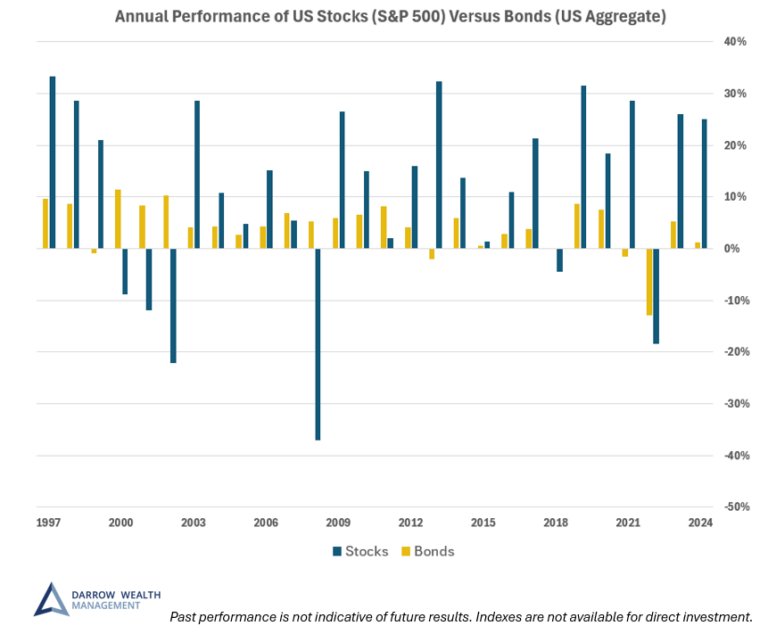

Stocks vs. Bonds: Historical Returns, Risk, and the Case for Both

Stocks and bonds differ in many aspects, including the risk and return investors can expect. Because of these differences, stocks and bonds accomplish different things

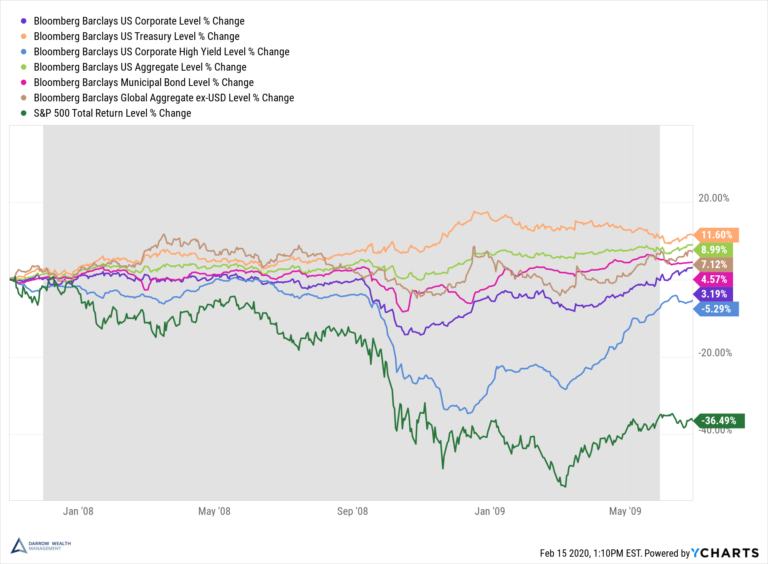

Are Bonds Safe During a Recession or Market Crash?

Although past performance is not indicative of future results, history can be a helpful lens to view bond performance during past recessions and bouts of

What Is An Early Exercise of Stock Options?

If you work for a private startup, you may be able to exercise your stock options early. Early exercisable stock options means you can exercise

Stress Test Your Retirement Income Plan

Don’t stress out about every headline, stress test your retirement plan instead. Markets move every day and the news cycle is 24-7. Unfortunately, headlines often leave

How to Find a Fee-Only Financial Advisor

When starting to search for a financial advisor, investors may not realize the different types of advisors out there…and they’re not all trying to sell

Can You Live Off Dividends In Retirement?

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income

Exercising Stock Options

When’s the best time to exercise your stock options? With stock options, employees have the right (not obligation) to buy the shares. When you exercise

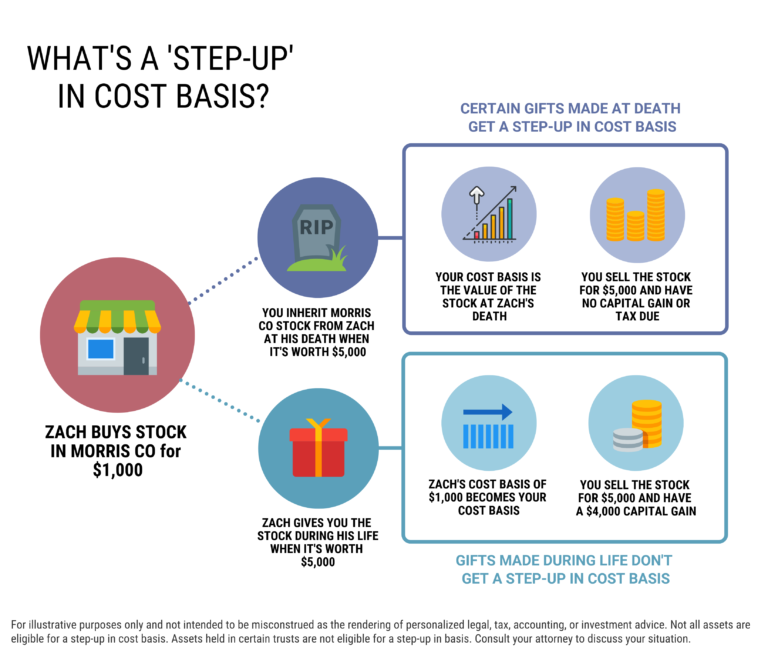

What is a Stepped Up Basis? Cost Basis of Inherited Stock and Other Assets

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. A stepped up basis can apply

7 Ways to Buy a New Home Before Selling Your Current House

Can I buy another house before I sell mine? Updated for 2025. Because who wants to move twice? To buy a new house while selling